Osman Kabaloev, Russia’s deputy head of the Finance Ministry, has reportedly stated that the country should be developing its own stablecoin.

Following a recent freeze on wallets linked to the sanctioned Russian exchange Garantex by US authorities and stablecoin issuer Tether, Russia is alleged to be exploring the creation of its own stablecoins.

BREAKING:

RUSSIAN FINANCE MINISTRY CALLS FOR CREATION OF NATIONAL CRYPTO STABLECOIN pic.twitter.com/ZmVZWZxTpH

— Crypto Rover (@rovercrc) April 16, 2025

Russia Thinking To Enter The Stablecoin Space Due To US-Led Sanctions

Kabaloev said the Kremlin should be exploring the possibility of developing a stablecoin like such as Tether’s USDT to avoid being at the mercy of Tether and the US authorities, according to April 16 reports by state-owned news agency TASS.

“We do not impose restrictions on the use of stablecoins within the experimental legal regime. Recent developments have shown that this instrument can pose risks for us,” Russia’s deputy head of the Finance Ministry told TASS.

He went on to add that, “This leads us to consider the need to develop internal instruments akin to USDT, potentially pegged to other currencies.”

On March 6 2025, the US Department of Justice collaborated with authorities in Germany and Finland to freeze domains associated with Russian crypto exchange, Garantex.

Authorities claimed the exchange processed over $96 billion worth of criminal proceeds since launching in 2019. USDT issuer Tether also froze $27 million worth of its stablecoin on March 6. Following this 8-figure freeze, Garantex was forced to halt all operations, including withdrawals.

Garantex was first hit with sanctions in April 2022 when the US Treasury’s Office of Foreign Assets Control targeted the exchange over alleged money laundering violations.

Allegedly, Garantex has resurfaced under a new name after reportedly laundering millions in ruble-backed stablecoins and transferring them to a newly established exchange, according to Swiss blockchain analytics firm, Global Ledger.

Meanwhile, Evgeny Masharov, a member of the Russian Civic Chamber, proposed on March 20 to create a Russian government crypto fund that would include assets confiscated from criminal proceedings.

DISCOVER: 20+ Next Crypto to Explode in 2025

Stablecoins Transactions Outpaced VISA Payments In 2024: Currency-Backed Tokens Forecasted To Hit $2 Trillion By 2028

Something huge happened in 2024, and very few people are talking about it.

For the first time ever, stablecoins outpaced Visa in volume. pic.twitter.com/TxeO5Gs681

— Bitwise (@BitwiseInvest) April 16, 2025

A crypto market review for Q1 2025 by crypto investment firm Bitwise from yesterday (April 16) highlighted a significant milestone that has mostly flown under the radar. In 2024

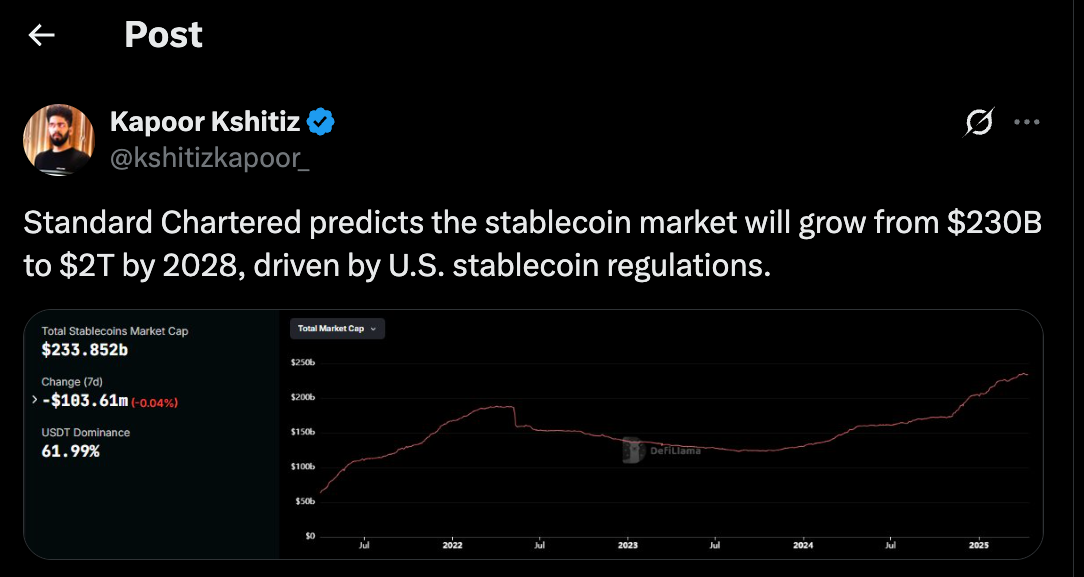

The whole stablecoin market capitalization has grown since mid-2023, surpassing $200 billion in early 2025. A joint report from on-chain analysis platforms Artemis and Dune showed that active stablecoin wallets increased by around 53% in one year.

Currently, the combined market capitalization stands at $236.4 billion, per CoinGecko. It is noted that the main cause of this growth will be the anticipated passing of the GENIUS Act in the United States.

The Guiding and Establishing National Innovation for US Stablecoins legislation aims to create a regulatory framework for stablecoins, defining when issuers fall under state or federal oversight.

With the passing of the GENIUS Act in mind, wealth management firm Standard Chartered have forecasted that by 2028, the total market value of stablecoins could rise to $2 trillion.

EXPLORE: This New Web3 Wallet Could be Secret Key to 2025 Bull Run

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Russia are exploring creating their own stablecoins

- Due to US sanctions and Tether freezing over $27 million in illicit funds from Russian exchange, Garantex, the soviet nation are looking to create their own stablecoins

- Garantex have reportedly began trading under a new name, per Global Ledger

- Stablecoins are hot right now, with a combined $263 billion market cap and Standard Chartered forecasting it becoming a $2 trillion industry by 2028

- In 2024, stablecoin transactions reportedly outpaced VISA payments

The post Stablecoins Predicted To Hit $2 Trillion By 2028: Russia The Latest Nation Exploring Its Own Stablecoin appeared first on 99Bitcoins.