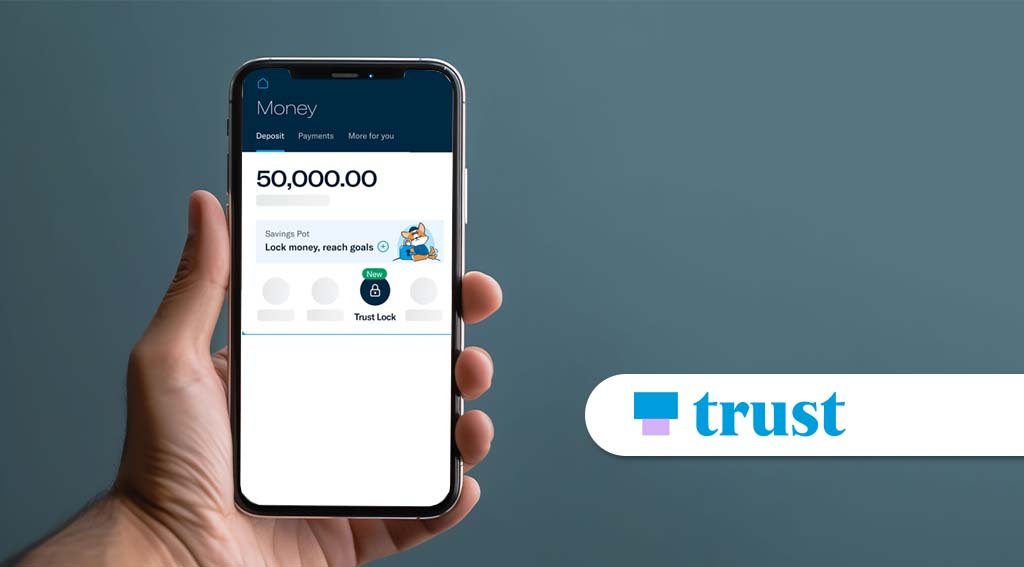

Singapore’s digital bank, Trust Bank, has introduced a new security feature called Trust Lock, designed to provide users with an added layer of protection against scams.

The launch comes amid rising concerns over financial fraud, with at least S$1.1 billion reported lost to scams in Singapore last year.

Trust Lock allows customers to secure funds in a designated Savings Pot within the bank app.

The funds cannot be moved unless digitally unlocked through a two-step verification process, which involves tapping a physical Trust card on an NFC-enabled phone and entering a six-digit Trust Key.

Once this is done, funds become accessible after a 12-hour cooling period.

Unlike some banking features that require in-person visits to unlock funds, Trust Lock is fully app-based.

Customers can create and lock up to five Savings Pots, which continue to earn interest and count toward Trust+ eligibility.

There are no limits on how much money can be locked.

The feature is designed to prevent unauthorised fund transfers, even in cases where scammers gain control of a customer’s mobile device through tactics like malware or phishing.

Aditya Gupta, Chief Product Officer, said,

“In a dynamic and fast evolving scam landscape, we are committed to keeping our customers’ money safe. We’ve already rolled out several market-first security features to help keep our customers safe against scams and fraud.

With Trust Lock, we are setting a new standard in convenience and security for our customers, giving them additional security features that are delightfully different.”

Featured image credit: Edited from Freepik