Despite rising global tensions and a joint U.S.-Israeli attack on Iran’s nuclear facilities, which appears to have fallen short, Bitcoin’s price is holding strong. After briefly dipping to $98,000 over the weekend amid fears of all-out war, BTC has bounced back and is now trading at $107,000.

Even violations of the ceasefire by Israel and Iran haven’t shaken its price action. Between conflicting reports about the success of the strikes and a fragile ceasefire in place, the natural question is: what’s next for BTC?

— Trump Posts on 𝕏 (@trump_repost) June 24, 2025

DISCOVER: 20+ Next Crypto to Explode in 2025

US Strikes on Iran: “Limited Success,” Intelligence Says

On Saturday, U.S. stealth bombers targeted three major Iranian nuclear sites – Fordo, Natanz, and Isfahan – with bunker-busting munitions. The U.S. used $3.5–$15 million bunker-buster bombs, dropped by $2.1 billion B-2 bombers, to hit Iran’s nuclear sites.

The operation likely cost over $100 million but only damaged surface structures, with Iran’s underground facilities largely intact, delivering limited strategic success despite the high expense.

Early assessments from the Defense Intelligence Agency suggest that Iran’s nuclear program was only temporarily set back, not dismantled. Centrifuges reportedly remain intact, and much of the enriched uranium stockpile had been moved before the bombings.

(Fordow Fuel Enrichment Plant After US Bunker-Buster Strike)

The Pentagon’s view contrasts sharply with political claims from the Trump administration, which declared the operation a “complete success.” Israeli Prime Minister Benjamin Netanyahu echoed that sentiment, saying Iran’s nuclear ambitions and missile capabilities have been “neutralized.” Yet, U.S. intelligence sources caution that Iran may resume its nuclear program in a matter of months.

A ceasefire, brokered by President Trump and Qatari officials, is now holding but remains fragile. Despite this, the crypto market seems to be holding well, with BTC up over 9% since the $98,000 dip.

What Is Next For BTC? Bitcoin Absorbs the Shock and Reclaims $107,000 Amid Israel Ceasefire Violations

Currently, Bitcoin’s resilience reflects growing investor belief in its role as a macro hedge. The $98,000 bounceback signals that BTC is already pricing in geopolitical volatility. But uncertainty still looms. A renewed Iranian response or breakdown of the ceasefire could shake markets again.

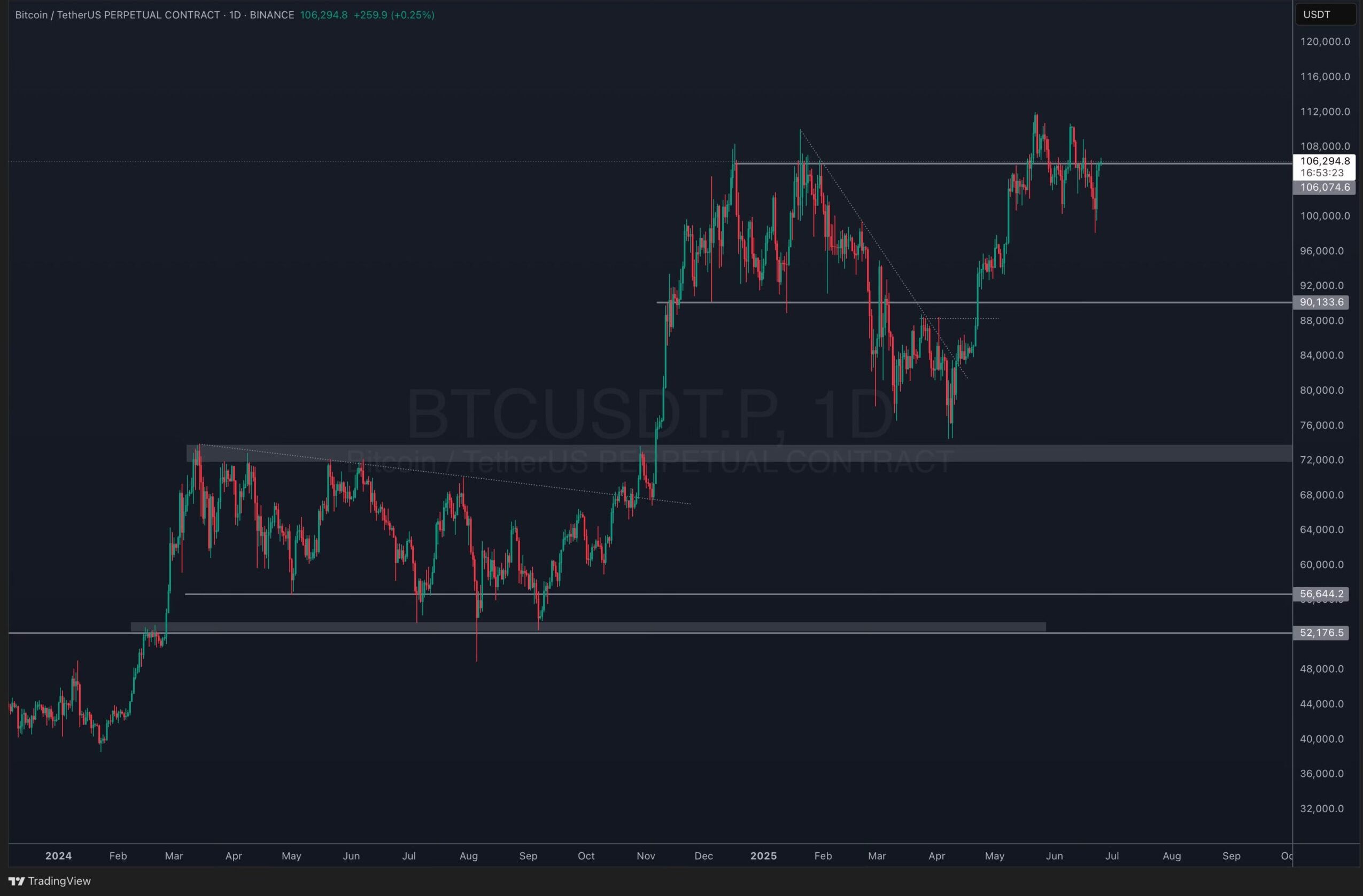

(BTCUSDT)

This move comes after BTC briefly dipped below the $100,000 psychological mark but found firm support at the $99,133 horizontal zone, which aligns with a key consolidation area from March 2025.

Technically, BTC is retesting a previous resistance zone around $106,000–$108,000. A clear breakout above $108,000 could pave the way for a retest of the all-time high near $112,000. However, failure to sustain above $106,000 might signal continued consolidation within the $99,000–$108,000 range.

Looking back, the $72,000–$76,000 region remains a historically significant support zone, marked by heavy accumulation during mid-2024. If macro tensions intensify or leverage continues to unwind, a retest of the $90,000 area remains plausible, but current price action suggests buyers are stepping in early.

Miners are another piece of the puzzle. With network rewards falling and operational costs high, mining profitability is under pressure. However, current data shows that most miners have already sold large parts of their BTC reserves, limiting the risk of a significant sell-off.

According to CryptoQuant, miner selling power remains near historic lows. Unless miner reserves increase or external financing dries up, the likelihood of miner-led downward pressure is minimal in the short term.

In short, BTC appears resilient despite geopolitical pressure. A sustained daily close above $108,000 would likely confirm bullish continuation.

EXPLORE: NPC Meme Coin Shoots Higher As VIRTUAL Price Cools Off From Rebound

Key Takeaways

- Limited U.S.-Israeli strike success. Costly attacks on Iran’s nuclear sites delivered minimal long-term damage; key infrastructure remains operational.

- BTC rebounded from $98,000 to $107,000, showing strength even amid war fears and Israel ceasefire violations.

- The ceasefire remains fragile. Brokered by Trump and Qatar, the truce is at risk with ongoing regional tensions and retaliatory threats.

- What is next for BTC? Bitcoin eyes breakout above $108,000; sustained move could retest $112,000 ATH, with key support at $99,000.

The post Israel Ceasefire Violations, US Strike Limited Success: What Does This Mean For BTC USD? appeared first on 99Bitcoins.