When will crypto go back up? Bitcoin, Ethereum, and Cardano consistently rank as the top cryptocurrencies by market cap. Not only do they drive markets, but they are consistently hogging most of the limelight when it comes to crypto news or media coverage.

It isn’t surprising, considering there are 10,000 cryptocurrencies and crypto-related projects listed on CoinGecko.

Plenty of cryptos exist, but most don’t deserve coverage like the top three. Let’s take a look at two underdogs that have the potential to make it to the top spots.

When Will Crypto Go Back Up? Methodology

Choosing the best two underdog cryptos is like asking what the best food is. Everyone has a different preference and palate so it is impossible to say that this pizza is better than that sushi.

The criteria for choosing our best underdogs will be market cap position, utility, and innovation. Here are two companies outside the top 50 that are severely undervalued.

1. Nexo: Instant Cryptocurrency-backed Loans

Though CoinGecko ranks Nexo #79, its trusted position as a cryptocurrency lending platform forms the foundation of its launch pad.

Launched in April 2018, Nexo’s price is expected to trend upwards in the following years, with some analysts predicting a $20 price point in the next five years. The hopes of a bright Nexo future are high, but driving market sentiment here is DeFi.

Nexo is a lending platform that provides loans to users. Sounds familiar, right? Unlike a traditional lender like a bank, Nexo is Ethereum-based and provides cryptocurrencies for those in need. Its features rival traditional lenders by offering services where interest on loans can be earned.

On Nexo borrowing a loan is instant and making payments is available all in one platform.

We’ve expanded our offering to include even more Futures contracts with up to 20x and 50x leverage.

Trade smarter and amplify your moves – open the Nexo app and enjoy increased flexibility in your trades.

— Nexo (@Nexo) March 12, 2025

What’s more, once you make a deposit, a credit line becomes available, enabling users to spend or withdraw immediately.

Plenty of crypto-based lending services have popped up in recent years. However, with $100 million insured against theft and licensed and regulated in over 200 countries, Nexo is unique in that it is already a trusted platform. Coupled with the market’s trust and its availability across the world, Nexo is a crypto lending platform ready to upset the financial services sector in the near future.

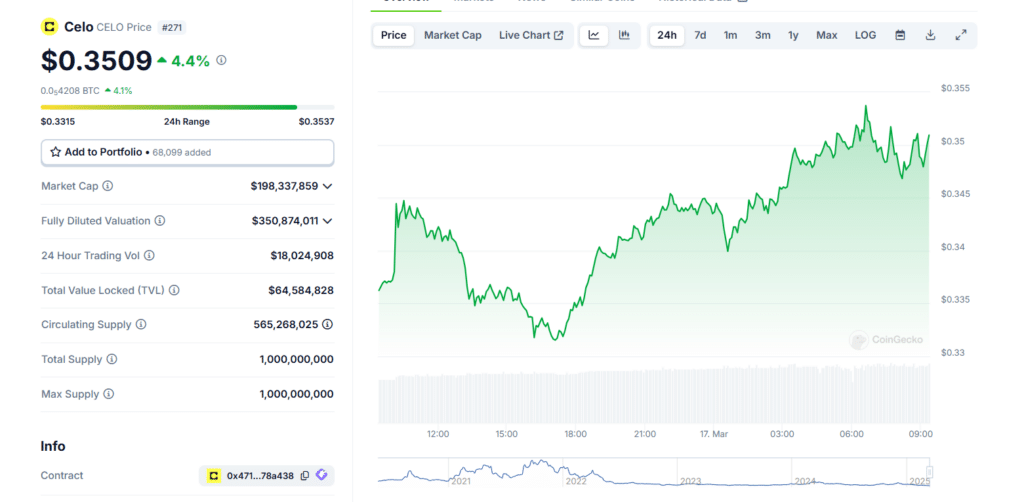

2. Celo: Smart Phones + Blockchain

By using phone numbers as public keys, Celo hopes to introduce cryptocurrency to anyone who owns a smartphone, including those without banking access.

Launched in 2020, Celo’s team includes ex-employees from Google, Visa, MIT, the Federal Reserve Bank, Harvard, Bank of America, and the Department of Justice.

Celo’s USP is to become the number one global peer-to-peer payment processing application. Yes, for you fintech investors, that means they want to take on PayPal, Venmo, and Square.

Celo aims to accomplish this by using both blockchain and smartphone technology. Essentially, smartphones would become nodes in the system and, therefore, help the network run much faster than any fintech application.

To put all this into perspective, here are some of the advantages that Celo has over Venmo:

- Celo doesn’t require you to have a bank account, while Venmo does

- The fees are higher with Venmo compared to Celo

- Celo has governance protocols that allow holders to cast votes that can sway the project’s direction.

When Will Crypto Go Back Up? The Future Outlook

Blockchain integration is slowly making its way into our daily lives. These two projects are evidence of that.

The two projects are backed by utility, meaning there are actual physical uses for these coins and their underlying technology and service. With utility and strong community support, Nexo and Celo are two projects you need to keep on your radar.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Plenty of cryptos exist, but most don’t deserve coverage like the top three

- Blockchain integration is slowly making its way into our daily lives. Both Nexo and Celo are evidence of that.

The post Taking A Look At 2 Underdog Cryptos: When Will Crypto Go Back Up? appeared first on 99Bitcoins.