Coinbase stock (COIN) is down more than 30% since its July peak, but 99Bitcoins analysts and others aren’t ready to call it a collapse.

Mizuho Financial, once openly skeptical of COIN stock, just bumped its price target from $217 to $267. The catalyst is a pickup in July trading volumes after a flat second quarter.

Still, the tone remains cautious. Mizuho kept its neutral rating, citing a 45% drop in consumer spot trading and a 39% dip in transaction revenue last quarter.

“While trading volumes were underwhelming this quarter, July has seen a rebound… reflecting improving market activity,” – Mizuho analyst note, August 2025

Trump Fueled Coinbase Stock Summer Surge

Much of Coinbase’s recent action tracks back to July’s legislative run. COIN rallied sharply after President Donald Trump signed the GENIUS Act, the first federal law to provide a regulatory framework for stablecoins. The optimism helped COIN join the S&P 500, but the rally was short-lived.

After spiking in mid-July, the stock reversed course and trades below Mizuho’s revised target of $297.87 as of Wednesday morning’s session.

We weren't allowed to run this ad on TV in the UK, but that's fine, we can just share it online.

We're using humor to make a very important point: the current financial system simply doesn't work for most people. It needs to be updated. https://t.co/VJqyYnnado

— Brian Armstrong (@brian_armstrong) August 1, 2025

Meanwhile, Citi analysts remain bullish, hiking their target from $270 to $505, betting that Coinbase will benefit from both regulatory clarity and rising BTC ▲0.14% prices.

In Q2, Coinbase reported $1.43 billion in net income, a massive jump from $66 million last quarter and just $36 million a year earlier. The platform processed $237 billion in trading volume, slightly up from $226 billion in Q2 2024, but most of that came from institutions, not consumers, a trend we see all over crypto right now.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Data Context: Index Trends Show Cooling Retail Activity

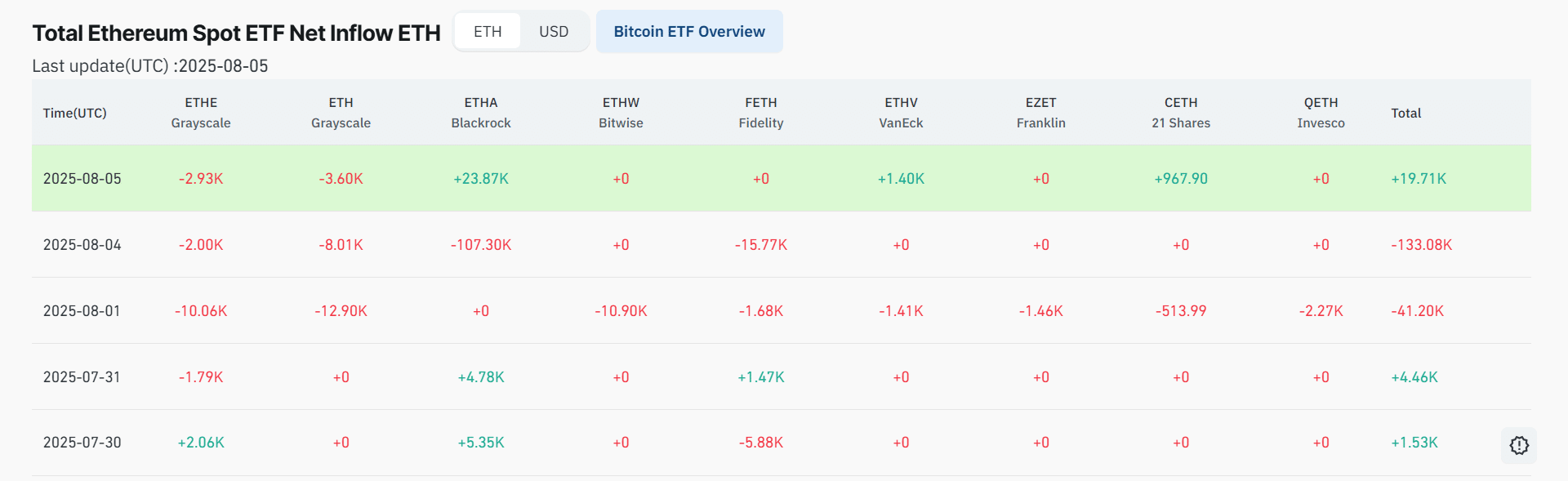

ERC-20 token activity in Coinbase custody wallets has slowed, according to CoinGlass data, signaling a cooling in altcoin demand.

But the dry spell may not last. Stablecoin inflows into Coinbase-linked wallets remain steady, suggesting capital is parked, not fleeing.

DISCOVER: 20+ Next Crypto to Explode in 2025

Bottom Line: Bullish Targets, Bearish Reality?

There’s reason for long-term optimism between Trump’s stablecoin law and July’s uptick in trading volume. While Coinbase stock might be cooling after a red-hot run, most analysts expect this is a temporary pullback.

Coinbase may not be out of fuel, but it’s clearly shifting into a lower gear for now.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Coinbase stock (COIN) is down more than 30% since its July peak, but 99Bitcoins analysts and others aren’t ready to call it a collapse.

- All eyes are on Jerome Powell next week as inflation lingers and labor metrics soften.

The post September Could Witness The Coinbase Stock Come Back of the Decade – Here’s Why appeared first on 99Bitcoins.