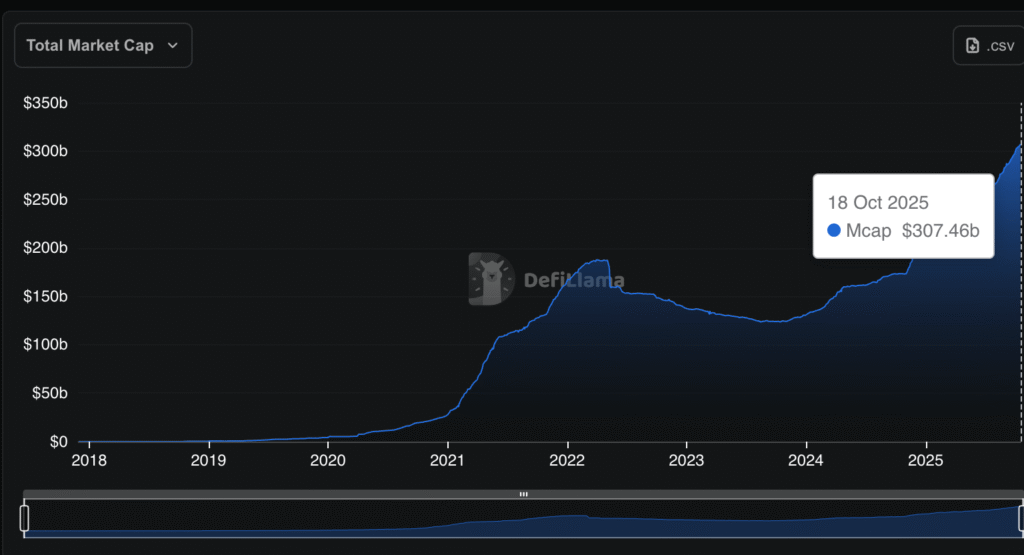

The stablecoin market just set a new record. The total value of dollar-pegged cryptocurrencies has climbed to about $307 billion, the highest on record, even as broader crypto prices remain uneven.

Plasma (XPL), a new layer-1 network built for stablecoin payments, also caught attention.

The token traded between $0.40 and $0.42 on strong volume, extending its recovery from last week’s lows. The move adds weight to the growing market focus on “stablecoin rails,” a theme driving renewed inflows.

Stablecoin Growth Is Strongest Backdrop For On-Chain Liquidity Seen in Months

DefiLlama data shows capitalization in stablecoins increasing by 5-6% over the last month, which is an indicator of a consistent supply of liquidity.

USDT is still the anchor of the industry, with an approximate circulating currency of $181-$182Bn Bn, and continues to record large daily trading volumes across exchanges.

Top crypto analysts say this renewed expansion matters. A rising stablecoin float often comes before higher spot and derivatives trading activity, hinting that broader market momentum could be rebuilding.

Analysts on X have linked the trend to three main drivers heading into Q4 ETF inflows, expanding stablecoin supply, and expectations of easier monetary policy before year-end.

Together, they form the strongest backdrop for on-chain liquidity seen in months.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

XPL Price Prediction: Is XPL Crypto Forming a Bullish Reversal Pattern After Its Long Downtrend?

A crypto analyst posted the XPL/USDT 4-hour chart, which shows signs that momentum may be shifting.

After sliding for weeks from above $1.80, the token has now settled near $0.40 a level that has become strong support.

A descending trendline from earlier highs has capped every rebound so far. But recent candles suggest that pressure is easing as XPL compresses inside a tightening wedge.

This pattern often appears before a reversal if buyers manage to break above resistance with strong volume.

At around $0.4178, XPL sits close to that breakout point. The next resistance is near $0.45, while support remains firm between $0.36 and $0.40.

Volatility has narrowed, and sellers appear to be losing momentum, a sign that some traders may be accumulating at the lower band.

If bulls push through the upper boundary, the chart points toward a potential move toward $1.60, roughly a 3.8× gain from current levels. But if the $0.36 floor fails, the bullish setup breaks down, likely triggering another leg lower.

For now, XPL trades in a make-or-break zone. A confirmed breakout could mark the start of a recovery phase, while another rejection might extend its broader downtrend in the sessions ahead.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Plasma XPL Pumps as Crypto Stablecoins Market Cap Hit All-Time High: Stop Shorting the Market appeared first on 99Bitcoins.