Standard Chartered’s custody role on a new tokenized money-market fund puts Polygon in the spotlight as “Uptober” begins and POL price is ticking higher.

AlloyX and Polygon Labs, with custody provided by Standard Chartered Bank, have launched RYT, a tokenized money-market fund on the Polygon network with ties to Hong Kong.

The aim is to deliver regulated, on-chain yield while linking decentralized finance with traditional banking frameworks.

AlloyX said RYT combines on-chain transparency with a regulated structure and T+1 settlement. Standard Chartered will handle custody, while Polygon Labs supports the rollout.

The fund will debut exclusively on Polygon before expanding to other blockchains.

“RYT aims to bridge DeFi liquidity with a transparent, audited cash management layer,” AlloyX CEO Dr. Thomas Zhu said.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Why Is the MATIC-to-POL Migration Important for Polygon Users?

For Standard Chartered, the launch adds to its growing digital assets strategy. The bank already operates a regulated spot trading service for institutions and earlier this year set up an EU custody entity.

It is also developing a collateral program centered on tokenized money-market funds, indicating a broader commitment to bank-grade tokenization infrastructure.

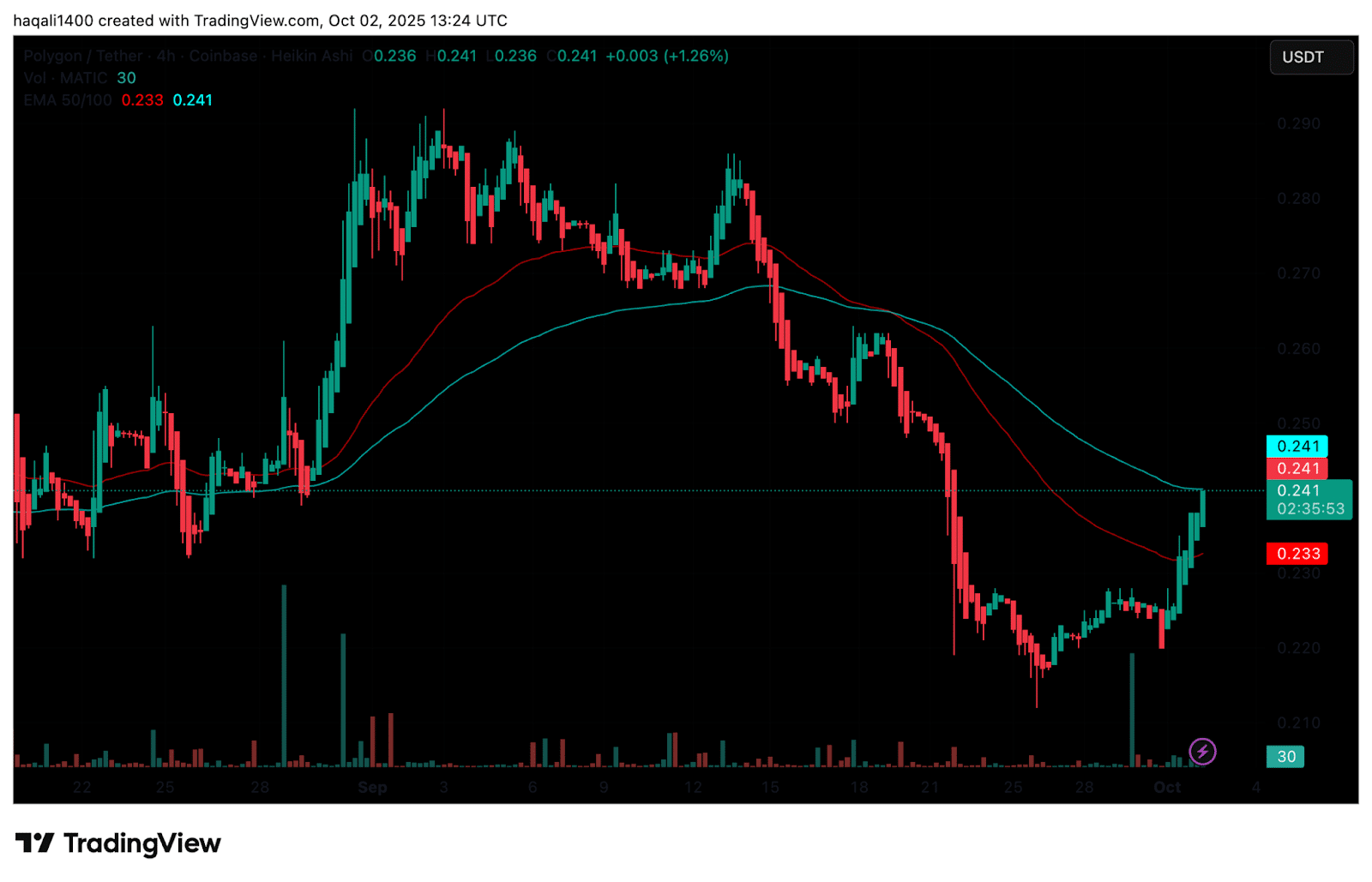

Polygon’s native token, POL, traded near $0.241 in afternoon sessions, up approximately 3-4% over the past 24 hours, giving it a market capitalization of around $2.5 billion. The coin’s intraday range was $0.233-$0.241.

The network completed its MATIC-to-POL migration in September, with roughly 99% of tokens converted.

Polygon continues to post strong usage data, reporting hundreds of thousands of daily active addresses, millions of daily transactions, and a multi-billion-dollar stablecoin float, the type of activity real-world asset issuers look for when selecting blockchains.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

POL Price Prediction: Is Polygon Price Gearing Up for a Bullish Reversal?

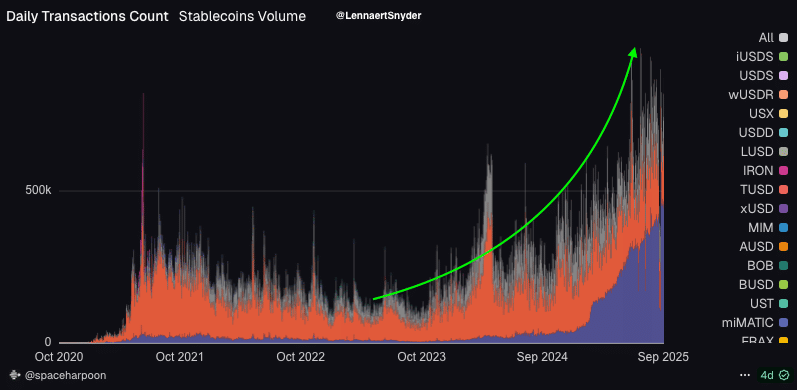

The stablecoin activity on Polygon has increased significantly since 2023, with the number of transactions per day growing by over 900% within a few years.

$POL daily stablecoin transaction volume is experiencing explosive growth.

Since 2023, the daily stablecoin transaction volume on Polygon has grown by over 900%.

This chart screams one thing loud and clear: @0xPolygon is built for payments. pic.twitter.com/brWxXcfjbJ

— Lennaert Snyder (@LennaertSnyder) October 1, 2025

According to the chart, the volume base remained stable until 2022 and then started accelerating upwards in mid-2024. By the end of 2025, transfers in Polygon stablecoins had topped 500,000 daily, some of the largest activity the network saw.

It has attracted the attention of analysts because they believe that the shift indicates that Polygon is becoming a more critical payment network, capable of making transfers fast and cheap at scale.

The demand from retail and institutional users is also reflected in the growth trend, as regulated tokenized funds and banking partnerships are brought on-chain.

The consistent growth even in turbulent market conditions signals Polygon’s robustness and growing applicability in real-world finance.

As per TradingView data, MATIC is recovering following weeks of pressure. The token had slipped above $0.27 in September to about $0.21, but was pushed by buyers to give prices a boost back into the $0.236-$0.241 band.

(Source: MATIC USDT, TradingView)

It is now experiencing resistance in the 100-EMA, and the 50-EMA in the 0.233-range has turned into support.

A clear break above $0.245 may contribute to the argument for a reversal, and the gap to $0.27 may become apparent.

The trading volume has been recording improvement in the rebound, and this promotes renewed interest. However, when support at $0.233 is breached, then the price can retest $0.22. In the meantime, the trend is biased towards a cautious bullish stance, but the larger trend remains uncertain.

DISCOVER: 10+ Next Crypto to 100X In 2025

The post Is Standard Chartered Set to Pump Polygon? POL Price Prediction For Uptober appeared first on 99Bitcoins.