Key Points

Taiwan Semiconductor Manufacturing (NYSE: TSM) was one of the best stocks to own in 2025 — it rose over 50%. But 2026 is a new year. None of the stock’s success from last year matters, although its business success will still carry over.

The biggest item investors are counting on in 2026 for Taiwan Semiconductor (or TSMC) is to maintain the momentum that drove it higher in 2025. With the tailwinds blowing in the AI space, I think that appears to be a safe bet.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Taiwan Semiconductor recently reported fourth-quarter earnings, and management gave some bullish guidance for 2026 and beyond. I think it’s a clear sign to buy the stock now, as the market still isn’t fully valuing the stock for how dominant it is.

Image source: Taiwan Semiconductor.

TSMC is at the heart of the AI computing buildout

It’s no secret that artificial intelligence requires an incredible amount of computing power. So it requires a lot of computing hardware to accomplish that task. Regardless of what computing unit is used to train and run AI models, they are all filled with chips that come from relatively few foundries.

The largest in the world, by far, is Taiwan Semiconductor. It’s the key logic chip supplier for many companies, including Nvidia and Apple. So, when there is insatiable demand for computing power in an area like AI, TSMC will naturally do well. Its Q4 results confirmed this and ensured that the AI race is still going full bore.

In Q4, Taiwan Semiconductor’s revenue rose 26% year over year in U.S. dollars. This shows strong, sustained gains, but TSMC isn’t stopping there. For 2026, it expects revenue to increase by nearly 30% in U.S. dollars. This shows that AI demand for chips is real and slated to continue growing in 2026, but that’s not the end of it. For the five years starting in 2024 and ending in 2029, TSMC now expects that its compound annual growth rate (CAGR) will be about 25%.

A 25% CAGR for a company the size of Taiwan Semiconductor is nearly unheard of, but it shows how massive the demand for logic chips is. As a result, TSMC can be viewed as not only a great investment for 2026, but also for a few years down the road. Despite its success, Taiwan Semiconductor is still one of the great values in the market.

Taiwan Semiconductor still trades at a discount to big tech

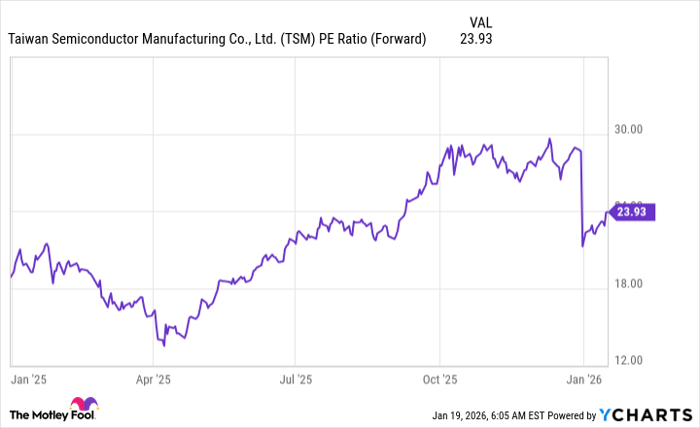

Most big tech companies trade at about 30 times forward earnings. (Nvidia gets a premium to that, due to its rapid growth.) However, none of these companies will come close to delivering 30% revenue growth in 2026. Taiwan Semiconductor should easily hit that threshold, yet it trades for 24 times forward earnings.

TSM PE Ratio (Forward) data by YCharts.

For reference, the S&P 500 trades for 22.3 times forward earnings. While Taiwan Semiconductor trades at a slight premium to the broader market, the market isn’t putting up growth anywhere close to TSMC’s. As a result, I think that investors can declare its stock rather cheap.

It’s not often that you can scoop up a stock with a clearly defined growth case, trading at a cheaper price tag than where it should. But that’s exactly where Taiwan Semiconductor is right now. I believe it’s one of the best stocks to buy now and hold for the next few years, as it’s a great “picks and shovels” play for the generative AI buildout. With AI spending expected to stay strong over the next five years, I can think of few better stocks positioned to take advantage of the massive AI spending spree than Taiwan Semiconductor.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 22, 2026.

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.