A poor millionaire sounds like an oxymoron, but they definitely exist. Roughly 6% of U.S. households are millionaires, yet many of them still don’t feel rich.

A poor millionaire is someone worth over $1 million but unable to access much of their wealth. In other words, their net worth is highly illiquid. A layoff, bear market, or job loss could quickly put them in peril.

In contrast, a rich millionaire is also worth over $1 million but can easily tap into their wealth. They’re liquid and resilient to financial shocks. Not only are they rich financially, they’re richer mentally. The thought of financial destruction rarely crosses their minds.

The Key Liquidity Zapper for Millionaires

The main culprit behind illiquidity is the primary residence. Owning a nice home is awesome, especially if you get to work from home or are retired. You just have to be careful owning too much home.

If you want to feel comfortable, aim to keep your primary residence below 30% of your net worth. If you want to feel rich, keep it below 20%. That way, at least 80% of your net worth can be in liquid or semi-liquid assets.

In reality, though, maintaining 70%–80% liquidity is tough, and also unnecessary. Millionaires often invest in rental properties, private real estate funds, venture capital, venture debt, and other illiquid alternatives. Decamillionaires and up usually have significant private business equity as well, another illiquid asset class.

That’s why having at least 20% of your net worth in liquid assets—like stocks and bonds—is so valuable. You’ll sleep better knowing you never have to sell illiquid holdings at fire-sale prices and always have dry powder to buy the dip when markets panic.

Recommended Income And Net Worth Chart Before Buying A Home

Below is a handy home-buying chart I put together based on income and net worth minimums. Ideally, you should have both the recommended income and recommended net worth associated with your target home price. If not, you need at least one of the following combinations before proceeding:

- The recommended income + the minimum net worth, OR

- The recommended net worth + the minimum income

Otherwise, you’ll likely feel financially strained.

My Experience With Liquidity After 26+ Years of Building Wealth

My recommendations come from real-life experience, building wealth from nothing in 1999 to financial independence today.

With every home purchase since 2003, I’ve tracked how each one made me feel. My latest home purchase in 2023 was another test of my 20%–30% rule. It was an all-cash deal equal to about 23% of my net worth.

The moment I closed, I felt uncomfortable—house rich and cash poor—hoping nothing bad would happen to our finances in the next year. It was a terrible feeling that I couldn’t wait to eliminate.

I even wrote about living paycheck to paycheck after that purchase, which ruffled some feathers. But I was simply being honest about how I felt. From that uncomfortable position, I decided to boost liquidity by negotiating more online business development deals and taking on a part-time consulting role at a seed-stage fintech startup. Too bad I could only last four months.

The experience reaffirmed my belief: to feel truly rich and secure, keep your primary residence to no more than 20% of your net worth. Even though I survived the anxiety, I don’t want to feel that way again.

Thanks to a bull market and continued savings, my home now represents about 19% of my net worth, and I feel great. What amplified that feeling was selling my old primary residence in early 2025, after renting it out for a year. Converting that illiquid property equity into public stocks, Treasuries, and an open-ended venture fund that offers quarterly liquidity felt amazing.

As bullish as I am on single-family homes with views on San Francisco’s west side, the peace of mind that comes with liquidity trumps all.

Liquidity by Level of Millionaire

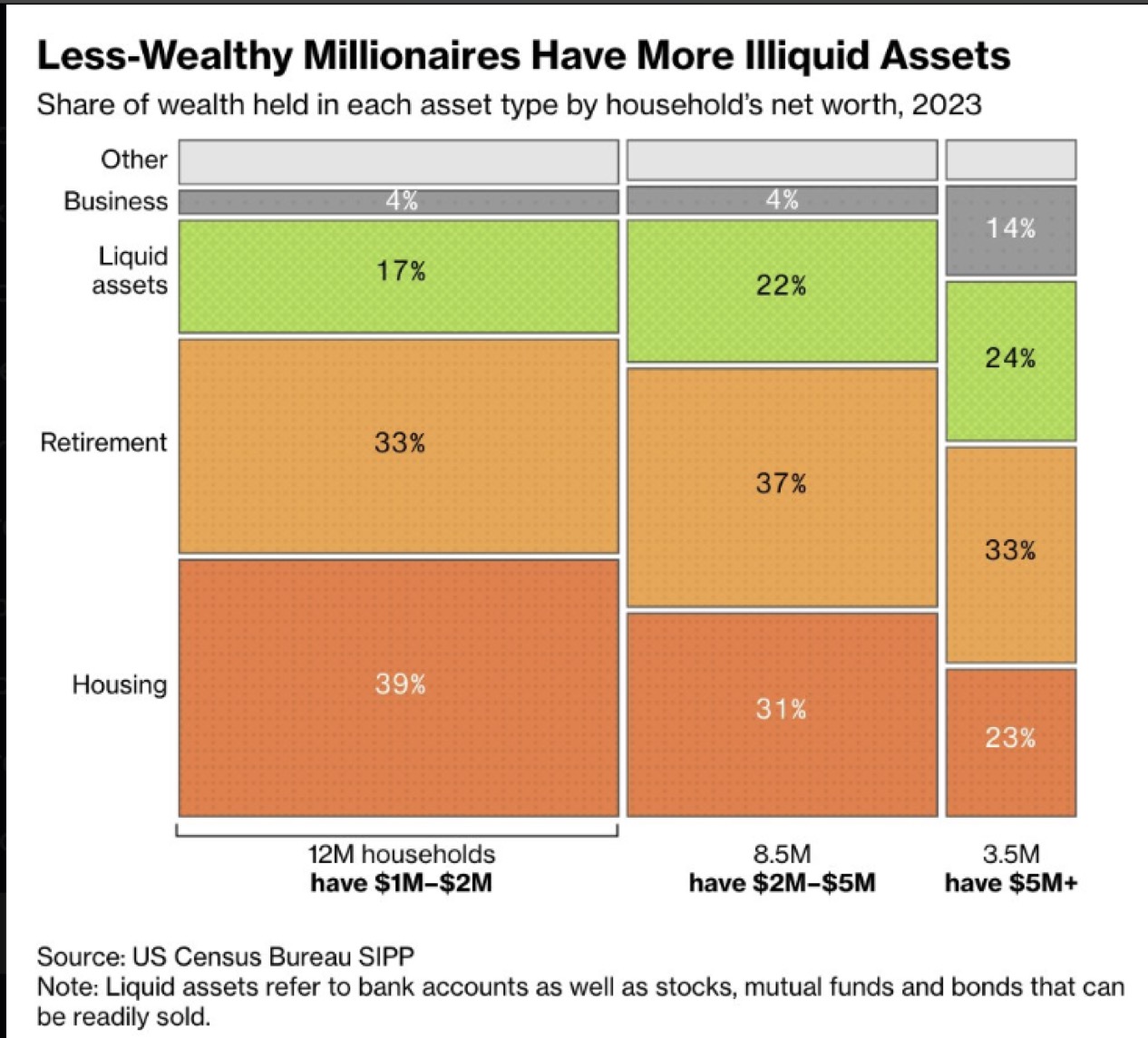

According to the latest U.S. Census Bureau data, millionaire liquidity varies widely.

For the ~12 million households with a $1M–$2M net worth, an aggressive 39% of wealth is tied up in housing. It’s no wonder so many of these “poor millionaires” say they don’t feel rich or feel like they’re just running in place. Thanks to inflation, a millionaire today needs over $3 million to match the purchasing power of a 1990s millionaire.

Meanwhile, for the ~3.5 million households with a net worth above $5M, only 23% is in their primary residence. Roughly 33% comes from retirement accounts, 24% from liquid assets, 14% from business interests, and the rest from miscellaneous assets. Much better.

Based on a Financial Samurai survey, $5 million is the ideal net worth for retirement with $10 million a close second. Once you feel rich enough, you’re willing to act, often by leaving a suboptimal job to pursue something more fulfilling.

I’m pleased to see that the 23% figure for housing among these “rich millionaires” aligns with my 20% guideline. I’m confident that for households worth over $10 million, housing as a share of net worth would fall even lower—likely under 20%.

I’ve written before about how you’ll feel reaching various millionaire milestones – $1M, $5M, $10M, and $20M+. And I’ll confidently say: once you have over $10M and your home makes up 20%, you’ll feel rich, even in expensive cities like San Francisco or New York.

For example, let’s say you owned a $2 million home with a mortgage, but had $4 million in a taxable brokerage account, $1 million in Treasury bonds, $2.5 million in a IRA, and $500,000 in cash. There is no doubt in my mind you will feel rich.

Housing Build Foundational Wealth, Everything Else Gets You Richer

The Census Bureau data reinforces one key truth: housing is the foundation of wealth-building.

Thanks to chronic undersupply, population growth, inflation, leverage, forced savings, and government incentives, owning your primary residence is a smart hedge against inflation. You might not build wealth at the fastest pace, but after a decade of homeownership, you’ll likely see substantial equity gains.

The combination of paying down your mortgage and enjoying long-term appreciation is a powerful force. Of course, there will be more opportune time than others to buy your primary residence. However, long-term, you want to get neutral housing.

Renting Temporarily Is Fine, But Not Long Term (7+ Years)

Some renters say they’ll “save and invest the difference,” but a minority actually do consistently. Discipline over decades is hard. In a way, owning a home with a mortgage protects you from yourself, forcing you to save and build wealth automatically.

If everyone had perfect discipline, we’d all be in peak financial shape with four-pack abs. Yet over 60% of Americans are overweight despite knowing the health risks.

I’m helping manage one of my relative’s investments for free. She’s in her 50s and has rented in New York City for over 30 years. Sadly, she’s now under pressure to move because her income hasn’t kept pace with the city’s relentless rent increases.

I am feeling the uncomfortable financial pressure through her and it truly stinks. If only she had bought a place 10 or 20 years ago, her life would be so much easier today.

The Cycle Repeats Once Housing Gets To Be a Small Enough Percentage

Once you own your primary residence, achieving “neutral” real estate exposure, you can invest aggressively in other asset classes. Your foundation is set. From there other asset classes can all help expand your wealth. Over time, as these other investments grow, your primary residence will naturally become a smaller percentage of your total net worth.

Ironically, once your home drops below 10% of your net worth, you might feel too frugal. At that point, you’re likely earning far more than you can spend from passive and active income.

So don’t be afraid to upgrade your lifestyle. Buy a home worth up to 20% of your net worth, maybe even 30% again if you wish. Enjoy the fruits of your discipline, then work that ratio back down to feel another great sense of achievement.

Housing builds your foundation, but liquidity builds your freedom. The rich millionaire doesn’t just own wealth, they can use it when it matters most.

So, readers, are you a rich millionaire or a poor millionaire? How much of your net worth is tied up in illiquid assets versus easily accessible cash or investments? And in your view, what’s the ideal level of liquidity to truly feel wealthy and free?

Suggestions To Build More Wealth

If you’re interested in investing in real estate without taking on a mortgage, consider checking out Fundrise. The platform manages over $3 billion in assets, with a focus on residential and commercial real estate in the Sunbelt. With interest rates gradually declining and limited new construction since 2022, I anticipate upward pressure on rents in the coming years, an environment that could support stronger passive income.

I’ve personally invested over $500,000 in Fundrise funds, and they’ve been a long-time sponsor of Financial Samurai as our investment philosophies are aligned.

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth and break free sooner.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. My goal is to help you achieve financial freedom sooner.