Image source: Getty Images

The Stocks and Shares ISA is a powerful investment vehicle. With access to tons of different investments and no tax on capital gains or income, it’s possible to generate a lot of wealth over the long run with one of these accounts.

And don’t think you need to invest its full £20,000 allowance to prosper, so here’s a look at how much a £2,000 investment a year could be worth by 2050.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Attractive returns

There’s no set or guaranteed rate of return with a Stocks and Shares ISA. Ultimately, your long-term returns will depend on the assets you’ve invested in.

I think it’s reasonable to expect returns of 6-10% a year on average, over the long run however, assuming a well-structured, diversified investment portfolio. So let’s run a few calculations to see what these levels of return could do to a £2,000 investment a year by 2050.

Five scenarios

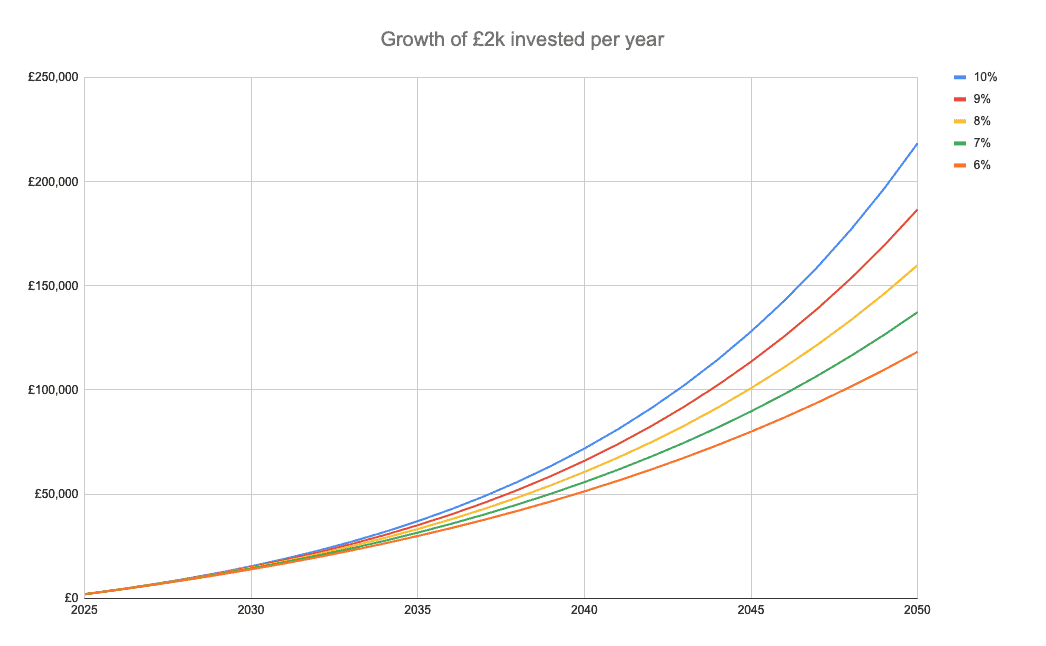

The chart below shows the growth of £2k a year at five rates of returns – 6%, 7%, 8%, 9%, and 10%. It ignores fees.

At a 6% annual return, the £2,000 a year grows to around £118,000 by 2050. At a 10% annual return, it grows to around £218,000.

The power of long-term investing

These calculations show the power of investing for the long term (with no tax). Over the long run, even small amounts of money can grow into huge sums due to the power of compounding.

They also show how someone with decades until retirement could potentially set themselves up for the future by starting early. Over the course of 25 years, it’s possible to build a substantial sum, even with smaller amounts invested.

Generating high returns

Now, history shows that generating a 6% return a year over the long run isn’t that difficult. Over the last 10 calendar years, the UK’s FTSE 100 index has returned about 6.3% a year.

Assuming the index produced the same kind of return over the next 25 years (it may not), a simple low-cost Footsie tracker fund may do the trick here. Note that dividends would need to be reinvested.

Achieving 10% a year over the long run is harder, but it’s not impossible.

To target this type of return, I’d suggest considering a mix of global equity funds and individual growth stocks. I’d use the funds as the foundation of the portfolio and stocks for extra growth.

For the latter, I’d focus on high-quality businesses with significant long-term growth potential (trading at reasonable valuations). An example here is Google owner Alphabet (NASDAQ: GOOG). This company has a great track record when it comes to generating wealth for investors. Over the last decade, it’s returned about 22% a year as the company has grown.

Looking ahead, I believe it has the potential to get bigger. Not only should it benefit from the growth of YouTube and its cloud computing division, but it should see growth from Waymo and other up-and-coming business segments.

Of course, there are no guarantees this stock will continue to deliver for investors. If generative artificial intelligence (AI) ends up destroying Google’s profitability, returns could be disappointing.

I believe the stock’s worth considering however. It currently trades on a forward-looking price-to-earnings (P/E) ratio of 22, which isn’t high for a world class tech company.