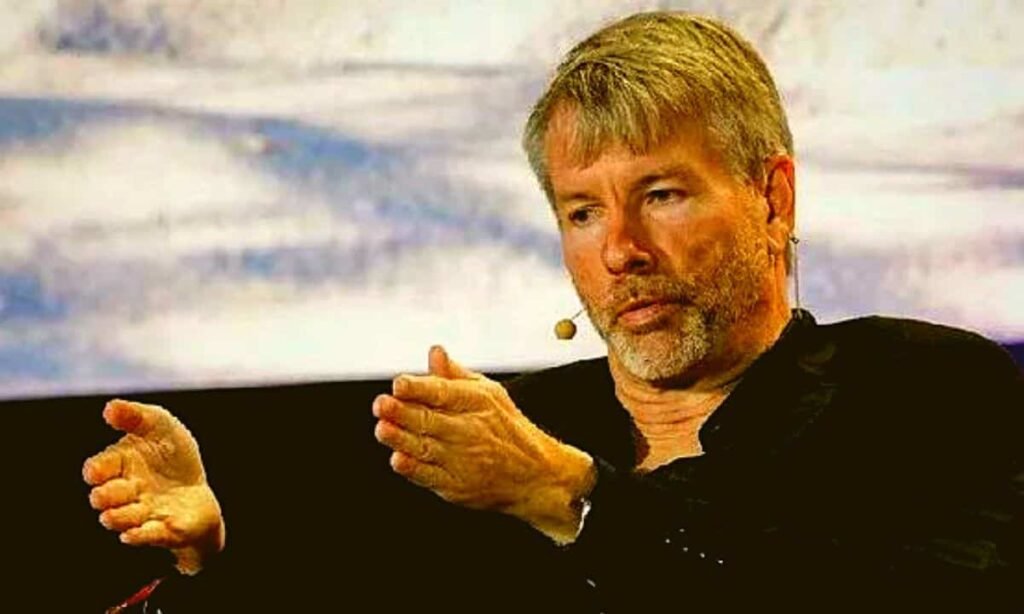

Michael Saylor, founder of Strategy (formerly MicroStrategy), has said that a Bitcoin strategic reserve will position the United States as a leader in cyberspace.

In an interview with Fox News Channel, Saylor argued that Bitcoin is a secure means of savings for individuals, companies, and governments.

Bitcoin Will Take The U.S. to Cyberspace

Saylor, whose company owns nearly 2.4% of the total Bitcoin supply, compared the cryptocurrency to digital land, urging the U.S. government to act quickly and secure its stake before foreign competitors do.

He further explained that establishing a Bitcoin strategic reserve is less about stockpiling the asset and more about gaining a leadership position in the digital economy.

“It’s really that you’re taking control of planting the flag in cyberspace because the digital economy is going to be capitalized on Bitcoin,” he said.

Addressing concerns that government adoption contradicts Bitcoin’s original vision as a decentralized asset, Saylor argued that its protocol was designed for universal adoption, empowering individuals, businesses, and even nation-states.

He argued that any country seeking economic stability and financial sovereignty would eventually see Bitcoin as a strategic asset.

If given the chance to advise policymakers, the founder said he would push for clear regulations on digital assets, emphasizing the need to differentiate between digital commodities like Bitcoin, digital currencies, and digital securities.

With a well-defined framework, he supports the careful and transparent accumulation of the flagship cryptocurrency to reinforce the country’s financial strength.

Altcoin Inclusion in The Crypto Reserve

On Sunday, President Donald Trump surprised many by announcing that altcoins such as Ethereum (ETH), Ripple (XRP), SOL (Solana), and Cardano (ADA) would be considered for a U.S. national crypto reserve.

While acknowledging the role of stablecoins and tokenized securities in financial markets, Saylor maintains that only Bitcoin qualifies as a reserve asset.

“The important thing to keep in mind is Bitcoin is the one universally agreed-upon foundational asset in the entire crypto economy because it’s the asset without an issuer,” he said.

His stance aligns with that of other industry leaders, including Coinbase CEO Brian Armstrong, who views Bitcoin as the most reliable long-term digital asset reserve.

Gemini co-founder Tyler Winklevoss has also dismissed the inclusion of altcoins, arguing that only Bitcoin is suitable for the initiative. Meanwhile, Peter Schiff supports a U.S. crypto reserve but has voiced opposition to XRP and other altcoins being part of the plan.

Trump is expected to unveil the Bitcoin reserve strategy at the White House Crypto Summit on March 7, where further details on the initiative’s structure and asset composition may be revealed.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!