Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continues to attempt to breach the $95,000 barrier with investors looking out for indicators that it might indeed do so. The digital money has failed to breach the point of resistance at this level since last Friday, market data revealed.

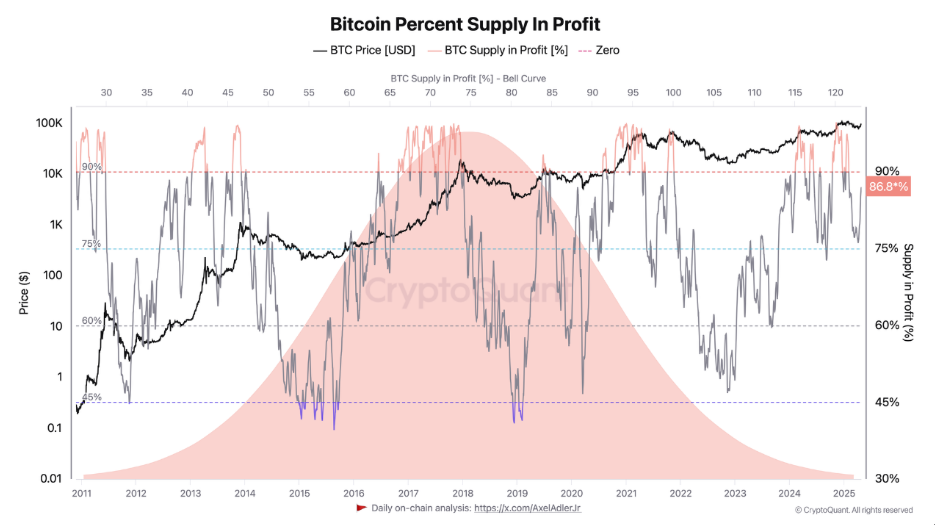

Still, despite this strain, a very impressive 91% of entire supply of Bitcoins are in the black, reflecting what market strategists describe as the “euphoria phase” of market activity.

Related Reading

Profits Soar As Market Rebounds

The strong percentage of profitable Bitcoin holdings is during a recent market recovery, according to data from analytics firm CryptoQuant. Technical expert Darkfost notes that when Bitcoin supply in profit is over 90%, it generally represents the last phase of a bull market.

This phase usually sees large price rises before any correction takes place. During recent price drops, the supply in profit nearly fell to 75%, a level that analysts believe could have triggered widespread selling if breached.

Market Pressure Eases On Holders

The current context provides room to breathe for Bitcoin holders. Since the majority of holdings are in profit, investors are less pressed to offload their coins during times of market uncertainty.

This diminished pressure might assist in sustaining Bitcoin’s price stability near the $95,000 level and gaining steam for future upside potential. As per various experts, this period of diminished selling pressure tends to lead to significant price action in cryptocurrency markets.

Analysts Project Possible $250,000 Bitcoin

Some institutions have made some high-profile Bitcoin price predictions. Standard Chartered is predicting that the cryptocurrency will hit $120,000 by the second quarter of 2025.

Other market analysts have predicted higher prices, in the range of $200,000 to $250,000, before the year’s end. These are some of the predictions as Bitcoin traded at $94,900, just below the psychological $95,000 mark that has been challenging to crack.

History Indicates Caution Following Euphoria

Although the market mood is positive today, CryptoQuant cautions that history indicates a pattern of corrections after these euphoria periods.

Historical data from past Bitcoin bull cycles suggest that after such periods of high profitability, corresponding massive price declines usually ensued.

Related Reading

In previous cycles, the proportion of Bitcoin supply in profit has dropped to approximately 50% at these times of correction – a characteristic of bear market situations.

The euphoria phase is not permanent, with CryptoQuant CEO Ki Youn Ju intimating such periods usually last from three to 12 months before the corrective action sets in.

The ongoing Bitcoin cycle has witnessed consistent growth over the past few months, driving the percentage of profitable holdings to levels that indicate both opportunity and caution.

As investors observe the $95,000 resistance level, many are asking whether history will repeat itself in another spectacular price spike before an eventual correction.

With 91% of Bitcoin currently in profit, the market is at a critical point that will challenge both bullish forecasts and historical trends in the coming months.

Featured image from Gemini Imagen, chart from TradingView