Recent happenings with whales have caused turbulence in the XRP market. A transaction of 131 million XRP tokens, which is around $273 million worth, has sent jitters among investors. This occurrence comes during the tough battle of XRP in attempting to cut through the resistance at $2.16.

Large Wallet Transfers Raise Questions About Market Stability

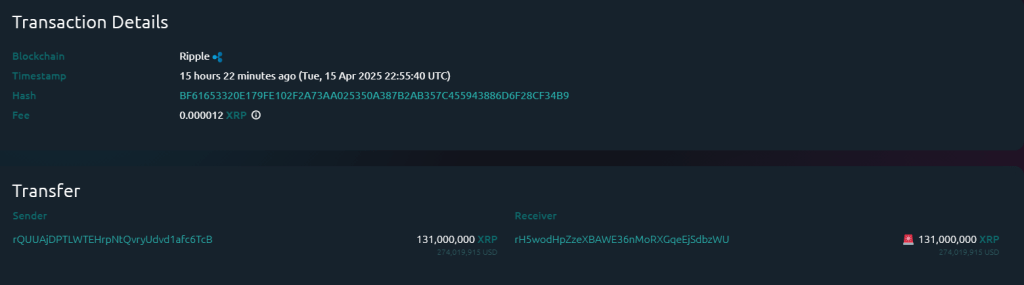

As per blockchain monitoring by Whale Alert, an unknown owner moved 131 million XRP between wallets in a single transaction. The activity prompted conversations on trading platforms as investors attempted to decipher the move. The wallet addresses used haven’t been traced to any known exchanges or parties, further fueling uncertainty.

This was not a one-off action, though. Only 12 hours ago, another big holder transferred XRP valued at $63 million. These consecutive moves by major token holders indicate that a trend may be emerging. Some observers think these may be over-the-counter transactions, while others are concerned about potential selling pressure to materialize.

131,000,000 #XRP (273,945,648 USD) transferred from unknown wallet to unknown wallethttps://t.co/CnMiTrxABL

— Whale Alert (@whale_alert) April 15, 2025

Price Continues To Fail To Break $2.17 Resistance

XRP has been unable to break the $2.17 barrier in recent times despite several attempts. These rejections have undermined bullish momentum and driven the price lower. According to reports, XRP traded at approximately $2.06 within the last 24 hours, and down by 4%.

The digital asset had registered a positive growth in the last week with a gain of 14%. Yet this upward movement wasn’t sustained even after the noise surrounding whale movement. The unplanned realignment of tokens is causing traders immediately across the marketplace to respond adversely.

Market analyst CasiTrades indicated that XRP might drop towards the support levels lower than $1.90 in case the downtrend persists. The analyst even indicated a likely drop to $1.55 if the volume of selling gains momentum higher than the present volumes. Such prices may present chances for buying once market interest re-emerges.

JUST IN: SWIFT nearing agreement with Ripple to use #XRP for cross-border payments, with billions of $XRP secured in escrow as liquidity reserves.

IF THIS IS TRUE WE ARE GOING TO $10,000+ pic.twitter.com/Tl4Y3FP6g6

— THE RIPPLE WHALES (@RIPPLE_WHALES) April 15, 2025

Long-Term Outlook Still Remains Promising

There are still some analysts who think XRP has a bright future, although it’s been weak recently. Investors get excited sometimes due to rumors of an XRP ETF and a potential agreement with payment system, SWIFT. But nothing significant has happened in the market from those expectations so far.

Currently, market participants are split. Large institutional trades and price pullbacks at key levels are resulting in conflicting views. The $1.90 to $1.55 support zone is critical. XRP must remain above this zone for the price to have any possibility of increasing soon.

The market is still following XRP closely in anticipation of concrete news. Whale movements and the chronic resistance at $2.16 are decisive factors in the direction of the market in the next few days.

Featured image from Pexels, chart from TradingView