Image source: Getty Images

Broadly speaking, the UK’s large- and mid-cap stocks have staged an impressive rebound of late. Yet even after this recovery, the valuations on FTSE 100 and FTSE 250 shares are still remarkably low by global standards, offering what may be a rare opportunity for investors to build long-term wealth.

Right now, the price-to-earnings (P/E) ratios for the Footsie and the FTSE 250 are 16.2 times and 12.6 times, respectively. That’s a huge discount to the S&P 500, whose ratio is 23.8 times, and the Nikkei 225, which has a multiple of 19.3.

This suggests there could be significant scope for capital growth, though valuations aren’t the only reason I’m bullish today. Historical market trends also suggest UK shares could experience a substantial upswing.

FTSE 100 in focus

Let’s take the FTSE 100 as an example. According to data from Curvo, investors have often enjoyed their strongest returns in the months following a market correction.

The UK’s premier share index slumped 11.8% in September 2002, before bouncing 8.7% the following month. And in March 2020, it dropped 13.4% — its worst monthly performance on record — before soaring 12.7% the following November, its best-ever monthly rise.

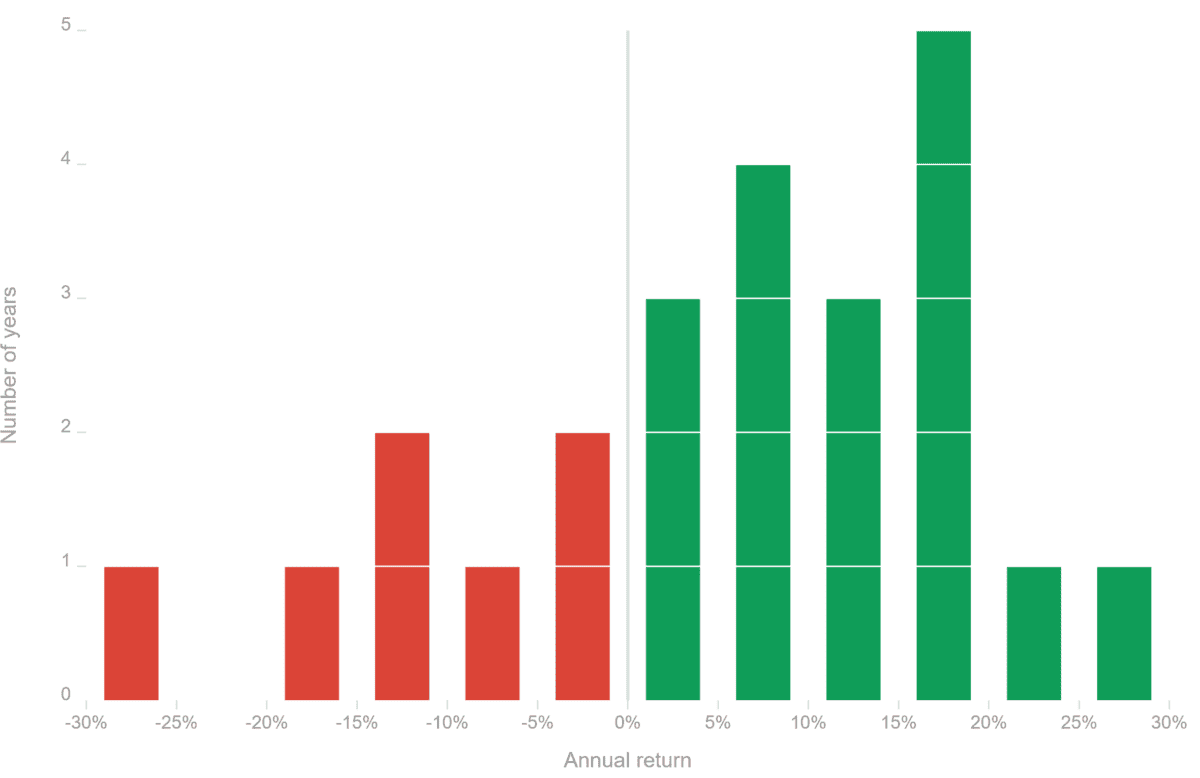

Curvo’s research also shows that market downturns in that time have frequently been followed by prolonged rallies. As the chart below shows, the FTSE 100 has delivered a positive return in 17 (71%) of the last 24 years.

The index has recovered from a global pandemic, banking sector collapse, war, AND a debt crisis in Europe to give investors a fat return. Indeed, someone who parked £10,000 in FTSE 100 shares in April 2000 would have seen the value of their investment swell to £34,169 by February just passed.

A UK stock fund

Of course past performance is not always a reliable guide to the future. But Curvo’s data certainly suggests now could be a good time to consider buying Footsie shares.

As I say, the cheapness of FTSE 100 and FTSE 250 companies provides room for UK shares to keep rebounding. And especially so as uncertainty over US economic and foreign policy supercharges investor interest in European shares.

Given the high-risk environment at the moment, purchasing an exchange-traded fund (ETF) could be worth considering to spread risk and target large returns. The SPDR FTSE UK All-Share ETF (LSE:FTAL) is one such fund on my own watchlist today.

This ETF offers great diversification, with 371 holdings spanning the London stock market. It also provides strong exposure to stable UK blue chips and mid-cap growth shares, with current weightings of:

- 81% in FTSE 100 stocks

- 16% in FTSE 250 shares

As you can see, this fund is also well diversified by sector, providing strength in case of underperformance in one or two areas. In addition, it holds a broad range of multinational companies (including HSBC, Unilever, and Rolls-Royce), meaning it also offers geographic diversification.

Since 2012, the FTSE 100 All-Share Index has delivered an average annual return of 7%. That’s solid rather than spectacular, but I think it could improve sharply from this point for the reasons I’ve described, giving a substantial boost to investors’ wealth.