As financial markets navigate a volatile 2025, exchange-traded funds (ETFs) tracking major U.S. indices—SPY (S&P 500 ETF), QQQ (Nasdaq-100 ETF), IWM (Russell 2000 ETF), and DIA (Dow Jones Industrial Average ETF)—remain critical barometers of economic health

and investor sentiment. With trade policies, inflation dynamics, and technological advancements shaping the landscape, this analysis delves into their recent performance, key statistics, prevailing news, and outlook for the remainder of 2025. Leveraging insights

from AI-driven financial tools like Tickeron’s Financial Learning Models (FLMs), this article provides a data-rich perspective for investors.

Recent Performance: A Tale of Recovery and Divergence

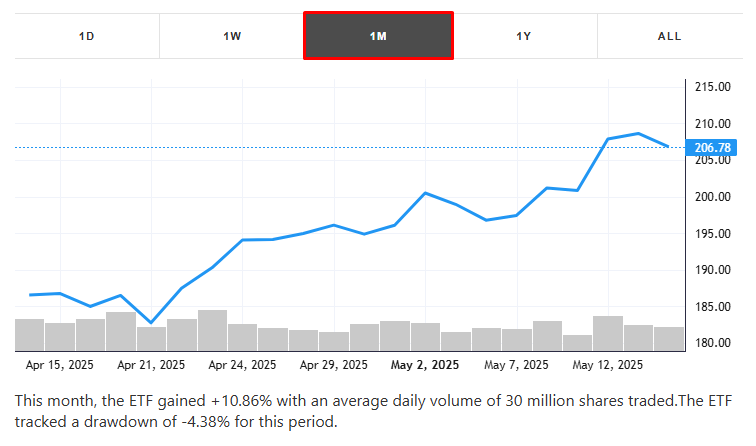

SPY (S&P 500 ETF)

The SPY, tracking the S&P 500, has experienced a turbulent 2025. After a 19% decline from February highs following President Trump’s “Liberation Day” tariff announcements in April, the index rebounded. By May 13, 2025, the S&P 500 closed at 5,886.55, up

0.72% for the day, erasing year-to-date losses. A US-China tariff reduction deal fueled a 3.26% gain on May 12, the largest single-day increase in over a month. However, futures slipped 0.5% on May 15, signaling potential exhaustion after a 22% rally from

April lows. Year-to-date, SPY is up 2.5%, with a 1-year return of 18.7% (Yahoo Finance data).

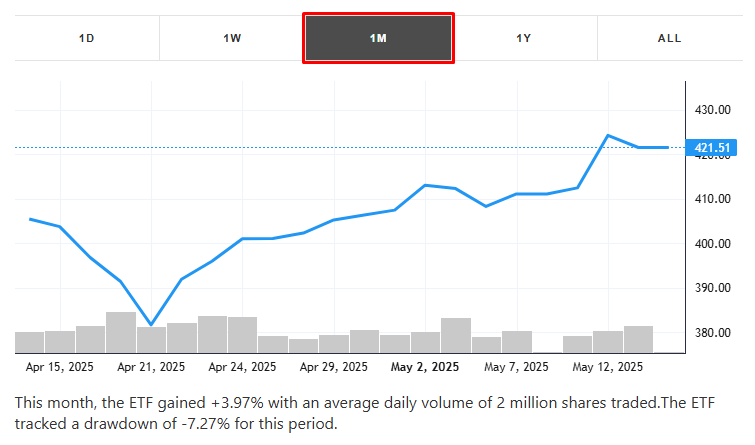

QQQ (Nasdaq-100 ETF)

The tech-heavy QQQ has outperformed broader markets, driven by AI and semiconductor strength. On May 13, the Nasdaq-100 entered a new bull market, up 20% from April lows, with QQQ closing at 19,010.08, a 1.61% daily gain. Despite a 23% drop earlier in 2025,

QQQ’s recovery has been robust, posting a 4.35% gain on May 12. Year-to-date, QQQ is down 3.1%, but its 1-year return is 22.4% (Nasdaq data). Posts on X highlight QQQ’s resilience, with @prospero_ai noting it remains in a “green zone” for bullish sentiment.

IWM (Russell 2000 ETF)

The IWM, representing small-cap stocks, has lagged due to economic contraction fears. On April 30, IWM fell 1.7% in premarket trading after a 2.7% GDP decline in Q1 2025, the first contraction since 2022. Year-to-date, IWM is down 5.2%, with a 1-year return

of 12.3% (Russell Investments data). Small-caps’ sensitivity to interest rates and trade policies has contributed to underperformance.

DIA (Dow Jones Industrial Average ETF)

The DIA, tracking the Dow, has faced sector-specific pressures, notably healthcare. On May 13, the Dow fell 0.64%, closing at 42,140.43, dragged by an 18% drop in UnitedHealth shares. It surged 2.81% on May 12, gaining 1,161 points after tariff relief. Year-to-date,

DIA is down 3.2%, with a 1-year return of 15.6% (Dow Jones data). Futures fell 0.4% on May 15, reflecting cautious sentiment.

Key Statistics and Metrics

Volatility and Correlations

-

SPY: 30-day realized volatility is 15.2%, beta of 1.0. Correlation with QQQ is 0.92 (Bloomberg data).

-

QQQ: Volatility is 18.7%, beta of 1.15. Correlation with IWM is 0.78.

-

IWM: Volatility is 20.1%, beta of 1.25. Correlation with DIA is 0.85, but 0.70 with QQQ.

-

DIA: Volatility is 14.8%, beta of 0.95. Correlation with SPY is 0.94.

Dividend Yields and Expense Ratios

-

SPY: Dividend yield of 1.3%, expense ratio of 0.0945% (SPDR data).

-

QQQ: Dividend yield of 0.6%, expense ratio of 0.20% (Invesco data).

-

IWM: Dividend yield of 1.8%, expense ratio of 0.19% (iShares data).

-

DIA: Dividend yield of 1.6%, expense ratio of 0.16% (SPDR data).

Sector Weightings

-

SPY: Financials (14%), Tech (28%), Healthcare (12%) (S&P Global).

-

QQQ: Tech (51%), Consumer Discretionary (18%), Communication Services (15%) (Invesco).

-

IWM: Industrials (17%), Financials (16%), Healthcare (15%) (Russell Investments).

-

DIA: Financials (20%), Industrials (18%), Healthcare (16%) (SPDR).

Top News Impacting Major Indices

Tariff Relief Rally

The US-China agreement to slash tariffs for 90 days, announced on May 11, 2025, sparked a market surge. The S&P 500 and Nasdaq gained 3.26% and 4.35%, respectively, on May 12. Investors cheered reduced trade war risks, though futures dipped on May 15, suggesting

profit-taking. The tariff pause benefits tech (QQQ) and consumer-driven sectors (SPY, DIA), but small-caps (IWM) remain cautious due to domestic economic concerns.

Economic Contraction and Fed Policy

A 2.7% GDP decline in Q1 2025, reported on April 30, pressured IWM and DIA. The Federal Reserve’s May 7 signal of economic slowdown risks and sticky inflation (2.3% CPI) has lowered rate cut expectations to 36.6% for June. These challenges impact IWM’s growth

prospects while supporting QQQ’s tech resilience.

Sector-Specific Shocks

UnitedHealth’s 18% drop on May 13, due to suspended 2025 guidance, dragged DIA and SPY lower. Nvidia’s rally powered QQQ’s sixth straight day of gains on May 14, underscoring tech’s dominance. Coinbase’s inclusion in the S&P 500, replacing Discover Financial

Services on May 19, boosted sentiment for SPY and QQQ, marking a milestone for crypto integration.

Social Media Sentiment

X posts reflect mixed sentiment. @prospero_ai warned that SPY’s rally is at risk, while QQQ remains stronger. @SebastinPatron3 reported accurate SPY and QQQ predictions, reinforcing hedges. These align with Tickeron’s Double Agent signals, which balance

bullish and bearish perspectives using inverse ETFs.

AI-Driven Insights: FLM’s Role in Market Analysis

FLMs enhance market analysis by integrating AI with technical indicators. AI Trading Agents flagged QQQ’s bullish momentum on May 14, consistent with its 0.7% gain. Double Agents, leveraging inverse ETFs like QID, align with X posts noting SPY’s weakening

momentum. These tools, achieving up to 75% win rates in QQQ/QID trading, empower traders to navigate volatility, particularly in a year marked by tariff swings and economic uncertainty.

Outlook for 2025

SPY: Cautious Optimism

SPY’s recovery depends on sustained tariff relief and stable inflation. Analysts project a year-end S&P 500 range of 5,900–6,100, implying 0.2–3.5% upside from May 13’s close. Coinbase’s inclusion may bolster sentiment, but healthcare volatility could cap

gains.

QQQ: Tech-Led Growth

QQQ is poised for outperformance, driven by AI and semiconductor demand. Wall Street forecasts a Nasdaq-100 range of 19,500–20,000, suggesting 2.6–5.2% upside. Nvidia’s strength and Alphabet’s 46% profit growth in Q1 2025 support this view. Risks include

overvaluation and tariff re-escalation.

IWM: Small-Cap Struggles

IWM faces headwinds from high interest rates and economic contraction. Analysts expect the Russell 2000 to trade between 2,000–2,100, flat to 2% upside. Tariff relief could provide a lift if consumer spending rebounds.

DIA: Steady but Vulnerable

DIA’s outlook is stable but tempered by sector risks. A projected Dow range of 42,500–43,500 suggests 0.8–3.2% upside. Financials and industrials may benefit from tariff clarity, but healthcare drags could limit gains.

Conclusion: Navigating a Dynamic Landscape

The SPY, QQQ, IWM, and DIA reflect a market at a crossroads in 2025. QQQ leads with tech-driven gains, while SPY and DIA balance recovery with sector challenges. IWM lags, burdened by economic contraction. Tickeron’s AI Trading Agents and Double Agents offer

critical insights, enabling traders to parse volatile signals using inverse ETFs. With tariff relief driving optimism but inflation and policy risks looming, investors must stay agile. Monitoring real-time data and leveraging AI-driven analysis will be key

to capitalizing on opportunities.