Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) came close to slumping below the psychologically important $100,000 mark last week, the short-term holders (STH) cohort started to show signs of weakening conviction in the leading cryptocurrency, raising fears of a deeper price correction.

Bitcoin STH Fear Resurfaces

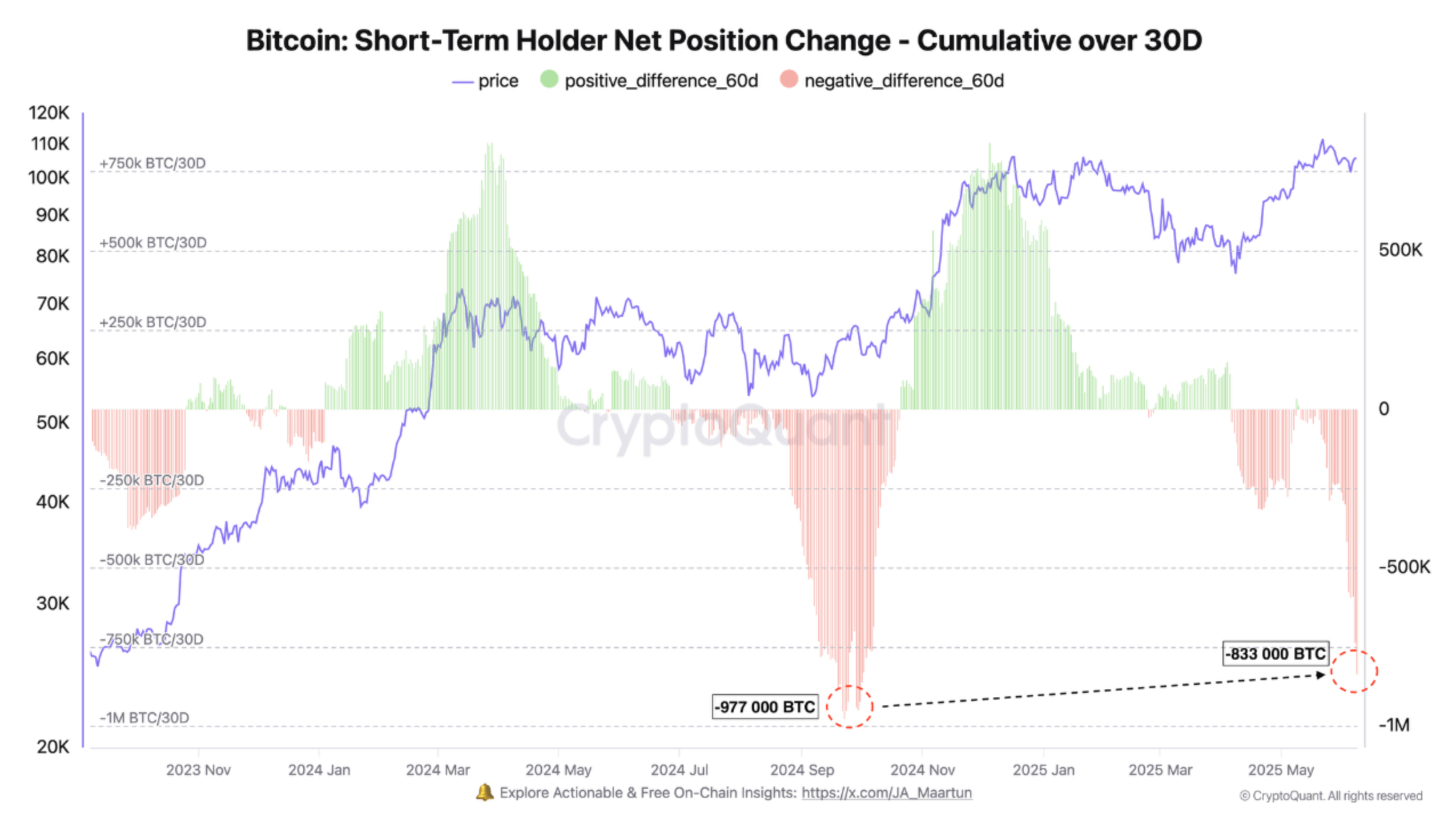

According to a recent CryptoQuant Quicktake post by contributor Darkfost, Bitcoin STH’s net position has turned sharply negative over the past month. This has happened despite BTC holding above the $100,000 level.

For the uninitiated, Bitcoin STH are investors who have held their BTC for less than 155 days. They are generally more reactive to price volatility and market sentiment, often selling during corrections or uncertainty.

Specifically, a cumulative net position change of -833,000 BTC has been recorded among short-term holders during the ongoing pullback. By comparison, the April crash saw a net position change of around -977,000 BTC.

Related Reading

Darkfost noted that current STH behavior closely resembles the activity observed during BTC’s brief drop below $80,000 in April 2025, when the digital asset bottomed out at $74,508. The analyst wrote:

Since then, STH appear to have become much more sensitive to market movements, and the recent dip around the $100,000 mark was enough to trigger renewed fear among this group of investors.

BTC Showing Signs of Reversal

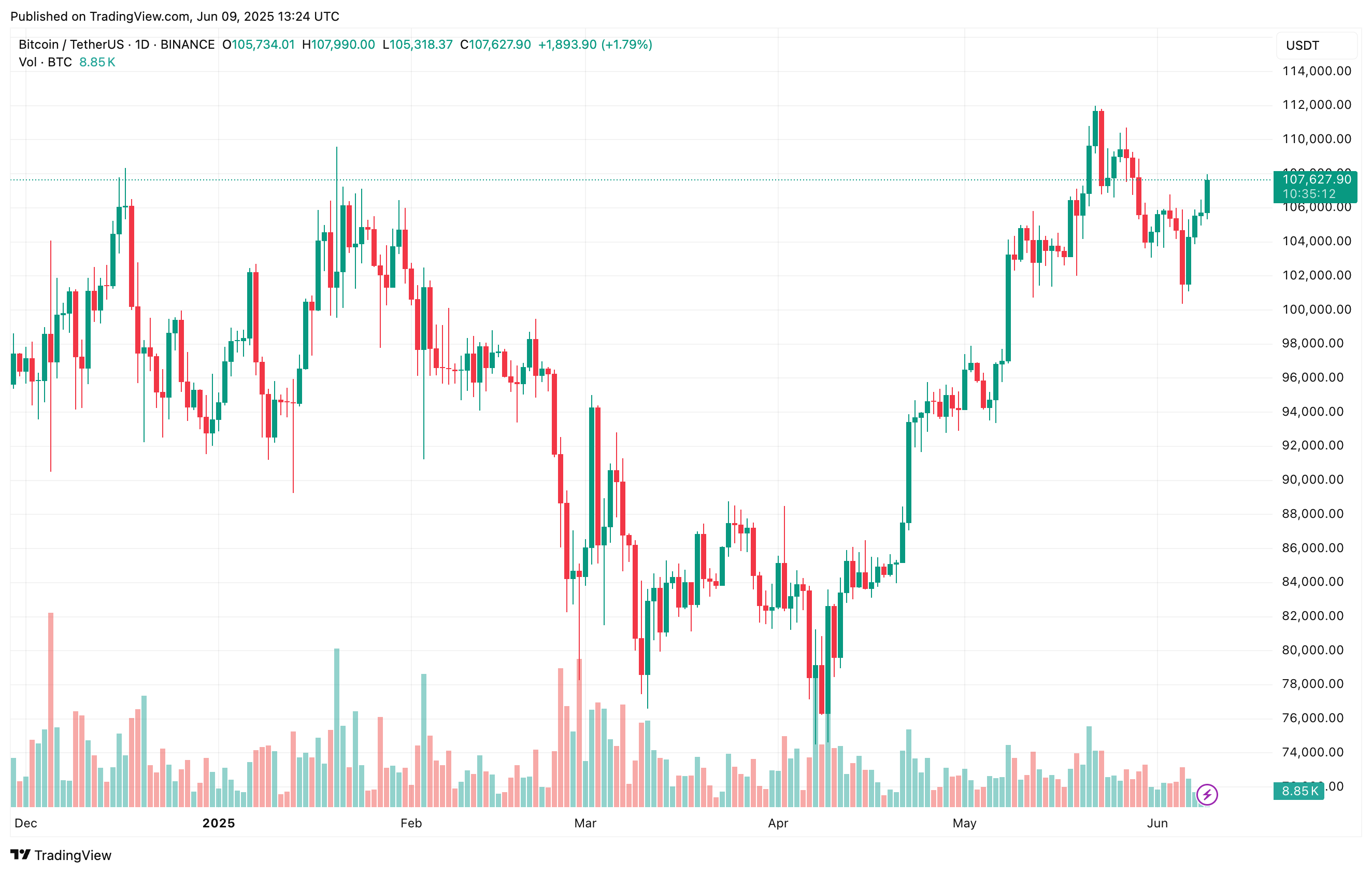

Although BTC lost momentum after reaching its latest all-time high (ATH) of $111,814, the leading cryptocurrency regained strength over the weekend – indicating a possible reversal may be underway.

Related Reading

For example, seasoned crypto analyst Ali Martinez noted that BTC has broken through the key resistance level at $106,600. In a recent X post, Martinez predicted that Bitcoin could rally to $108,300 or even $110,000 if current momentum continues.

In a separate X post, fellow crypto analyst Rekt Capital shared the following Bitcoin daily chart, noting that the cryptocurrency not only broke out of its two-week downtrend – highlighted in light blue – but may now be turning that former resistance into a new support level.

Meanwhile, several technical indicators also point to continued bullish momentum. Notably, Bitcoin’s Hash Ribbons have recently flashed a prime buying signal.

Additionally, on-chain data suggests that BTC could experience a sharp upward move in the short term, potentially driven by a negative funding rate on Binance. A prolonged period of negative funding rates often sets the stage for a short squeeze.

Despite the bullish outlook, some red flags remain. Recent data shows that long-term holders are gradually exiting the market, while an influx of retail investors could add volatility to the current rally. At press time, BTC trades at $107,627, up 1.9% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com