The search for the best crypto to buy right now continues as the market sends mixed signals. Bitcoin is hovering around $115,000, stuck in a low-volume zone between $110K and $116K. Traders are watching this tight range closely, as a break lower could trigger more downside. Meanwhile, Ethereum briefly broke above $3,700 before pulling back, adding to the market’s uncertain tone.

But there is more.

Some sectors are holding up better than others. Layer 2 tokens like Mantle jumped more than 20% in the last week, while centralized exchange tokens such as BNB and CRO posted modest gains. On the other hand, meme coins, PayFi projects, and AI tokens saw losses, showing less confidence from investors.

ETF activity has started to turn positive again. On August 6, U.S. spot Bitcoin ETFs saw $91.55 million in net inflows after four days of outflows. Ethereum ETFs also recorded $35.12 million in net inflows, with only Grayscale’s ETH Mini Trust posting a small outflow.

EXPLORE: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Binance released its latest Proof of Reserves report, showing user BTC holdings increased by nearly 3% to 591K BTC. ETH holdings, however, dropped by almost 10%, possibly due to rotation into other assets. USDT balances rose to nearly $30 billion, signaling steady stablecoin demand.

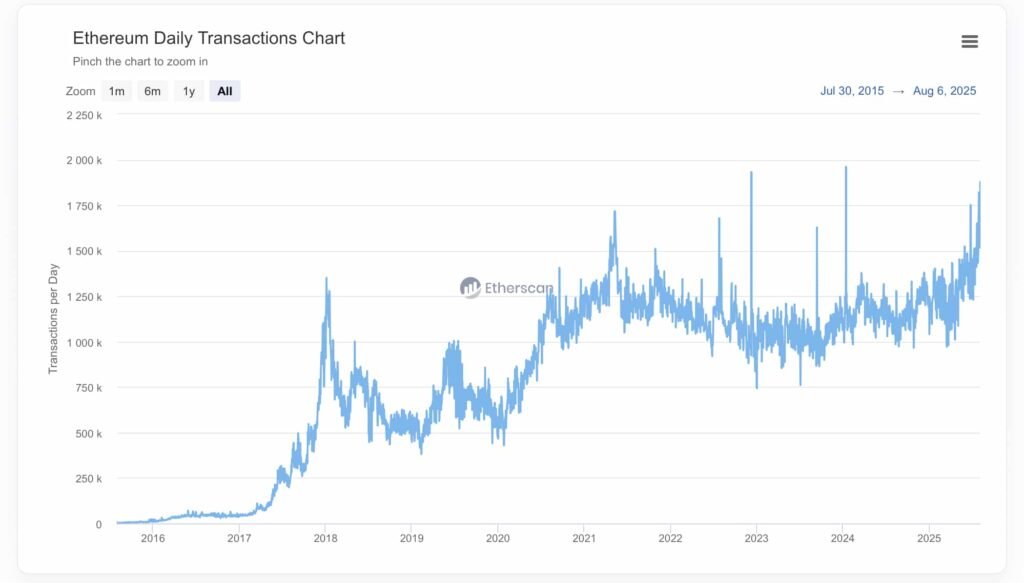

Ethereum network activity is also heating up. The network handled 1.87 million transactions yesterday, close to its all-time high. According to Nansen, much of this activity comes from USDC, Tether, and Uniswap.

(Source)

Best Crypto to Buy? Look Where Activity Is Growing

In this uncertain environment, we still can ask ourselves: what’s the best crypto to buy right now? For now, Layer 2 tokens and CeFi coins are showing strength, backed by growing usage and investor interest. While Bitcoin remains range-bound, altcoins tied to real network activity or ETF momentum may offer the best short-term setups.

Still, caution is key. Until Bitcoin breaks above $116,000 with conviction, gains could be short-lived. Watching sector rotation and inflows will be critical in spotting the next strong move.

Is TROLL Run Over? TROLL Falls 30% After $207M Peak – TOKEN6900 the Next Meme Coin Explosion

After an explosive run, TROLL has pulled back, dropping 30% from its recent $207 million ATH. One early investor turned $22,800 into $2.48 million in just 3.5 months, a 109x gain, and is still holding. We call those diamond hands! But many traders aren’t that patient: they’re cashing out and rotating into new opportunities.

One of these under-the-radar gems could be TOKEN6900, and here’s why.

Unlike utility-pretending projects, TOKEN6900 fully embraces its meme roots: mocking TradFi, locking in a fixed supply, and offering no utility—just chaos. The humor is intentional. It’s a throwback to old-school internet culture, where fun came first and speculation followed.

With a much lower entry price than TROLL and other meme coins with similar concepts—like SPX6900 and USELESS—TOKEN6900 is gaining attention as the more chaotic sibling: “absurd squared.”

The presale is capped at $5 million, and with over $1.69 million raised, it’s already 34% sold out. Once it’s gone, it’s gone. Early buyers can also stake tokens for a 37% APY.

For those hunting the next 100x meme coin, TOKEN6900 might just be it.

August 7: Bitcoin and Ethereum ETFs See Strong Inflow

Both Bitcoin and Ethereum ETFs recorded positive net flows on August 7, signaling renewed investor interest.

According to the latest data:

- 10 Bitcoin ETFs posted a net inflow of +607 BTC, equivalent to $70.72 million.

- iShares Bitcoin Trust (BlackRock) led the pack, adding 363 BTC (about $41.36 million), bringing its total holdings to 738,171 BTC, valued at approximately $86.05 billion.

Meanwhile, Ethereum ETFs also saw gains:

- 9 Ethereum ETFs recorded a net inflow of +4,116 ETH, worth $15.87 million.

- iShares Ethereum Trust took in 9,077 ETH (around $34.99 million), now holding 2,960,973 ETH, with a total value of $11.41 billion.

These inflows reflect growing confidence in institutional crypto products, especially as markets await clarity on broader regulatory developments.

Is Dogecoin Priming For a Mega Bounce? DOGE Price Pushes Up as BONK Crypto Tumbles

The meme coin market, including Dogecoin and Bonk, is back in green territory, adding nearly 3% in the past day. At press time, all meme coins now command a market cap of $71.8 billion, and Dogecoin, which is up 3% in the last 24 hours, has a market cap of $31 billion. Meanwhile, related trading volume is at $1.1 billion, nearly 10X that of Shiba Inu, which stands at $142 million in the same period.

Bonk, which is perched at fifth in the meme coin market, is firm, adding 3% in the past 24 hours. However, it is among the biggest losers in the top 10, shedding 15%.

Trump to Sign Executive Order Allowing Crypto and Private Equity in 401(k)s

President Donald Trump is expected to sign an executive order on Thursday that could allow crypto, private equity, real estate, and other alternative assets to be included in 401(k) retirement plans, according to Bloomberg News.

The order would direct Labor Secretary Lori Chavez-DeRemer to work with the Treasury Department, SEC, and other regulators to explore possible rule changes. The goal is to expand investment options in defined contribution plans, which hold around $12 trillion in retirement savings.

If implemented, the move could benefit large asset managers like Blackstone, KKR, and Apollo, who specialise in alternative investments.

However, some experts warn the change could introduce too much risk into retirement accounts.

The White House has not yet commented on the report.

Union Jack Oil Eyes Early Bitcoin Mining at West Newton Site

Union Jack Oil plc has announced early-stage plans to monetize gas from its West Newton site (PEDL183) by powering on-site Bitcoin mining operations. Operator Rathlin Energy has signed a non-binding Letter of Intent with Texas-based 360 Energy Inc. to explore the deployment of gas-powered data centers.

This strategy would convert natural gas from the WNA-2 well into electricity for mining Bitcoin, offering early cash flow ahead of full field development. The companies are now working toward a definitive agreement, pending regulatory approval.

Executive Chairman David Bramhill called the plan a creative solution amid planning delays, with potential to deliver strong returns and support a future Bitcoin treasury strategy.

West Newton holds an estimated 200 billion cubic feet of recoverable gas, making it one of the UK’s largest onshore gas prospects.

Delhi High Court Tells WazirX To Hand Over Binance Deal

The Delhi High Court has ordered Zettai Pte Ltd, the company behind crypto exchange WazirX, to hand over documents detailing its agreement with Binance, as well as its ongoing restructuring plan.

The court gave a deadline of one week. This comes after months of fallout from a $235 million hack and a growing number of lawsuits from creditors trying to recover lost funds.

Now creditors demand answers after major breach.

The post Latest Crypto News, August 7 – Mixed Signals From The Market As BTC Hovers Around $115K Is There a Best Crypto to Buy Right Now? appeared first on 99Bitcoins.