Blockchain oracles connect real-world data to decentralized networks, and RedStone Crypto (RED) is stepping up to challenge the Chainlink (LINK) hegemony.

By 2025, Chainlink, Pyth, and RedStone Crypto are shaping the oracle landscape, each with its own edge. Here’s how they compare.

Key Similarities Across Chainlink, Pyth, and RedStone Crypto

Chainlink,

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

Price

Volume in 24h

<!–

?

–>

Price 7d

, and

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

Price

Volume in 24h

<!–

?

–>

Price 7d

may approach it differently, but they deliver the same core promise: precise and dependable price feeds for major assets across leading blockchains.

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

Price

Volume in 24h

<!–

?

–>

Price 7d

may dominate the oracle space, but RedStone is grabbing headlines. By meeting the demand for fast, precise DeFi data, this upstart has sparked more intrigue than its established rival.

Past: Foundation and Early Development

2021: Concept and Foundation

RedStone was founded with the goal of building a flexible and efficient oracle system that addresses the limitations of traditional oracles. The project focused on… pic.twitter.com/LtK677uESL

— CryptoJournaal (@CryptoJournaal) March 25, 2025

To separate these, you should consider the following for RedStone:

- Are they a legit competitor to Chainlink? Not yet, they have a ways to go. LINK is the largest crypto by market capitalization in the oracle coins sector.

- Will it pump harder than Chainlink in the short term? Likely yes. They already have. In this crypto space, hype and speculation are everything, and RED is on the come-up.

This space is is also desperately trying to deliver Chainlink an L in its own home. That’s why Pyth Network and Wormhole, two other Oracle competitors, the former outperformed Chainlink this month.

RedStone Price Action

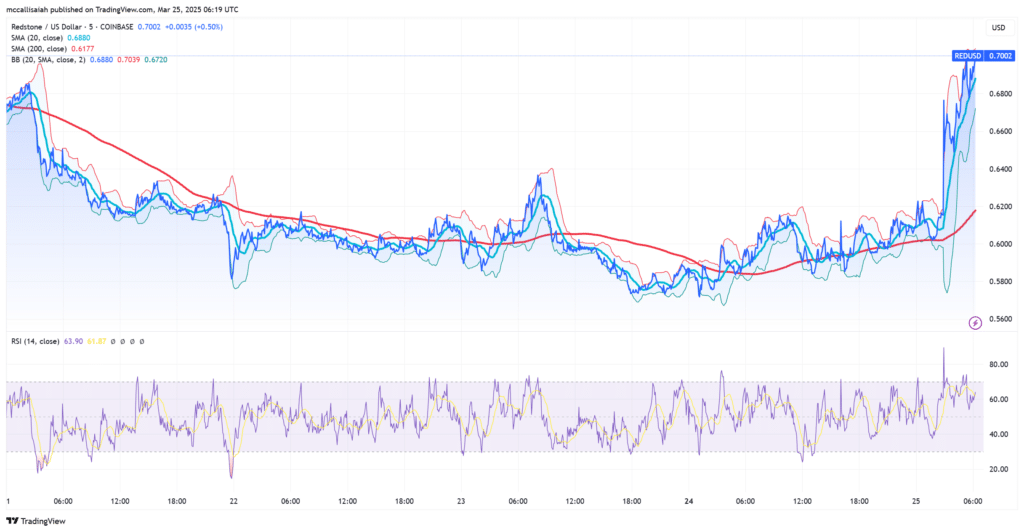

Redstone’s breakout is gathering steam. A golden cross just formed with the 20-day SMA ($0.6880) overtaking the 200-day SMA ($0.6177), adding weight to its bullish momentum.

The RSI is nearing overbought territory at 64, while volume spikes confirm buyers are backing the move. If the price clears $0.70 with strong follow-through, $0.74-$0.75 could be the next target. Support is steady at $0.66.

What Sets RedStone Crypto Apart From the Rest

While the similarities create a strong foundation of utility, the differences between these three players highlight their unique strengths. Here’s a closer look at what makes each oracle distinct:

-

Chainlink: Chainlink, the veteran, champions reliability and aggregators in its Push model, servicing juggernauts like Venus and Aave.

-

Pyth Network: Pyth moves fast, built around the Pull model, honing in on perpetual markets and staking with the help of Wormhole.

-

RedStone Crypo: RedStone flips the script, combining both models for unmatched flexibility, delivering low-latency, gas-efficient feeds for cutting-edge use cases like Proof of Reserves.

DeFi’s backbone is built on oracles, each with a distinct edge. Chainlink secures its legacy with proven reliability; Pyth focuses on speed; and RedStone pushes boundaries with adaptability and cross-chain precision. They all have a strong chance of performing well if we enter a bull market.

EXPLORE: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Blockchain oracles shows RedStone Crypto (RED) is stepping up to challenge the Chainlink (LINK) hegemony.

- Alternatively, Pyth moves fast with the help of Wormhole.

- $LINK is still the largest cryptocurrency by market capitalization in the oracle coins sector.

The post Is RedStone Crypto a Legit Competitor to Chainlink? RED Price is Undervalued appeared first on 99Bitcoins.