USDT issuer Tether has been dealt a blow in its multibillion-dollar lawsuit with Celsius after a US bankruptcy judge ruled that the lawsuit can proceed. The judge denied Tether’s attempt to dismiss claims that it “improperly” liquidated Celsius’s Bitcoin collateral during the crypto lender’s collapse in 2022.

Per court documents filed in New York on June 30, Celsius claims that Tether executed a “fire sale” of over 39,500 Bitcoin

in June 2022, which it then used against Celsius’s $812 million debt without following pre-agreed procedures.

Tether loses bid to dismiss Celsius suit seeking to reclaim what is now over $4B of BTC that Tether took from Celsius as it fell into bankruptcy

Being offshore doesn’t allow you to evade US courts – especially when virtually all Tether’s assets are sitting in the US#Tether pic.twitter.com/rdshox2n0c

— Novacula Occami (@OccamiCrypto) July 1, 2025

Celsius Bitcoin Lawsuit Against Tether – Claims That Tether’s Liquidation Cost The Firm Over $4B In Bitcoin At Current Prices

Celsius believes that Tether’s actions in the Summer of 2022 breached its lending agreement, violated the principle of “good faith and fair dealing” under British Virgin Islands law, and constituted fraudulent and preferential transfers that are avoidable under the US Bankruptcy Code.

The complaint stems from a margin call Tether issued as the Bitcoin price plummeted. Celsius argues that Tether sold its collateral before a pre-agreed 10-hour waiting period, liquidating the BTC position at an average price of $20,656 below market levels, and later transferring the proceeds to its own Bitfinex accounts.

In the filing, Celsius alleges that Tether’s liquidation of its Bitcoin position cost it over $4 billion worth of BTC at current prices. It further claims that Tether’s actions involved US-based communications, personnel, and financial accounts.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

This is key, as if proven true, it would establish sufficient ties for US jurisdiction, despite Tether’s incorporation in the British Virgin Islands and Hong Kong.

In an early win for Celsius, the US judge agreed Celsius made a plausible case that the transfers and alleged misconduct were “domestic” in nature, rejecting Tether’s argument that the claims fall outside of US bankruptcy law jurisdiction.

Last year, in August, Tether attempted to dismiss the lawsuit in its entirety, claiming that the US court lacked jurisdiction and that Celsius’s allegations fail to state valid claims. While the court dismissed some counts at the time, it allowed Celsius’s key breach of contract, fraudulent transfer and preference claims to proceed.

Tether CEO In The News After Refuting Claims The Company Is Going Public

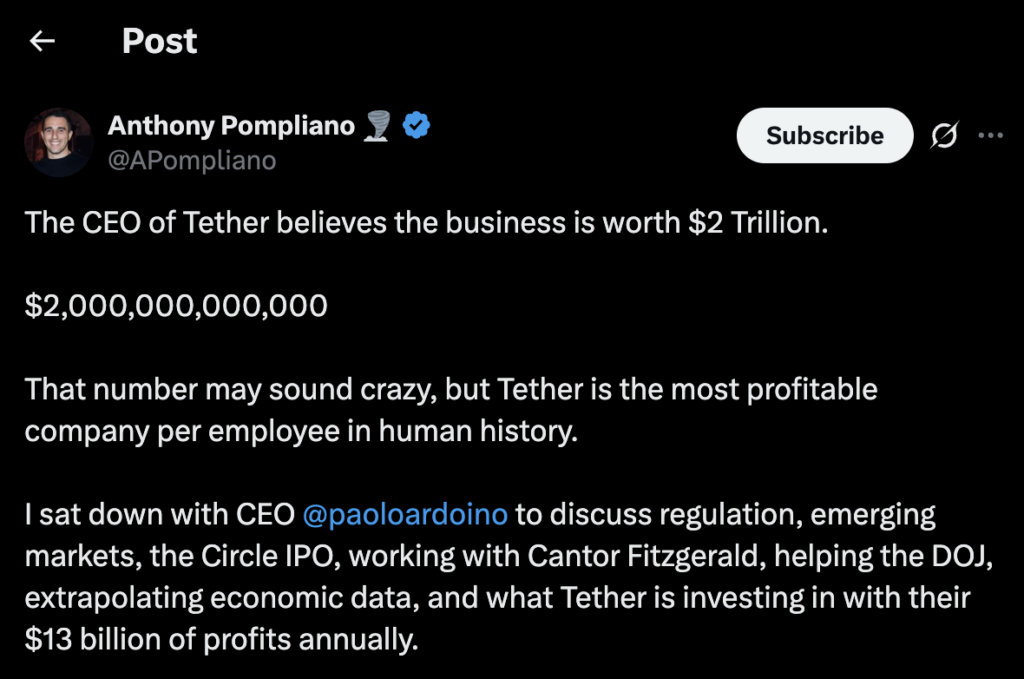

Last month, in June, Tether CEO Paolo Ardoino stated that the company has no plans to go public, following much speculation. Ardoino responded to rumours of a potential Tether IPO, dismissing the idea outright.

This public denial did not stop the chatter, with analysts claiming a public offering could value the stablecoin giant at over $500 billion, which would put it higher than global corporations such as Walmart or Coca-Cola.

Ardoino did, however, call the $515 billion valuation a “beautiful number,” although he suggested it might even undervalue Tether, considering its sizable holdings of Bitcoin and gold.

Tether’s flagship product, the USD-backed stablecoin $USDT, is the third-largest digital asset, trailing only Ethereum and Bitcoin, with a market cap of over $157 billion. It is by far the most used stablecoin on the market, evidenced by its $38 billion daily trading volume.

(SOURCE)

Circle’s USDC stablecoin, widely recognised as the second-largest USD-backed stablecoin, has a market capitalisation of $61 billion and a daily trading volume of only $7 billion. Circle has been in the news recently after going public following a successful IPO. It is up 11% daily, trading for $192 and a market cap of around $42 billion.

Considering that Tether’s USDT stablecoin processes nearly the same daily trading volume as Circle’s entire market cap, it is no wonder that Paolo Ardoino believes $515 billion for Tether may be undervalued.

Meanwhile, Tether continues to expand its African footprint. Yesterday, it announced that it has signed a Memorandum of Understanding (MoU) with the Zanzibar e-Government Authority (eGaz) to advance digital asset education and financial innovation.

The stablecoin issuer plans to integrate its USD-backed $USDT and gold-backed $XAUT stablecoins into the Zanmalipo payment gateway, improving available options for users locally. It is part of Tether’s long-term expansion strategy for Africa, aimed at boosting digital asset adoption on the continent.

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Judge Dismisses Tether’s Dismissal Bid In $4B Bitcoin Lawsuit With Celsius appeared first on 99Bitcoins.