Traders are leaning bullish on the gold futures price, with the GC00 curve steepening, according to Correlation Economics.

Gold’s dip during the U.S.-China trade war earlier this year wasn’t a flight from safety—it was a byproduct of a stronger dollar and a broad risk rally that lifted the S&P 500 15% off its lows.

“Gold actually has properties — you can use gold for all sorts of things. People value gold for the metal. Nobody values bitcoin for the bitcoin; they value it because they believe that they can exchange it for something else.”

— Peter Schiff, guy who would trade his wife for gold

So what’s a better hedge against inflation: Bitcoin or gold? Truth be told, neither protect you from inflation.

Everyone today is completely confused as to what inflation is. The problem is that if you don’t understand this simple point, then you’re not going to understand the long-term value of cryptocurrency, gold, or even stocks.

Here’s what you should know:

Crypto is NOT a Hedge Against Inflation

Bitcoin and Ethereum aren’t insurance policies against inflation—they’re bets against fiat debasement.

Inflation isn’t just about printing money. It’s what happens when supply chains fracture, wars break out, or demand outpaces production.

The Federal Reserve printing dollars doesn’t automatically spike prices at the grocery store. What it does do is pump financial assets—stocks, crypto, housing—because that’s where the liquidity lands.

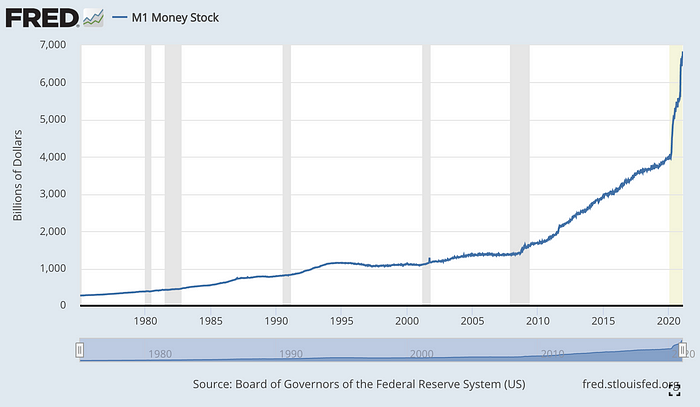

Sure, you shouldn’t print too much money — like the Federal Reserve printing 1/4 of the total supply of dollars ever— but the main factor in inflation isn’t the printing of money, it’s the supply and demand of goods.

They think that a rampant inflation crisis will cause the price of gold to go up. This isn’t the case. When it comes to out-of-control inflation, nothing can protect you.

Gold Is Worth Slightly More Than It Was 40 Years Ago

Bitcoin tends to move with tech stocks. So, for perspective, here’s how a $1 investment in different asset classes back in 1802 would’ve played out:

Gold is acceptable as a complement to your stock portfolio. That’s it. The only excuse for making it your primary asset is by being schizophrenic with a hard-on for armageddon.

It’s probably why Peter Schiff’s top videos are “Stock up this could get very ugly” or “We’ve never seen anything like this” or “We’re about to suffer much worse than I thought.”

So what about Bitcoin and Ethereum?

In a world where inflation eats wages and savings earn less than your local vending machine, crypto offers a counterweight.

Not because it’s trendy, but because the top cryptocurrencies like Bitcoin, Ethereum, SOL, SUI, and others don’t bend to policy whims. Scarcity is built in. Supply is capped. And as more people find reasons actually to use these networks, the pressure only builds—this time in the right direction.

In a world of unhinged economic uncertainty, including a Federal Reserve that controls the economy like a dictatorship and banks that promise you’ll own nothing by 2030, it’s good to have a store of value that can’t be debased.

That’s what crypto is. And that’s why it’s stronger than ever in the summer of 2025.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Traders are leaning bullish on the gold futures price, with the GC00 curve steepening, according to Correlation Economics.

- In a world where inflation eats wages and savings earn less than your local vending machine, crypto offers a counterweight.

The post Is Gold Futures Price A Better Investment Than Bitcoin Now? appeared first on 99Bitcoins.