Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

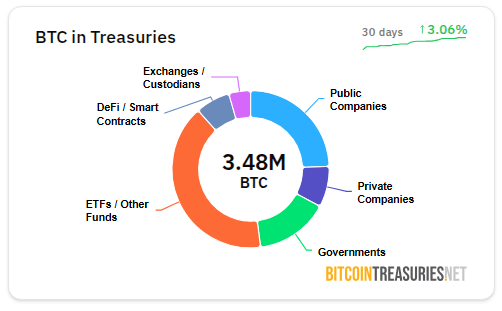

According to recent data, public companies have raced ahead of Bitcoin spot ETF issuers by snapping up more than twice as much BTC in the first half of 2025.

Public firms added 245,510 BTC to their balance sheets from January through June, a 375% jump over the 51,653 BTC they bought in the same stretch last year.

At the same time, spot ETF issuers purchased 118,424 BTC, leaving them well behind their corporate counterparts.

Related Reading

Public Firm Purchases Smash ETF Buys

According to data from Bitcoin Treasuries, the 245,510 BTC bought by public companies during H1 2025 is more than four times the 118,424 BTC ETF issuers gathered.

That ETF component is 56% lower than the 267,878 BTC they purchased in H1 2024, despite the funds experiencing more robust inflows than they experienced towards the end of 2024.

The difference indicates increasingly companies are holding Bitcoin directly instead of relying on exchange‑traded products.

More Companies Join Bitcoin Rush

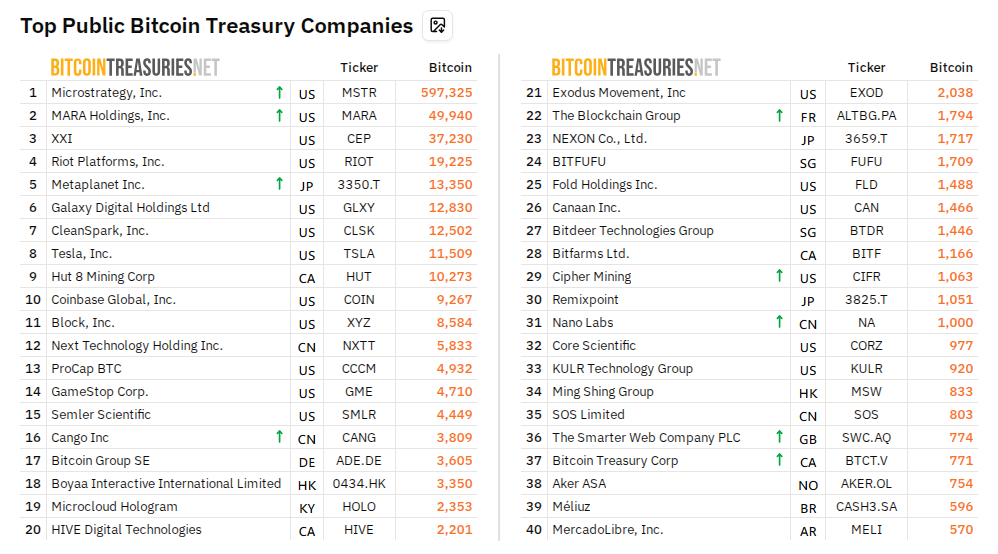

Data shows 254 entities now hold Bitcoin, and 141 of those are public companies. That marks big growth from the start of the year, when only 67 firms had BTC, and the end of March, when the number hit 79.

Those counts translate to a 140% rise in six months and a nearly 80% gain in three months, underlining how many new players have jumped in.

Strategy’s Share Of Acquisition Dips

Strategy (formerly MicroStrategy) still leads corporate buyers, but its slice of the total has shrunk. In H1 2024, Strategy’s purchase of 37,190 BTC made up 72% of all corporate buys.

In the first half of 2025, the Michael Saylor‑led company purchased 135,600 BTC but now accounts for 55% of the total—down from its previous dominance. Firms such as Metaplanet,

GameStop and ProCap have stepped into the spotlight, each adding large sums to their Bitcoin holdings.

Supply Shock Could Be Coming

According to industry commentary, the increase in corporate purchasing in addition to continuing ETF demand could take a bite out of available supply.

When the next halving event reduces new Bitcoin issuance, less will flow into the market. Analysts caution that increasing institutional interest and declining supply might produce a significant price response.

Related Reading

As public firms climb aboard and ETFs keep on buying—though at a reduced rate—the battle for Bitcoin is escalating. Although Strategy’s investments have increased in absolute value, the arrival of new buyers indicates the market is expanding.

If that trend continues and reward for miners decreases following the halving, the battle for Bitcoin’s scarce supply could get fiercer.

Investors and analysts alike will be paying close attention to how these forces influence the price of Bitcoin in the second half of 2025.

Featured image from StormGain, chart from TradingView