Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana is showing signs of strength after weeks of heightened volatility and aggressive selling pressure. As the broader crypto market stabilizes amid ongoing macroeconomic uncertainty and global trade tensions, Solana has managed to inch closer to a critical resistance level. Despite the risks still looming, especially with trade war rhetoric between the US and China escalating, some market participants believe the conditions are aligning for a potential recovery rally.

Related Reading

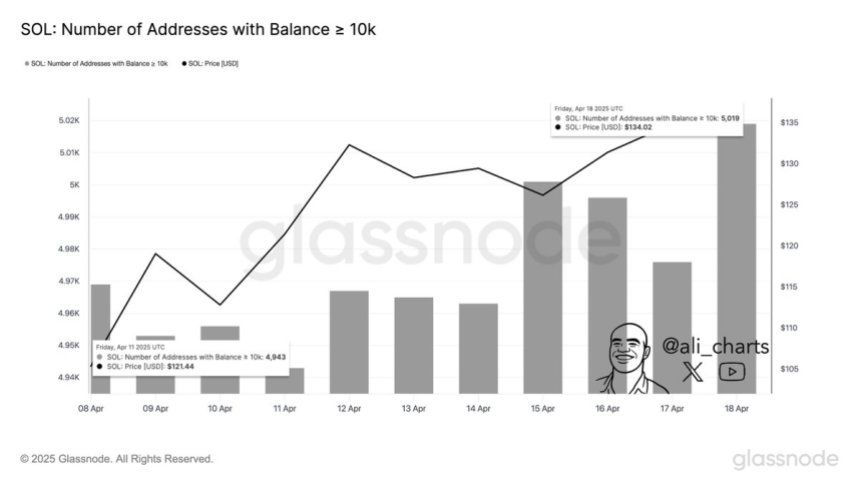

Adding weight to that view, recent on-chain data from Glassnode reveals a subtle yet notable shift in whale activity. The number of wallets holding more than 10,000 SOL has increased by 1.53% over the past week, rising from 4,943 to 5,019.

This uptick suggests that larger holders may be accumulating ahead of a possible breakout, interpreting current price levels as favorable entry points. Historically, such accumulation phases have preceded strong upward moves, particularly when combined with technical recovery signals and improving market sentiment.

Whether Solana can break through resistance and sustain a recovery remains uncertain, but the growing whale interest paints a cautiously optimistic picture for the days ahead.

Whale Accumulation Grows As Bulls Regain Momentum

Solana has been one of the hardest-hit assets during the recent market downturn. Since peaking in January, SOL has lost over 65% of its value, reflecting deep investor uncertainty and heightened selling pressure. As macroeconomic tensions between the US and China continue to grow, global markets have shifted toward a risk-off sentiment, with high-volatility assets like Solana taking the brunt of the damage. However, there may now be signs of relief.

A possible resolution in the ongoing trade dispute and improving liquidity conditions are breathing fresh life into the broader altcoin market. In Solana’s case, the recovery narrative is gaining support from on-chain metrics. According to data shared by top analyst Ali Martinez on X, the number of wallets holding over 10,000 SOL has increased by 1.53% over the past week, rising from 4,943 to 5,019. This subtle but notable uptick in large-holder activity suggests growing institutional or whale confidence in Solana’s long-term potential.

This accumulation trend, paired with rising momentum among bulls, could mark the beginning of a shift in sentiment after weeks of relentless pressure. If global risk appetite improves and Solana can hold key support zones, this whale behavior could lead to a sustained rebound in price.

Related Reading

Solana Tests Key Resistance As Investors Aim For A Recovery

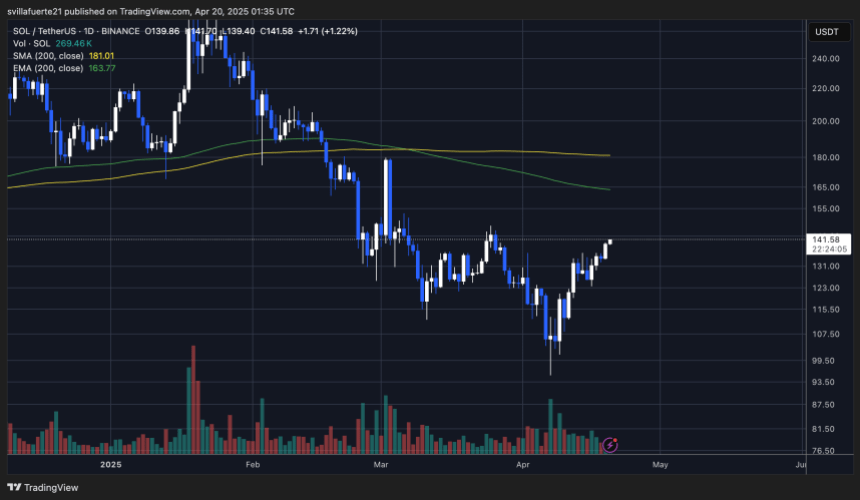

Solana (SOL) is currently trading at $140, just below a critical resistance zone that has capped price advances for weeks. After showing signs of strength in recent sessions, bulls are now attempting to push SOL above the $150 level—a key threshold that, if broken, could quickly propel the price toward the $180 mark. The current momentum is being closely watched, as reclaiming this resistance would signal a trend reversal and provide the foundation for a stronger bullish recovery.

To confirm an uptrend, SOL must break and hold above the $150 mark and then target the 200-day moving average, currently acting as a dynamic resistance. A decisive move above the 200-day MA would indicate a shift in sentiment and reinforce Solana’s breakout potential in the near term.

Related Reading

However, if bulls fail to reclaim and defend these levels, bearish pressure could return. A rejection at current prices would likely open the door for a retest of lower demand zones. Losing support around the $125 level could take SOL back to $100—a level that previously served as a strong support during earlier selloffs. The next few days will be pivotal for determining Solana’s short-term trajectory.

Featured image from Dall-E, chart from TradingView