Q.

I’m a 58-year-old surgical nurse retiring in July. My

will be roughly $55,000 annually and it will start paying out in September. I have $48,000 in unused

registered retirement savings plan

(RRSP) contribution room. Should I

on my 2025 taxes? I have enough saved to do so. Or, should I stick to topping up my

(TFSA)?

—Thanks, Richard in Ontario

FP Answers:

Richard, there are a few things to consider when deciding on an RRSP or TFSA contribution. The best place to start is with a good understanding of the math behind RRSPs and TFSAs.

It is often said that RRSP contributions are made with pre-tax money and TFSA contributions with after-tax money. Although true by design, it is not true based on the way most people make RRSP contributions.

Most people think, “I have $10,000, should I add it to my RRSP or TFSA?” If you are adding to your RRSP you will likely do it in one of three ways: you will gross up the amount (which I will explain later), you will reinvest the tax refund, or you will invest only the $10,000.

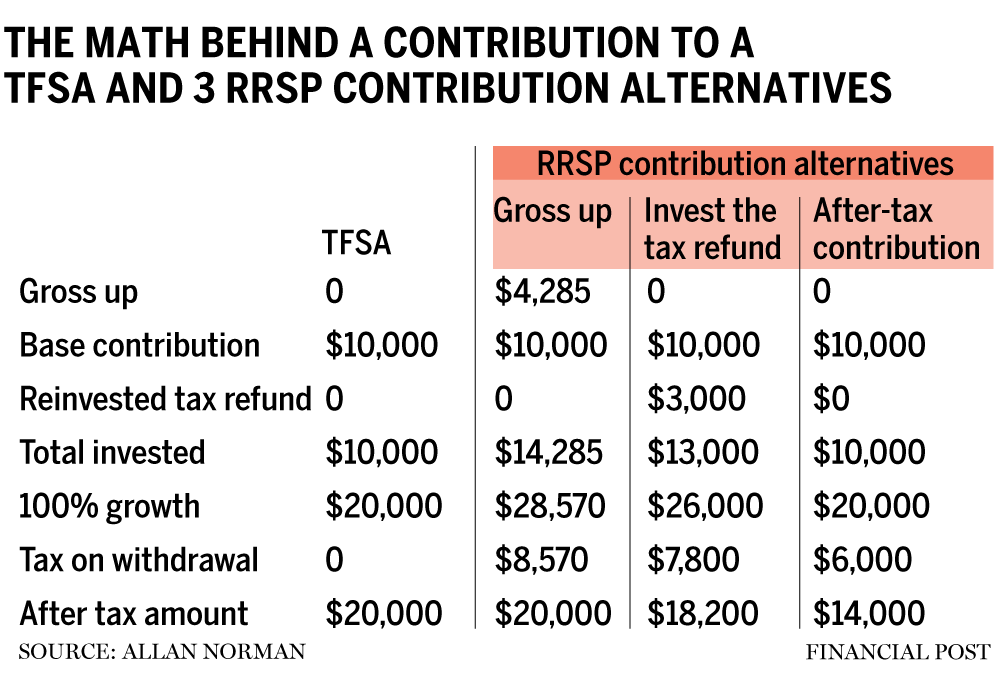

The accompanying table illustrates the math behind a $10,000 contribution to a TFSA, and three RRSP contribution alternatives. I am assuming the full contribution and withdrawal is taxed at 30 per cent and the initial investment grows by 100 per cent over time.

The results in the chart are showing no difference between TFSAs and RRSPs if you are grossing up (pre-tax) your RRSP contribution. You can also infer that if at the time of withdrawal you are in a lower tax bracket, the RRSP beats the TFSA and if in a higher tax bracket, the TFSA beats the grossed-up RRSP.

Also apparent from the table is that if you are not grossing up your RRSP contribution the math favours a TFSA contribution.

Grossing up your RRSP contribution means contributing an amount equal to what you had to earn before tax, to have $10,000 in your bank account. Here is the gross up formula: $10,000/(1-30 per cent (your marginal tax rate)). To get the extra $4,285 you can either borrow the money from a lender or from yourself and then pay it back when you get your tax refund.

Richard, you may be questioning, if you maximize your $48,000 RRSP contribution how can you gross up your contribution? You can’t, but it is still important to understand the math behind contributions. You need to also be looking at the other benefits of making RRSP contributions.

RRSPs and TFSAs are both tax shelters. However, you will likely stop earning RRSP contribution room once you stop working, whereas each year you will earn additional TFSA contribution room. Plus, this may be your highest income earning year. Based on that it may be best to maximize your RRSP and then use the tax refund to top up your TFSA.

Keep in mind that you don’t have to claim all or any of your RRSP tax deduction in the year you make an RRSP contribution. Your income in 2025 will be made up of salary and pension and may be your highest earning year until you start your

(CPP) and

(OAS). You may want to claim an RRSP deduction to bring your income down to the top of the first tax bracket and save your remaining RRSP deduction for a future year or years. If you decide to do some part-time work the saved RRSP deductions may be useful.

Another consideration is that money within an RRSP compounds tax-free. The money you have saved to make the $48,000 contribution may be earning taxable interest, dividends, or capital gains. The longer you have the money in your RRSP the bigger this advantage becomes. Now, if you are planning to spend the $48,000 in the next year or two you may only want to add enough to your RRSP to bring you down to the top of the lower tax bracket — about your pension income — and then top up your TFSA with the rest, possibly leaving some non-registered money.

Richard, as I mentioned earlier, RRSPs and TFSAs are both tax shelters and RRSPs have a limited shelf life compared with TFSAs. If this is long-term money you have saved to add to your RRSP it may be best to use it while you have the higher income and save your TFSA room.

Allan Norman, M.Sc., CFP, CIM, provides fee-only certified financial planning services and insurance products through Atlantis Financial Inc. and provides investment advisory services through Aligned Capital Partners Inc., which is regulated by the Canadian Investment Regulatory Organization. He can be reached at alnorman@atlantisfinancial.ca.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.