Image source: Getty Images

One of the most exciting holdings in my Stocks and Shares ISA is Joby Aviation (NYSE: JOBY). This is a leader in developing electric vertical take-off and landing (eVTOL) aircraft. Or electric air taxis, in plain terms.

At $7.50 as I write, the stock is up 49% over the past year. That’s a very solid return by any stretch of the imagination.

So, why do I think I might have backed the wrong horse? Let me explain.

Revolutionising short-distance travel

Joby’s eVTOLs can take off vertically like a helicopter and fly like a drone. They transport a pilot and four passengers in near-silence at speeds of up to 200mph. A flight can replace a one-to-two-hour drive with a journey that takes 10-20 minutes, potentially saving hours sitting in traffic.

The firm’s first commercial service is on track to launch later this year in Dubai, where construction of a vertiport at the international airport is underway.

But Joby isn’t the only game in town. Another eVTOL company called Archer Aviation (NYSE: ACHR) is also racing to commercialise an air taxi service. The stock jumped 22% on 13 May, bringing its one-year gain to 253%!

Reassessment

Symbolically, this means that Archer’s market cap of $7.3bn has overtaken that of Joby ($5.7bn) for the first time. A year ago, Joby’s was more than twice Archer’s — the clear leader. So investors have reassessed the competitive dynamics here.

Like Joby, Archer is set to launch a commercial service in the Middle East at the end of this year (in Abu Dhabi). Both have similar amounts of cash on the balance sheet and are progressing well towards securing aircraft certification with the US Federal Aviation Administration (FAA).

So, what’s the difference? Well, in its recent Q1 results, Archer said it was partnering with Palantir to “build artificial intelligence (AI) for the future of next-gen aviation technologies“. It’s already partnered with defence start-up Anduril to leverage cutting-edge AI technology to make a military eVTOL.

Therefore, the company is moving quickly to secure innovative defence partnerships. There might be early evidence emerging that ambitious Archer is more forward-thinking than Joby.

None of this would have bothered me a year ago. Back then, I owned both stocks. However, I decided to get off the fence and go with one over the other. With Archer stock up over 200% since I sold it, that’s looking like a mistake.

| Archer Aviation | Joby Aviation | |

| Market cap | $7.3bn | $5.7bn |

| Cash | $1bn | $813m |

| Q1 net loss | $93.4m | $82.4m |

| Backers | Boeing, Stellantis, and United Airlines | Toyota, Uber, and Delta Air Lines |

High-risk, high-reward stock

Some analysts envision a $1trn market for eVTOLS over the next decade. But there are plenty of operational and regulatory risks to navigate for both companies. There could be delays or a safety incident that sets the whole industry back.

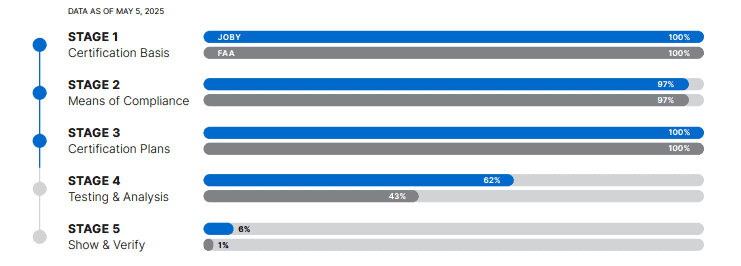

In Q1, Joby had completed 62% of the fourth stage of aircraft certification (of five). It had $813m in cash, plus an additional $500m commitment from backer Toyota. It also announced a partnership with Virgin Atlantic to launch air taxis in the UK.

It’s too early to say if I backed the wrong horse. But the fact one is outperforming the other by a wide margin is a little disappointing.

Long term, I’m still bullish on Joby, as eVTOLs should be a massive growth market. Fact is though, we don’t know what margins will look like, meaning this stock is only suitable for investors with a stomach for high risk.