Binance sets USDC as the default for Binance Pay as Trump pushes for deregulation. The stablecoin market cap soars to over $233 billion. Is tokenization the future?

Crypto, like any other industry, thrives on collaboration. Recently, Binance—the world’s largest crypto exchange by trading volume and client count—announced that USDC, the stablecoin issued by Circle that tracks the U.S. dollar, would become the default currency for new users of Binance Pay. Binance Pay is a payment solution that supports over 100 crypto assets, including some of the best cryptos to buy in 2025.

The Age of Tokenization And Stablecoins

This decision to back USDC comes as the Donald Trump administration pushes for deregulation and prioritizes creating clear laws, especially around stablecoins.

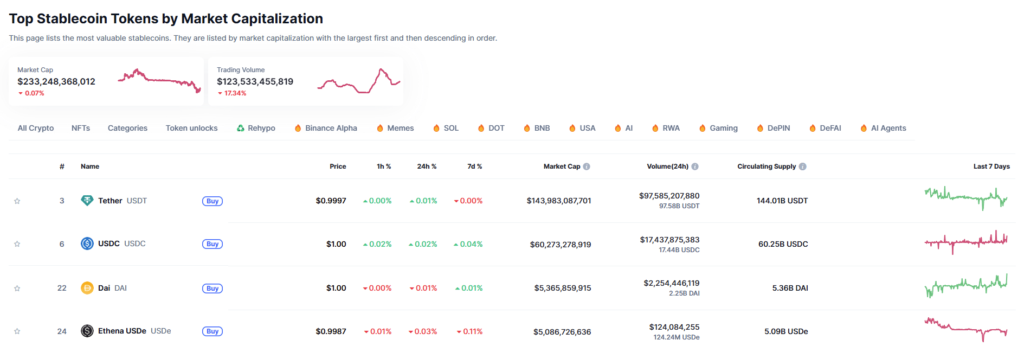

As of April 9, the total market cap of all stablecoins, particularly those tracking the USD, stood at over $233 billion. Over the past few years, more stablecoins have launched, spurred in part by Tether’s profit spike and rising crypto adoption worldwide.

With this collaboration, questions are being raised—especially now that World Liberty Financial, a DeFi platform backed by the Trump family, is expanding into crypto and set to airdrop early supporters of WLFI security tokens with the USD1 stablecoin.

The question remains: Is Binance quietly propping up USDC as a future digital embodiment of the tokenized USD?

Binance Pay Pivots to USDC: Details

Binance Pay is a popular payment platform that supports peer-to-peer crypto settlements and serves more than 40 million monthly users.

With USDC as the default currency for Binance Pay, it marks a significant departure from its earlier reliance on BUSD, the stablecoin phased out in early 2024 due to regulatory pressures.

By adopting USDC as a “vital dollar stablecoin” for its corporate treasury and promoting it across its ecosystem, Binance strengthens its position.

Circle CEO Jeremy Allaire hailed the integration as a big move for Binance, saying it would allow millions of users to access the popular stablecoin.

Moreover, he highlighted its unique features, including multichain support and near-zero transaction fees on several chains, such as Solana and the BNB Chain.

Trump Administration Kills CBDCs

The timing of this integration is notable.

It coincides with the Trump administration making key policy changes aimed at making America the crypto capital of the world, possibly reviving the bull wave of 2024. Then, some of the best meme coins on Solana soared to new valuations.

The issuance of the Digital Finance Technology executive order in late January effectively killed all federal efforts to develop a central bank digital currency (CBDC).

Of note, the order revoked a 2022 Biden directive, arguing that a CBDC would threaten the stability of the financial system.

Recently, another executive order disbanded the Department of Justice (DOJ) National Cryptocurrency Enforcement Team (NCET), stating that efforts should focus more on tackling real crimes.

The Trump directive axing the NCET also stated that agencies should not act as digital asset regulators—a role the administration believes stifles innovation.

Instead, the focus is now on stablecoins, a move intended to promote the sovereignty of the U.S. dollar in the global landscape.

This move also aligns with anticipated U.S. stablecoin legislation, such as the GENIUS Act. The bill aims to provide a regulatory framework for stablecoins like USDC.

Explore: 10 Best AI Crypto Coins to Invest in 2025

Focus on Private Stablecoins

Analysts say rising demand for stablecoins would drive capital into U.S. Treasuries. Currently, Tether is one of the largest holders of U.S. bonds, surpassing even France and Canada.

Leading the charge, World Liberty Financial plans to launch a stablecoin on Ethereum and the BNB Chain. The stablecoin, USD1, is pitched as a “credible and secure” option for institutional and sovereign investors.

Still, it faces stiff competition from USDT—the world’s largest by market cap—RLUSD by Ripple, and many other algorithmic stablecoins, including USDS (formerly DAI).

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

Binance Backs USDC as Trump Kills CBDCs, Tokenization The Future?

- Binance Pay adopts USDC as Trump pushes for a crypto-friendly environment

- Trump wants to boost the development of private stablecoins like USDC and USD1

- Trump-backed World Liberty Financial plans to launch USD1

- GENIUS Act and DOJ NCET shutdown signal a deregulated future for USDC dominance

The post Is Binance Quietly Positioning USDC as the Future of the US Dollar? appeared first on 99Bitcoins.