Image source: Getty Images

Regularly feeding money into a Self-Invested Personal Pension (SIPP) has the potential to significantly boost an individual’s retirement. That’s true even if the person is only just starting to invest in their middle age.

To demonstrate, I want to look at how much someone could have by retirement by investing £700 a month in one of these DIY pensions. Let’s get started.

Tax relief

A SIPP is a type of tax-efficient retirement investment account available to UK residents. The way it works is similar to a Stocks and Shares ISA, but a key difference is that funds cannot be accessed until at least age 55 (rising to 57 in 2028).

Another difference is that there is tax relief on contributions. In other words, the UK government boosts pension savings by adding 20% tax relief for basic-rate taxpayers. Higher-rate (40%) and additional-rate (45%) taxpayers can claim even more relief through their self-assessment tax return.

So, for someone investing £700 per month into a SIPP, the tax relief would add an extra £175, bringing the total investment to £875.

However, it’s worth pointing out that only 25% of the pension pot can eventually be withdrawn tax-free. The remainder is then taxed as income upon withdrawal.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

£663k!

Putting this together then, a 45-year-old basic-rate taxpayer putting £700 into their SIPP every month (£10,500 per year thanks to tax relief) would have around £663,000 by age 68.

This assumes an 8% return (after fees) over the long run. While not guaranteed, I think this rate of return is achievable for most people willing to carefully research their investments and build a diversified portfolio.

It’s certainly not a bad result for someone starting at 45 and putting away £700 a month. Undoubtedly, it would be a nice supplementary boost in retirement.

Global index

SIPP accounts offer a wide range of investing options, including stocks, bonds, investment trusts, and exchange-traded funds (ETFs).

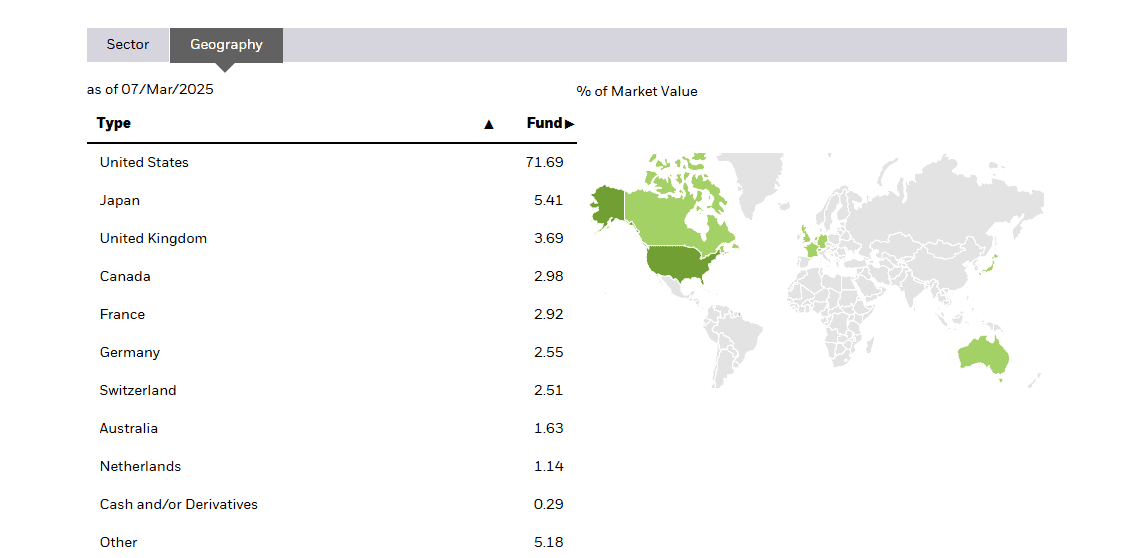

For many investors, a global index fund like the iShares Core MSCI World UCITS ETF (LSE: SWDA) will form a core part of their portfolio. This fund offers broad exposure to a wide range of global companies (1,355 holdings) within 23 developed countries.

Over the past decade, it has delivered an annualised total return of 9.9%. While it’s not assured to deliver that in future, I’m optimistic it can still return at least 8% over the long term.

Now, it’s worth mentioning that the US market has dominated returns and now makes up around 71% of the ETF’s total. So if the American economy enters a recession due to President Trump’s tariffs, the fund’s return could be lower than expected over the next few years. This is a key risk here.

Longer term however, I think it’s safe to assume that the tech revolution will only get stronger. Indeed, it could even accelerate dramatically as emerging fields like AI and (potentially) quantum computing take hold.

Such innovation should drive global economic expansion. A global index fund is the simplest way to capture this growth, in my opinion.

Of course, progress is not linear and there will be major volatility along the way. But with £875 to deploy each month, an investor will be picking up bargains during downturns, likely setting them up for strong future returns.