The DeFi platform backed by the Trump family, World Liberty Financial (WLFI), has proposed a plan to distribute its native stablecoin, USD1, via an airdrop to WLFI holders as a trial.

Per the proposal, the aim of the test is to verify the platform’s on-chain airdrop infrastructure for future plans while also rewarding early adopters.

We just posted a new governance proposal:

To test our airdrop functionality by distributing USD1 to all $WLFI holders — rewarding our earliest supporters and preparing for future growth.

Join the discussion

https://t.co/NDg5yMYUrM

— WLFI (@worldlibertyfi) April 7, 2025

World Liberty Financial Call The Proposed USD1 Airdrop A ‘Small Amount’

World Liberty Financial (WLFI), the DeFi project backed by Trump and his sons, has issued a proposal to conduct a small-scale airdrop of its USD1 stablecoin to all current holders of WLFI tokens to test the airdrop system in a live environment.

The test is also aimed at introducing the stablecoin to early supporters of WLFI. According to the proposal published on Monday (April 7), all wallets currently holding WLFI tokens would be eligible to receive a fixed amount of USD1, subject to requirements still to be announced by the team.

WLFI plans to distribute a fixed amount of USD1 to each eligible wallet using its airdrop system. The exact amount would be finalized based on the total number of eligible wallets and available budget.

If passed, the airdrop will take place on the Ethereum network. However, the logistics and timing of the USD1 distribution has not yet been announced.

The project states it has reserved the right to modify, suspend, or cancel the test airdrop at any time, even if the proposal is approved by governance. Further conditions and execution details are expected to follow pending community feedback and a formal vote.

Per its co-founder, Zach Witkoff, World Liberty Financial raied over $550 million during a series of token sales. $75 million of the $550 million came from Tron founder, Justin Sun.

Great to see @ZachWitkoff, co-founder of @worldlibertyfi, highlight the importance of stablecoins and their mission to integrate them across all areas of commerce in the U.S.@trondao will continue to support crypto adoption alongside @worldlibertyfi—just as we’ve been doing… pic.twitter.com/d5exEfthWn

— H.E. Justin Sun

(@justinsuntron) March 27, 2025

EXPLORE: Is Bitcoin Price Repeating 2017 All Over Again? BTC Breakout on Horizon As BTC Bull Token Fires Up

USD1 Airdrop Comes After WLFI Announced The Stablecoin Will Be Backed By US Treasuries

Late last month, World Liberty Financial announced plans to launch USD1, a stablecoin for institutional and sovereign investors. It will initially be available on both Ethereum and BNB Chain.

In March, the team was found to be testing USD1 transfers between BNB Chain and Ethereum, with the assistance of leading market-maker, Wintermute.

According to the official announcement from the WLFI team, the USD1 stablecoin will be fully backed by US Treasuries, US dollars, and other cash equivalents, ensuring it maintains a stable value of $1 per token.

USD1 is designed to function as a secure and transparent digital asset, with its dollar-backed reserves held by BitGo, a firm providing institutional clients with deep liquidity and trading support.

The WLFI team also stated that its reserve portfolio used to keep USD1 pegged to the dollar will be regularly audited by a third-party accounting firm. However, the DeFi platform has not yet disclosed the firm’s identity or the official launch date of USD1.

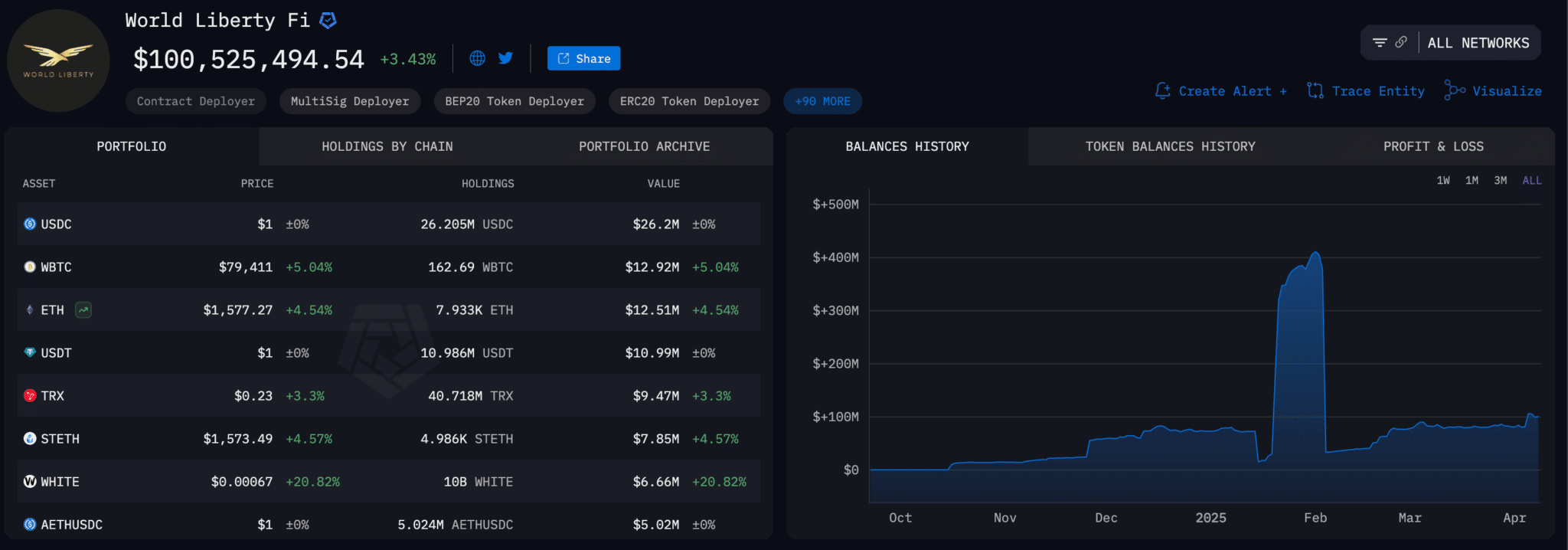

Per the Arkham Intelligence dashboard for World Liberty Financial, the firm currently holds over $100 million in digital assets. Its portfolio is mostly made up of USDC, Wrapped BTC, ETH, USDT and TRX.

(ARKHAM)

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The Trump family backed World Liberty Financial proposes a 'small' USD1 stablecoin airdrop to WLFI holders

- If passed, WLFI holders will receive a small sum of USD1 to test airdrop functionality

- The proposed airdrop will take place on the Ethereum blockchain

- No official launch date for the USD1 stablecoin has been announced yet

- The WLFI Arkham Intelligence dashboard shows the platform holds over $100m in crypto

- WLFI raised $550m in token sales, with Tron founder Justin Sun investing $75m into World Liberty Financial

The post Trump-Backed World Liberty Financial Proposes USD1 Stablecoin Airdrop To WLFI Holders appeared first on 99Bitcoins.