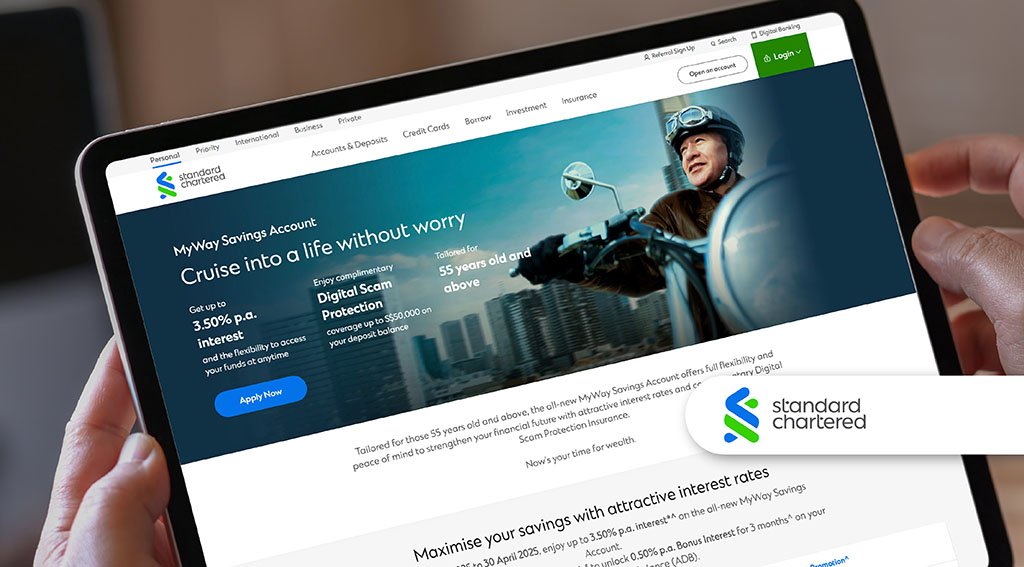

Standard Chartered Bank has launched a new savings account, MyWay, aimed at customers aged 55 and above, offering up to 3% interest without any lock-in period.

Notably, the account includes complimentary digital scam protection insurance, covering up to S$50,000 against losses from unauthorised electronic transfers due to phishing and malware scams.

The digital scam protection insurance is provided by and underwritten by MSIG Insurance.

This makes it the first retail savings product in Singapore, and Standard Chartered‘s first globally, to offer this type of insurance.

Account holders will also receive health and lifestyle privileges and exclusive invitations to retirement and legacy planning events.

The MyWay account allows for daily interest accumulation and provides flexibility for customers to manage their funds according to their changing needs.

Standard Chartered also offers separate wealth management services for customers interested in higher-risk investment options.

In addition to the account launch, Standard Chartered has been actively involved in community efforts to combat scams.

The bank has partnered with IMDA to conduct digital literacy clinics for seniors, with nearly 300 seniors participating over the past six months.

Standard Chartered also participates in anti-scam initiatives with the Singapore Police Force and the Association of Banks in Singapore.

The bank will release a series of scam awareness videos featuring key influencers, in English and Mandarin, to educate the public on common scams.

As part of the MyWay launch, Standard Chartered is offering an additional 0.50% annual bonus interest for six months on incremental balances, valid until 30 April 2025.

“At the heart of our approach is putting clients first. Beyond offering clients competitive returns on their deposits as they plan for retirement, we wanted to also provide peace of mind and help our clients safeguard those later years.

As the first bank in Singapore to integrate a digital scam protection insurance with a savings account, it’s a testament to our strength as a leading wealth manager, helping our clients manage, protect and grow their wealth,”

said Usman Khalid, Global and Singapore Head for Deposits, Mortgages & Payments at Standard Chartered.

Featured image credit: Edited from Freepik