TON crypto spiked 40% after Telegram announced the finalization of the $1.5 billion bond sale, backed by BlackRock, Citadel, and Mubadala. As tokenization picks up steam, will Toncoin and Tonchain dominate?

What differentiates crypto from securities is hype. True, market forces impact crypto, but when the “hype” catches on, prices tend to surge rapidly. There are many examples, including the rise of some of the best Solana meme coins, like BONK, which hit record highs in the last bull run.

Explore: 9+ Best High-Risk, High-Reward Crypto to Buy in May 2025

TON Spikes 40%

Currently, TON, the native coin of the Tonchain ecosystem, could be primed for more gains if the spike on May 28 spills over to today.

The nearly 40% surge in the past 24 hours could be enough for swing traders to explore buying opportunities, load up on dips, and expect prices to climb higher.

(TONUSDT)

However, for fundamental traders, the TON crypto surge is more than just a breakout.

Telegram Finalizes $1.5 Billion Bond Sale

Yesterday, Telegram, the popular messaging app with over 1 billion users worldwide, announced a $1.5 billion bond sale, lifting TON prices.

The bond sale attracted A-list institutional investors, including BlackRock, Citadel, and UAE’s Mubadala, fueling the surge.

Telegram, closely tied to Tonchain and TON, did what many corporates do: refinance.

The May 28 announcement of the finalization of the $1.5 billion bond sale sparked a frenzy, boosting TON and dominating headlines. The funds will refinance previous debt and, crucially, support future growth.

The bond carries a 9% annual yield over five years. If Telegram goes public within this period, it is convertible into equity at a discount.

The possibility of Telegram going public by 2030 likely attracted BlackRock and others.

Still, the bond was designed to draw long-term investors who believe in Telegram’s prospects.

Moreover, the 9% yield signals the app’s robust financial health and potential to expand its ecosystem, which is bullish for TON.

Explore: 10+ Crypto Tokens That Can Hit 1000x in 2025

The BlackRock Endorsement

Despite legal challenges surrounding Pavel Durov, the involvement of BlackRock, an asset manager with over $13 trillion in assets, is a decisive vote of confidence in Telegram and an indirect validation of Tonchain, where TON plays a critical role.

Additionally, the participation of Citadel and Mubadala, both major institutional powerhouses, adds credibility and capital to Telegram, accelerating TON adoption and Tonchain ecosystem expansion.

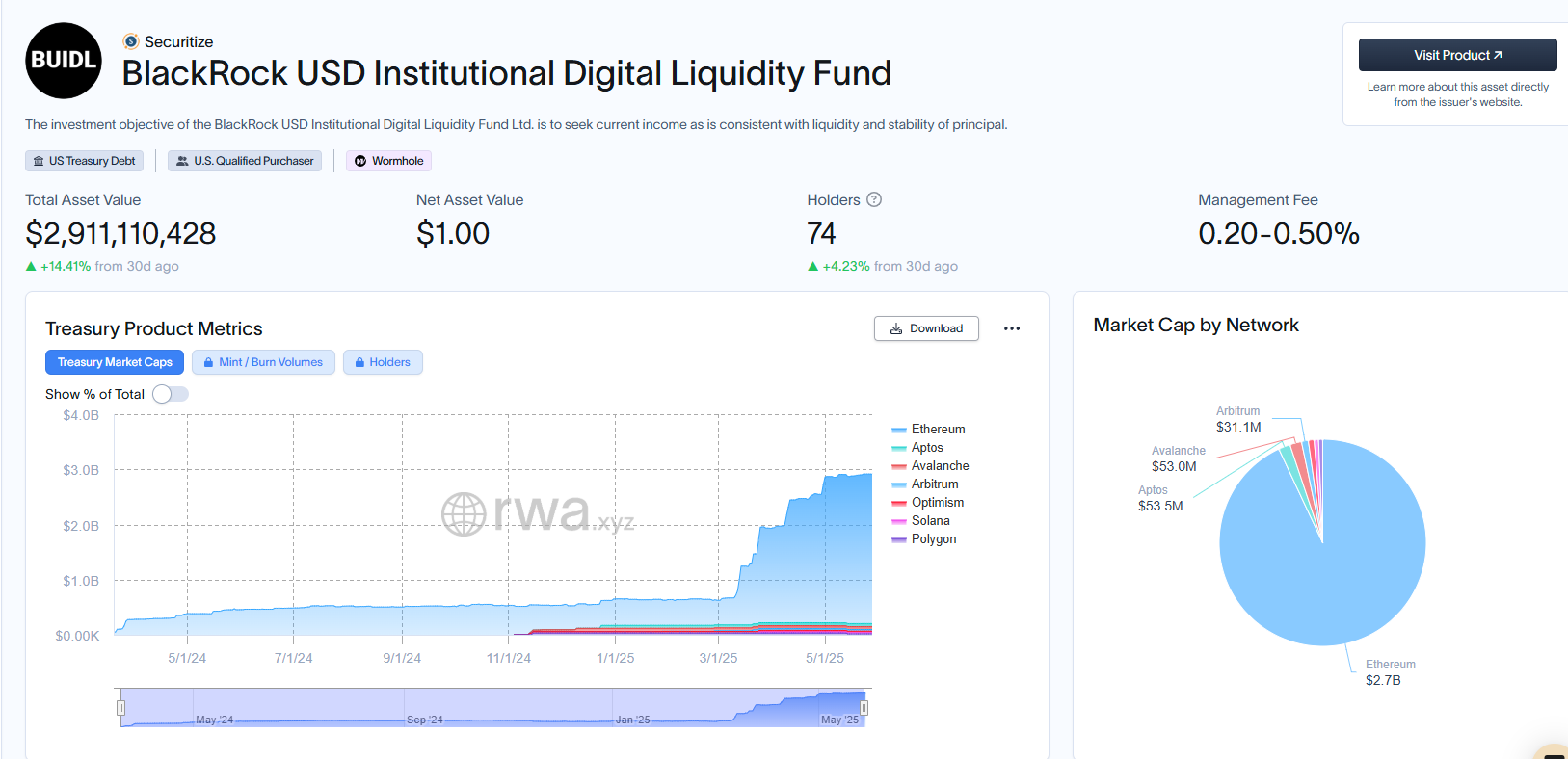

BlackRock is pro-crypto, issuing spot Bitcoin and Ethereum ETFs for U.S. institutions. Moreover, their BUIDL fund has attracted over $2.9 billion from investors seeking exposure to liquid U.S. Treasuries.

(Source)

Larry Fink, the CEO of BlackRock, projects the tokenization market to reach $1 trillion by 2030. If this will be the case, analysts are convinced that these top 20 coins may explode in 2025.

Will Tokenization Gain Traction on Tonchain?

The $1.5 billion bond sale aligns with the growing trend of tokenization.

Recently, Libre launched a $500 million Telegram Bond Fund (TBF) on Tonchain.

The RWA narrative just got a huge push as @librecap & TON Foundation are tokenizing $500M of Telegram bonds on TON Blockchain via the Telegram Bond Fund ($TBF)!

Key points:

$500M in Telegram bonds on TON

Access for institutional & accredited investors

Powered by Libre… pic.twitter.com/nXOdSsatKN

— TON

(@ton_blockchain) April 30, 2025

Additionally, Tether and USDe have been integrated into Tonchain, making them accessible to over 1 billion Telegram users.

The timing is critical, especially as the U.S. prepares laws to fast-track the tokenization of U.S. Treasuries and, possibly, equities in the future.

This summer, Telegram users will gain access to the best AI technology on the market. @elonmusk and I have agreed to a 1-year partnership to bring xAI’s @grok to our billion+ users and integrate it across all Telegram apps

This also strengthens Telegram’s financial… pic.twitter.com/ZPK550AyRV

— Pavel Durov (@durov) May 28, 2025

Yesterday, Durov announced a partnership between Telegram and Elon Musk’s xAI to bring Grok agent to Telegram.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

TON Crypto Adds 40% After BlackRock Backs Telegram’s $1.5B Bond Sale

- TON crypto firm, may extend gains

- Telegram finalizes their $1.5 billion bond sale

- Bond sale backed by BlackRock, Citadel, and Mubadala

- Will Tonchain be a hub of tokenization in the coming months?

The post TON Crypto Soars After BlackRock Backs Telegram In $1.5B Bond Sale: What’s Next? appeared first on 99Bitcoins.