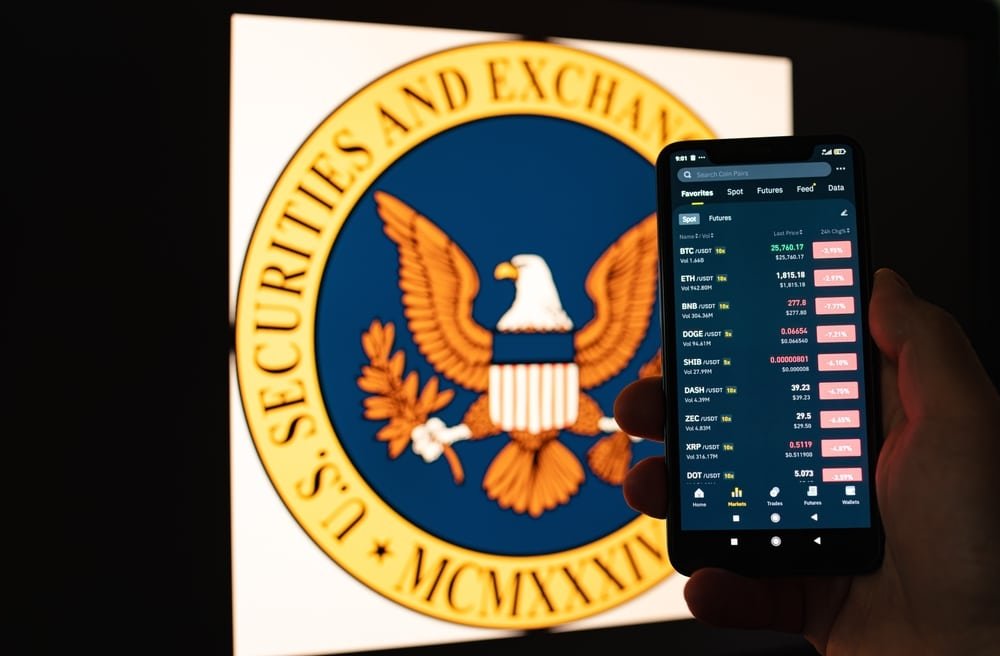

If you thought wrapping a traditional asset in a blockchain token would sidestep securities laws, think again. David Hirsch, who leads the SEC’s Crypto Assets and Cyber Unit, made it very clear during a recent talk at Yale: tokenization does not change what the asset is at its core.

He was talking about the growing trend of turning real-world assets like stocks or bonds into digital tokens on a blockchain. The idea sounds modern, even forward-thinking, but from the SEC’s perspective, it’s still the same product. Hirsch’s message was blunt. A security is a security, no matter how you package it.

Tokenization Doesn’t Equal Exemption

The crypto industry has embraced tokenization as a way to reinvent how finance works. It makes assets more portable, potentially lowers costs, and lets people trade around the clock. But Hirsch warned that technical upgrades do not rewrite the law. Just because a bond or equity gets digitized does not mean it loses its status as a regulated financial instrument.

He used a straightforward comparison. If you slap a new label on something, you can change how it looks, but you are not changing what it is. That’s how the SEC views tokenized assets. If they meet the legal definition of a security, they will still be treated as one.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Institutions Are Watching

This matters because tokenized finance is starting to attract some of the biggest names in the industry. Firms like BlackRock and Franklin Templeton are exploring tokenized treasuries and money market funds. Some crypto platforms are building businesses on the idea that tokenization opens the door to a more flexible legal framework.

But Hirsch’s statement hits pause on that optimism. He said the SEC is watching closely and will apply the same legal standards to these new formats as it does to traditional offerings. Registration, disclosure, and investor protections still apply, even if the asset now lives on a blockchain.

Enforcement Isn’t Slowing Down

Despite a few recent losses in court, Hirsch made it clear that the SEC is not easing up. He pointed out that the agency continues to file new enforcement actions and is keeping a close eye on firms that try to stretch the rules. Even companies that are making an effort to stay compliant need to be cautious about how they interpret the legal boundaries around tokenization.

Hirsch acknowledged that the crypto industry is moving fast and evolving, but reminded everyone that the law is still the law. Being innovative does not mean you can skip the regulatory playbook.

DISCOVER: 20+ Next Crypto to Explode in 2025

So What Does it Mean?

For startups, developers, and institutional players experimenting with tokenized assets, the message is pretty straightforward. The technology might be new, but the regulations are not. Whether you are dealing with a digital token or a printed share certificate, the legal treatment stays the same if it qualifies as a security.

Tokenization may offer efficiency and access, but it does not give anyone a free pass. The rules still apply, and the SEC is making sure everyone understands that.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- SEC official David Hirsch says tokenized assets are still subject to securities laws if they meet the legal definition of a security.

- Putting traditional assets like stocks or bonds on a blockchain does not change how they are treated under U.S. law.

- Hirsch warned that the SEC will apply the same rules to tokenized products, including disclosure and registration requirements.

- Big firms exploring tokenized finance, like BlackRock and Franklin Templeton, are being watched closely by regulators.

- The SEC is continuing enforcement efforts and reminding companies that new tech doesn’t cancel out old rules.

The post SEC Official Says Tokenized Assets Are Still Securities Under U.S. Law appeared first on 99Bitcoins.