Image source: easyJet plc

The travel industry’s post-pandemic recovery has surpassed even the most optimistic of expectations. Strong and sustained demand for plane tickets have propelled the share prices of many airline stocks through the roof. easyJet (LSE:EZJ) shares are up 31% over the last three years.

But signs of weakness have emerged more recently. And following a profit warning on Thursday (17 July), easyJet’s share price is now down 11% since the turn of 2025.

Bright price forecasts

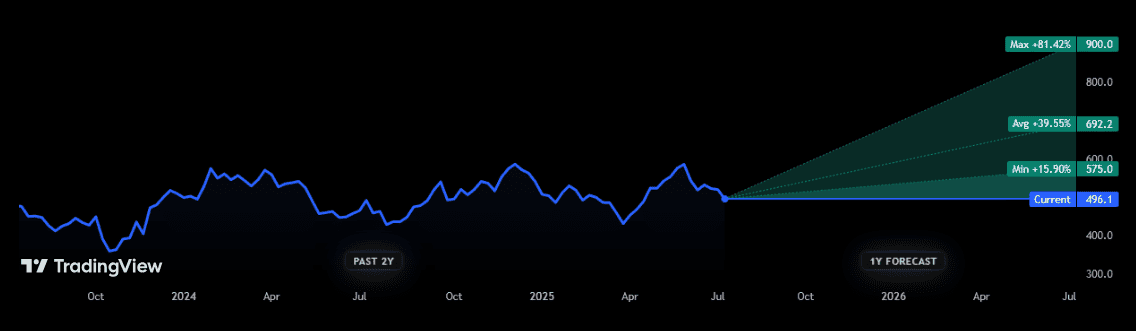

Yet, City forecasts suggest the budget flyer’s recent price woes will prove nothing more than temporary turbulence. Seventeen analysts currently have ratings on the FTSE 100 company. And they are unanimous in their belief that it will rise in value over the next 12 months:

The consensus view is that easyJet will rise roughly 39.6% in value over the period. If this is accurate, £10,000 worth of shares today would become £13,960. Add in dividends, and the total return would be even higher (easyJet shares carry a healthy 2.9% forward yield today).

Given the cheapness of the Footsie stock, on paper it could have considerable scope to rebound. Its forward price-to-earnings (P/E) ratio is just 6.9 times, one of the lowest in the sector.

What’s more, its price-to-book (P/B) ratio is just 1.4. It’s above the value watermark of one, showing it trades at a slight premium to the value of its assets. But it’s still lower than its 10-year average of 1.7 times.

Profit warning

All this being said, I’m not convinced of easyJet’s capacity to climb sharply higher. I also feel that the airline’s cheap valuation reflects the many challenges it faces in the short term and beyond.

My fears have been confirmed by today’s unwelcome profit warning. In it, the company said “recent higher fuel costs and the scale of industrial action by French air traffic control in July” would dent full-year profits to the tune of £25m.

Labour disruptions to airport and air traffic infrastructure are longstanding threats to the airline industry. And easyJet is especially susceptible, given most of its destinations are in Europe where such disruptions are common.

The problem of volatile fuel costs is equally persistent and no less substantial. Roughly 30% of the airline’s expenses are related to fuel.

On the plus side, demand for easyJet plane tickets and package holidays continues to steadily rise. Group turnover was up 10.9% between April and June, and pre-tax profit rose 21.2%.

However, it also said the recent trend of holidaymakers taking time to book has continued. Could this be a sign of weakening traveller appetite as cost-of-living crises endure?

Steering clear

For these reasons, I’m not tempted to buy easyJet shares despite the bright share price outlook of City analysts.

Following today’s update, Panmure Liberum cut its 12-month price forecasts to 730p per share from 800p, one of many reductions by City analysts. I fear more such cuts could be forthcoming and could push the FTSE 100 company’s shares sharply lower from today’s levels.