Sea Ltd has injected an additional S$78 million into its Singapore-based digital bank, MariBank, as part of its ongoing effort to scale its digital financial services presence across Southeast Asia.

The latest capital infusion, confirmed by filings with Singapore’s Accounting and Corporate Regulatory Authority (ACRA) and by the company to DealStreetAsia, was made in two tranches this year—S$36.6 million in February and S$37.4 million in March.

These follow two earlier injections in 2024—S$19.1 million in October and S$37.2 million in December—bringing Sea’s total capital investment in MariBank to S$488 million since 2021.

MariBank said the new funds will support the expansion of its digital banking services, enhance operational capabilities, and help the company better serve customers in a competitive market.

The company views the capital injection as an expression of Sea’s confidence in its long-term growth trajectory.

The latest funding came shortly before MariBank acquired SeaBank Philippines in April.

Although SeaBank functions as a digital bank, it is classified as a rural bank due to its acquisition of Banco Laguna in 2021.

The deal allowed Sea to enter the Philippines’ digital banking market despite a regulatory moratorium on new digital bank licences after the initial six were granted.

SeaBank Philippines president Marco Cabreza informed customers that the bank would be integrated under MariBank Singapore’s group structure.

The move includes new capital support and regional strategic oversight from Singapore.

Sea Ltd’s digital banking operations now span several markets.

In addition to MariBank in Singapore and SeaBank in the Philippines and Indonesia, the company entered the Malaysian market earlier this year through Ryt Bank—a joint venture with YTL Digital Capital.

The group also reportedly submitted a digital bank licence application in Thailand in October 2024.

MariBank’s revenue surged more than sixfold in 2023 to S$10.1 million, but its net loss widened to S$51.9 million, driven by increased customer deposits and higher operating costs.

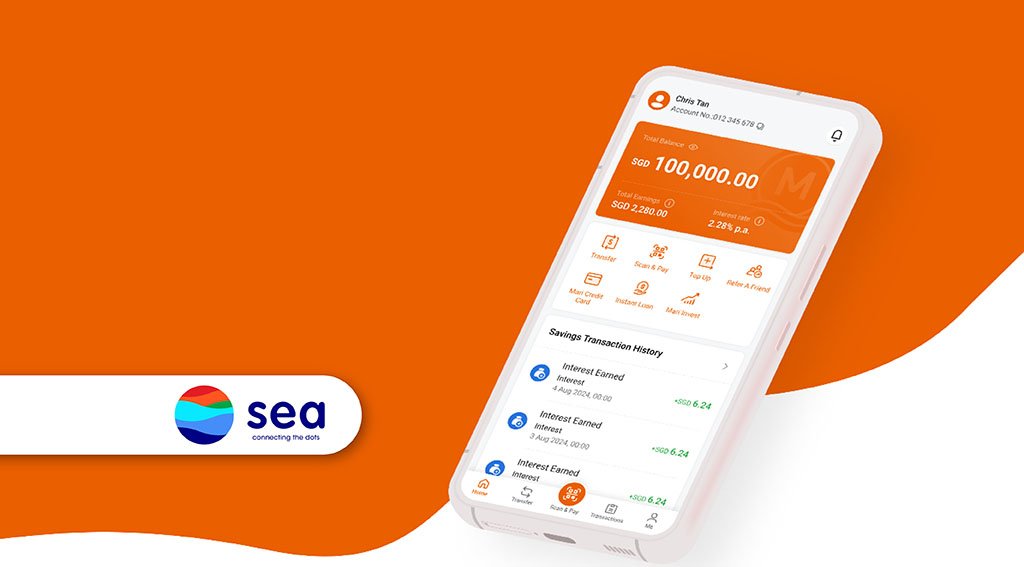

Featured image: Edited by Fintech News Singapore, based on image by MariBank