Image source: Getty Images

At 402.9p, Tesco‘s (LSE:TSCO) shares have risen by almost a third in value over the last year. That’s a pretty tasty result, given the enduring cost-of-living crisis and intense competitive pressures it faces.

It’s also better than the 6.4% increase the broader FTSE 100‘s enjoyed over that time.

With dividends also having risen 13.2% in the last financial year (to February 2025), it’s delivered an impressive total shareholder return.

But threats to the blue-chip grocer remain, and particularly from a new bloody price war among Britain’s grocers. So can Tesco’s share price and dividends continue surging? And should investors consider buying the retail giant this July?

Share price

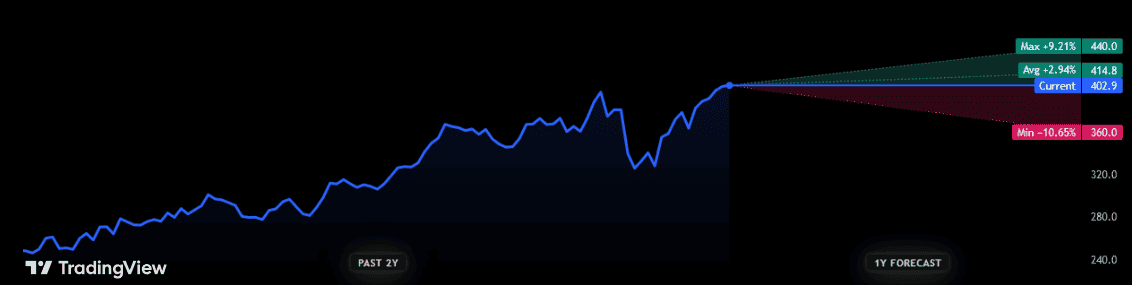

City analysts certainly expect further price gains over the next 12 months, albeit at a far, far slower rate.

The 12 forecasters with ratings on the supermarket expect it to rise around 3% in value in that time. The most bullish estimate suggests a rise by high single digits, too, far below the 30.1% increase of the last year.

At the other end of the spectrum, one broker thinks the retailer will reverse more than 10% over the coming year. A diversity of views is common among share analysts, though it’s fair to say analysts aren’t expecting more rip-roaring price gains.

Dividends

On the dividend front, City consensus similarly points to a steady increase in payouts over the near term. However, like Tesco’s share price, they are tipping advances to cool from recent breakneck levels:

They expect:

- A total dividend of 13.9p per share in financial 2026, up 1.5% year on year.

- A 15.1p full-year payout the following year, up 8.6%.

Dividend growth for this year is tipped at the lower end of that predicted for the broader FTSE 100 (1.5% to 2%), though the rate of increase picks up substantially in financial 2026.

Still, current forecasts result in middling yields of 3.4% and 3.7% for financial 2025 and 2026, respectively. These are broadly in line with the Footsie’s longer-term average of 3%-4%.

Is Tesco a buy?

It’s critical to remember that broker forecasts aren’t set in stone, however. As was the case over the last year, it’s possible that Tesco shares could deliver better-than-expected returns.

My worry, however, is that the supermarket’s price and dividend targets could miss to the downside.

Sales have been extremely resilient in recent times, and on a like-for-like basis increased 5.1% in the UK between March and May. But it may struggle to achieve such growth without sacrificing margins as Asda pledges to use its “pretty significant war chest” to launch a new price war.

The pressure to slash prices is especially great today as Britain faces a prolonged cost-of-living crisis. Discount chains like Aldi and Lidl plan to continue rapidly expanding through the rest of this decade, too, potentially grabbing more cost-conscious shoppers from Tesco’s grasp.

On the plus side, the business has the highly popular Clubcard programme to help defend its market share. It also has considerable economies of scale to help it limit costs and offer competitive pricing.

But on balance, I think investors should consider avoiding the retail giant. In my opinion, the potential benefits here aren’t substantial enough to outweigh the risks.