Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As the Bitcoin price skyrockets past former all-time highs (ATH), one technical analyst has ignited a wave of excitement across the crypto community with his bold new prediction. According to the forecast, Bitcoin could blow off to an astonishing $325,000 price peak — and the most shocking aspect of this analysis is not just the price target but the accelerated timeline for this meteoric rise.

Related Reading

Bitcoin Price To Peak At $325K?

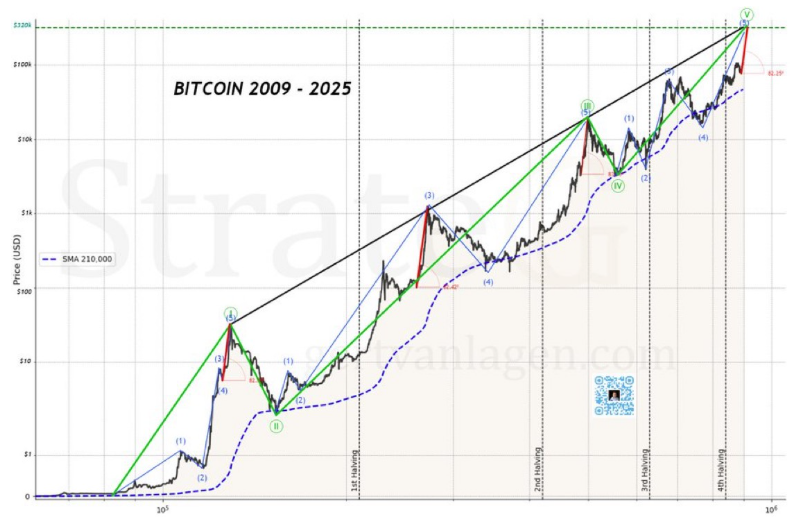

The $325,000 Bitcoin price forecast by Gert van Lagen, a prominent crypto analyst on X (formerly Twitter) is based on a technical analysis chart spanning BTC’s movements from 2009 and 2025. The chart applies Elliott Wave Theory on a High Time Frame (HTF), tracking a massive five-wave impulsive structure, with each wave representing a major bullish cycle driven by halving events.

Lagen disclosed that Bitcoin is currently in Wave 5, the last wave of this mega-cycle, suggesting that the market is on the verge of its final parabolic blow-off.

Each of Bitcoin’s past bull markets, according to the analysis, has ended with a near-vertical explosive surge, where price accelerates rapidly before crashing into a corrective phase. This surge has always been defined by a price angle of at least 82 degrees from the bottom.

The crypto analyst has drawn a trendline connecting the peaks of Wave 1 and 2, creating a rising wedge pattern. The lower boundary of this wedge is represented by the 210,000 block SMA, which acts as a long-term support.

Additionally, the upper trendline of this wedge intersects with the forecasted market top of Wave 5, which sits at around $325,000. Notably, this bullish prediction relies heavily on Bitcoin maintaining strong momentum and completing Wave 5 as a single clean impulse move, without any deviation or elongation, just like past cycles.

Lagen’s bold $325,000 price forecast for Bitcoin comes with an exceptionally near-term timeline. The market expert predicts that BTC could reach this ambitious target as soon as July 5, 2025, which is just over a month away.

Interestingly, this timeline is grounded in the movements observed in previous post-halving cycles. The analyst’s projected trajectory of Bitcoin’s surge to a market top also aligns closely with the past patterns that followed each Bitcoin halving cycle.

These halving events have triggered strong bull markets during past cycles. The current rally also follows Bitcoin’s fourth and most recent halving event, which took place on April 20, 2024, reinforcing the repetitive and cyclic nature of Bitcoin’s price movements.

A Historic Correction Could Follow This Price Surge

Beyond the dramatic $325,000 Bitcoin price prediction, Lagen’s analysis also carries a foreboding bearish outlook. He cautions that after Bitcoin reaches this projected market top, what comes next may be a high time frame price crash, possibly lasting several years.

Related Reading

Once the five-wave structure is completed, Lagen expects Bitcoin to enter its first true Wave 2 correction at the highest degree. Historically, Wave 2 retracements are deep, and given the current backdrop of global tightening and recession risks, the post-peak environment could challenge even the most seasonal holders.

Featured image from Unsplash, chart from TradingView