OpenWay, a global provider of digital payment software, has supported the launch of Visa Flex Credential at Asia Commercial Bank (ACB) in Vietnam.

This marks the first implementation of the solution in Southeast Asia.

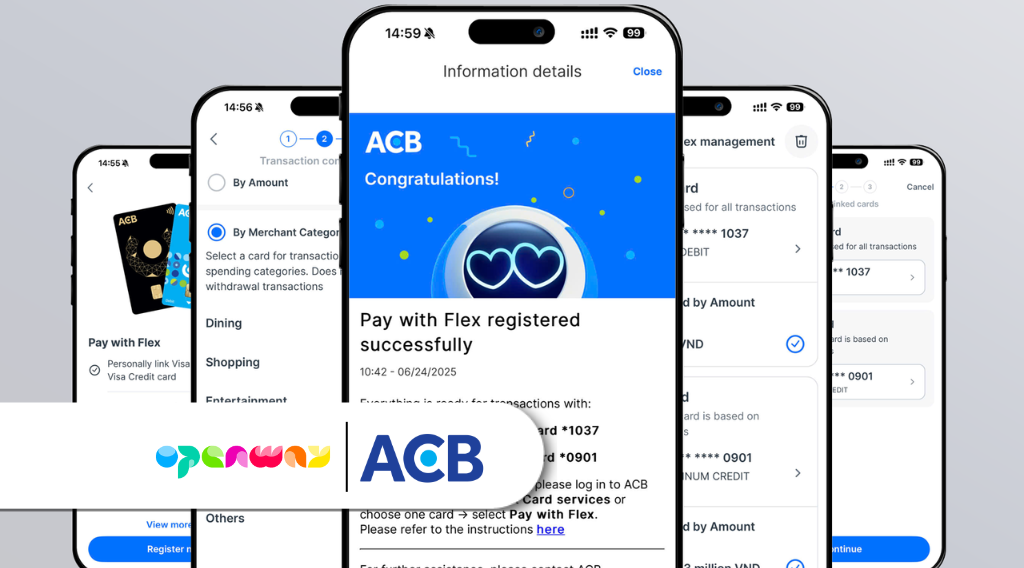

The new feature allows ACB customers to switch between debit and credit payment options using a single card, providing them with greater control over their spending and a more flexible payment experience.

For ACB, the introduction of Visa Flex Credential is expected to encourage faster card activation and increased usage, while also providing deeper insights into customer behaviour.

These insights can help enable more tailored offers and reduce dormant accounts, contributing to stronger overall portfolio performance.

The technology underpinning this development is OpenWay’s Way4 issuing and acquiring platform.

Nguyen Tam Khoa, Deputy Head of Consumer Division at ACB, commented:

“Here in Vietnam, debit remains the dominant form of card payment, and we see significant potential and room for growth in credit and flexible payment products like Visa Flex Credential. Thanks to our 10-year collaboration with OpenWay and their Way4 platform, ACB has pioneered multiple market-firsts, including Visa Flex Credential, Apple Pay tokenisation, QR-code ATM deposits via mobile, and more. We’re proud that our customers are the first in the region to enjoy innovative, convenient, real-time, personalised payments.”

Ha Nguyen Manh, General Director of OpenWay Vietnam, added:

“Today ACB is one of the first banks globally to support Visa Flex Credential. With our Way4 platform as their foundation, they are well-positioned to expand this offering further, for example, by adding instalment or loyalty accounts to the selection, in line with the bank’s insights into evolving customer expectations.”

The project involved several enhancements to ACB’s existing systems.

These included upgrades to Way4’s interfaces with Visa and the ACB One mobile app to support the updated transaction logic, modifications to the card system database and workflows to accommodate tokenisation, and the implementation of smart routing capabilities in coordination with Visa’s Flex Credential portal.

The solution received Visa certification and was brought to market within a few months.

ACB’s implementation of Visa Flex Credential illustrates the strategic role of the Way4 platform, which is used by financial institutions worldwide to deliver complex projects and support business growth.

OpenWay has previously supported initiatives such as the world’s first mobile Visa peer-to-peer transfers and the first central bank digital currency cards in Eurasia.

Additional rollouts of Visa Flex Credential powered by Way4 are currently in progress in other regions.

Featured image credit: OpenWay