The week ahead is a macro minefield; we might be on the precipice of a crypto crisis. Between the Fed’s July meeting, earnings from tech giants, inflation prints, and labor numbers, investors face a stack of intimidating market signals.

Add in trade tensions with the EU, and Q3 could jolt sharply in either direction. Here’s what you need to know:

All Eyes on the Fed’s July Meeting

“We are here to save the bull run.”

Do you think either of those guys thought that? Regardless, don’t expect fireworks from the Fed this week.

The consensus on Polymarket points to rates staying put between 4.25% and 4.5%. Trump keeps pushing for cuts, but Powell’s sticking to his guns and waiting for more data. With a 62% market-implied chance of a September cut, Wednesday’s press conference and GDP release should be mandatory viewing.

LMAO! A reporter just asked Trump at the Federal Reserve: "As a real estate developer, what would you do with the project manager with the over budget?"

TRUMP: "I'D FIRE HIM!"

Powell looks SUPER uncomfortable

pic.twitter.com/ROwXKatq2E

— Nick Sortor (@nicksortor) July 24, 2025

Thursday’s release of the Personal Consumption Expenditures (PCE) index will indicate what the Fed does next. PCE will offer clarity on whether tariff-related pressures are creeping further into the economy.

Economists expect a 0.3% month-over-month rise and a 2.5% annual inflation rate. Core PCE, excluding food and energy, is projected to increase 0.3% monthly and 2.7% annually.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Trade Optimism Rises Ahead of August 1 Deadline

Meanwhile, the July nonfarm payrolls report drops Friday, providing the most direct read on the labor market’s resilience amid trade uncertainty. Consensus estimates project 102,000 new jobs and an unemployment rate ticking up to 4.2%.

“Initial jobless claims have dropped for six straight weeks… but continuing claims suggest it’s taking people time to get rehired.” — Dow Jones economist briefing

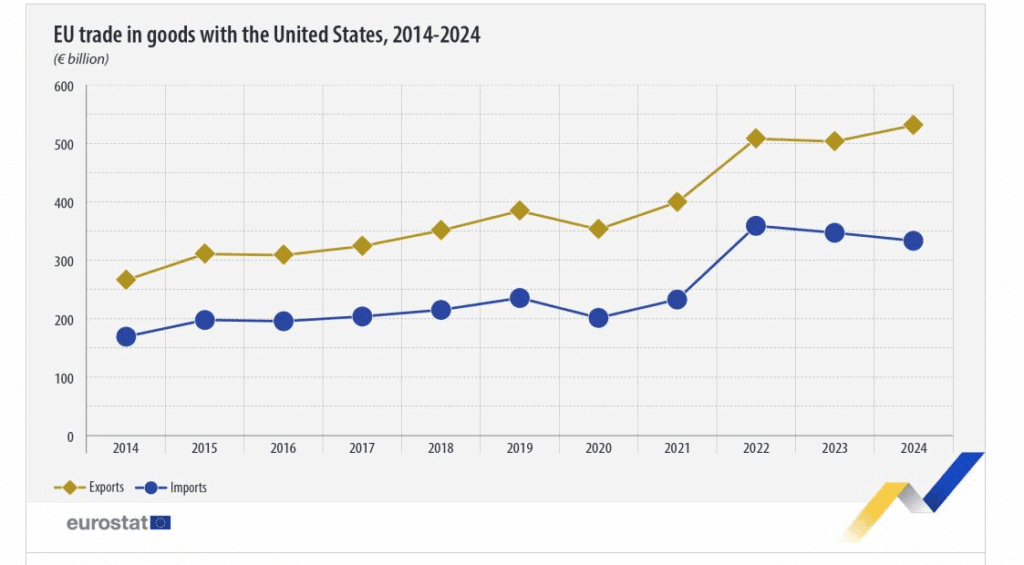

Markets are cautiously optimistic heading into this week’s U.S.-EU trade deadline. With recent agreements struck with Japan, Vietnam, Indonesia, and partial progress with China, the risk of major new tariffs has decreased.

The Trump administration is also preparing for new trade talks with Chinese officials in Sweden, which could further boost markets.

Furthermore, roughly 40% of the S&P 500 is reporting earnings this week:

- Meta Platforms (Wed): Analysts expect $43.84 billion in revenue and EPS of $5.91. Focus is on AI spending.

- Microsoft (Wed): Forecasts call for $73.81 billion in revenue and EPS of $3.37. Azure growth and commentary on AI services and infrastructure investment will be the top line items.

- Apple (Thu): Analysts project $40 billion in iPhone sales as consumers rush to beat potential tariff effects. Expectations are muted for the second half of the fiscal year.

- Starbucks (Tue): How else are any of us supposed to work without Starbucks? (Estimated revenue of $9.31 billion)

If the Fed signals dovish intent and trade clarity emerges by August 1, risk assets like BTC ▼-0.12% could surge higher.

For now, traders are entering the week positioned with cautious optimism. This it; here we go.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The week ahead is a macro minefield; we might be on the precipice of a crypto crisis.

- All eyes are on Powell this week as inflation lingers and labor metrics soften.

The post Markets Brace for Crypto Crisis: Fed, Earnings and Trade Talks Take Center Stage appeared first on 99Bitcoins.