Commander Bobo, the time has come to execute order $66k. “It will be done, Lord Bogdanoff…” Okay, all jokes aside, is BlackRock Bitcoin Holdings planning a secret coup?

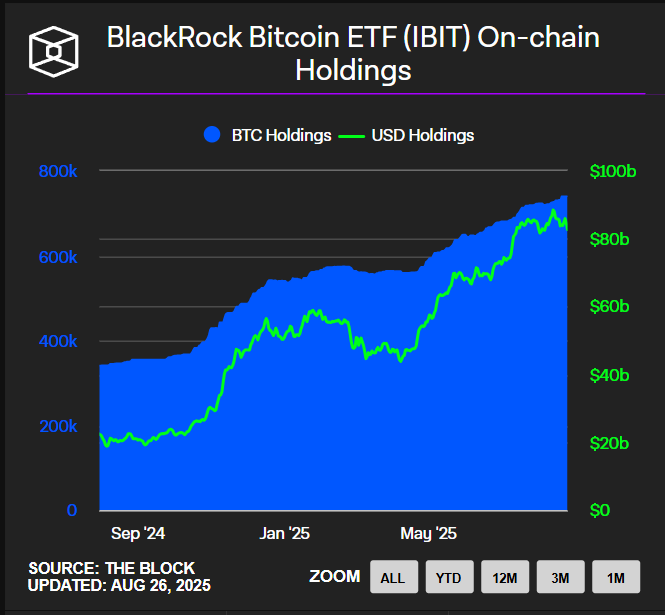

The launch of Bitcoin exchange-traded funds (ETFs) has transformed the market, giving institutional investors an on-ramp into the once retail-led ecosystem. BlackRock’s iShares Bitcoin Trust (IBIT) is at the center of this shift, which now manages more than 781,000 BTC—about $88 billion in assets.

That’s nearly 6.5% of ETH ▼-2.56% circulating supply locked into a single vehicle, surpassing the reserves of many major exchanges. Net inflows into IBIT have consistently outpaced rival products, cementing BlackRock as the most influential Bitcoin ETF player. Are we all just players in BlackRock’s game now?

Is This Wall Street’s Bitcoin Now? How BlackRock Bitcoin Holding’s Stake in MicroStrategy Changes the Game

There has been a multi-cycle boom of Bitcoin Maxis on social media, telling people to buy Bitcoin ETFs instead of buying BTC the normal way on an exchange.

But why? 99Bitcoins analysts believe part of the reason they do that is that they know if people are buying ETF Bitcoin instead of BITCOIN directly on exchanges, they won’t ever be tempted to trade it for shitcoins. ETFs’ path means people don’t even see the shitcoins. BlackRock, Strategy, or Greyscale buy on their behalf now.

DISCOVER: Top 20 Crypto to Buy in 2025

Exchanges are bleeding coins while BlackRock keeps stacking.

CryptoQuant confirms

BlackRock has now surpassed major exchanges to become the largest known custodian of $BTC.The world biggest asset manager, with trillions under management, is quietly turning into Bitcoin’s… pic.twitter.com/wPlrdOyiFK

— Broke Doomer

(@im_BrokeDoomer) August 22, 2025

Moreover, BlackRock didn’t stop at ETFs. Earlier this year, the firm disclosed a 5% stake in MicroStrategy (MSTR), the largest publicly traded Bitcoin holder with more than 200,000 BTC on its balance sheet.

That concentration of BTC makes some uneasy when one institution holds that much sway, price discovery starts to look more like a Wall Street chessboard than a peer-to-peer marketplace.

Bitcoin’s original pitch was decentralization, an escape from financial gatekeepers. However, the rapid consolidation of custody under regulated ETFs has critics warning that the asset could morph into another instrument managed by the same firms it was built to bypass.

Market-wide skepticism now applies to Bitcoin’s decentralization: how decentralized is it if one institution holds such a massive stake?

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Are Bitcoin’s Decentralized Ideals at Risk? Data Shows ETFs Reshaping Market Liquidity

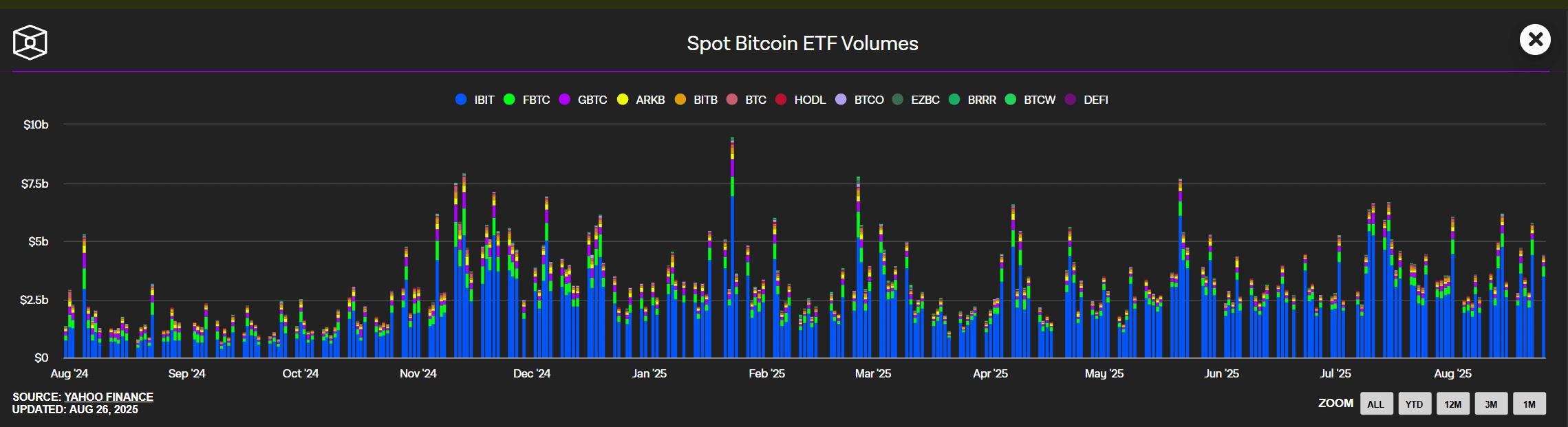

According to Conglass data, ETF activity is already one of the strongest price drivers in 2025. Sustained inflows tend to support Bitcoin’s upward momentum, reducing volatility. Sharp outflows, like those seen in August, can exacerbate sell-offs.

The critical question, however, is whether Bitcoin is still the decentralized asset “of the people,” or is it quietly being captured by Wall Street giants? Between IBIT’s record-setting inflows and a direct stake in MicroStrategy, BlackRock now sits at the center of Bitcoin’s institutional machinery. They’re the puppet masters. They have more power than a nation.

The implications aren’t subtle. More capital and credibility flow into the ecosystem, but at the cost of concentrating power in a single gatekeeper.

Bitcoin was designed to resist that kind of centralization, and we’ll now see whether its core ethos can hold against institutional scale.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Commander Bobo, the time has come, execute order $66k. All jokes aside, is BlackRock Bitcoin Holdings planning a secret coup?

- Market-wide skepticism now applies to Bitcoin’s decentralization: how decentralized is it if one institution holds such a massive stake?

The post The World’s Largest Custodian: Is BlackRock Bitcoin Holdings Planning a Coup? appeared first on 99Bitcoins.