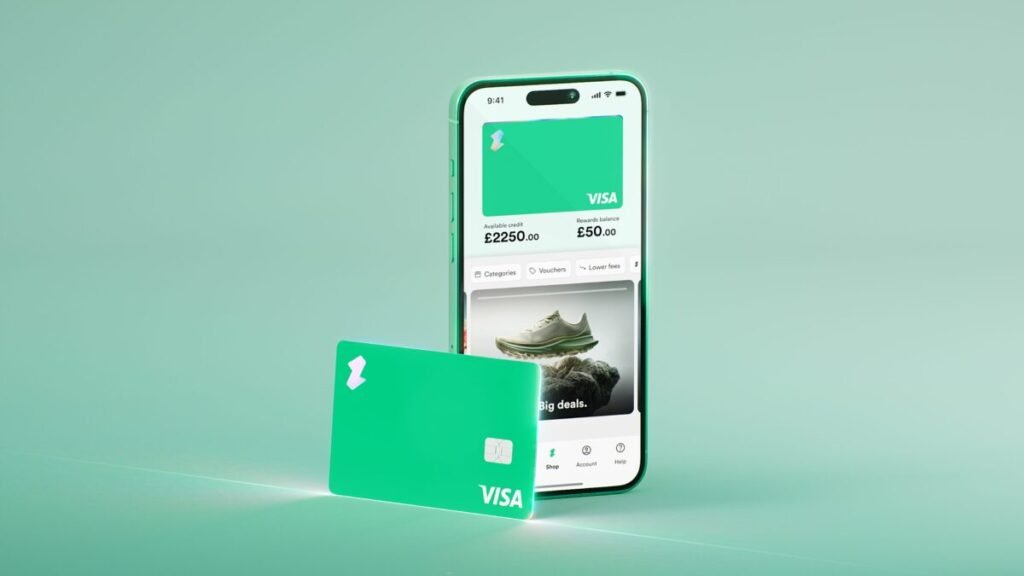

London-based ad-enabled payments company, Zilch, has announced the launch of its first-ever physical payments card via a strategic multi-year partnership with digital payments company Visa.

The partnership marks a significant step forward for Zilch in delivering faster, smarter and more seamless payment experiences, as well as laying the groundwork for continued growth. The deal will also continue to help expand the next generation of customer-first benefits. These will include more ad-enabled deals, discounts and cashback opportunities.

Mandy Lamb, managing director, UK and Ireland at Visa, commented: “It’s fantastic to welcome Zilch into the Visa ecosystem, as we work together to deliver word-class products and solutions to help them scale. Fintechs are shaping the future of commerce and we’re proud to support UK unicorns such as Zilch with their growth ambitions as they provide innovative services to consumers and businesses, while driving financial inclusion through their core offering.”

Flexibility in payments

The new physical card aims to open up flexibility to millions of customers – particularly those who prefer the assurance a physical card brings. It also unlocks the ability for Zilch to be used for key transactions like home maintenance, hotel check-ins or car rentals, unlocking a space that currently witnesses tens of billions in spend annually.

One in seven UK working adults are already Zilch customers with a virtual payment card stored in the Zilch app or in their mobile wallets. To date, Zilch has processed over £4billion of purchases – both online and in-store.

The card will work securely and seamlessly across Visa’s extensive global network that reaches over 150 million merchant locations in over 200 countries and territories, providing trust, resilience and innovation to global money movement. Customers will have the ability to shop anywhere in the world that Visa is accepted while continuing to earn rewards and enjoy flexible repayment options.

The next steps for Zilch

Speaking on the main stage at Money 20/20 Europe in Amsterdam Zilch CEO and co-founder, Philip Belamant, said: “Today’s announcement is about scaling reach, deepening utility, and setting the stage for the next era of Zilch. By partnering with Visa – a global leader in payments – we’ve plugged our AI-driven engine into a network that touches over 150 million merchants worldwide. This move will allow us to fully deploy our ad-enabled payments technology across both digital and physical retail, bringing measurable savings to consumers and margin efficiencies to merchants.

“With nearly 80 per cent of UK adults still not regularly using mobile wallets, the physical card is a strategic unlock to greater transaction volume. This move is Zilch executing its model at scale – removing cost from payments, increasing behavioural intelligence, and converting that into enduring value for both users and the ecosystem.”