Image source: Getty Images

Shares in Coca-Cola HBC (LSE:CCH) have fizzed higher on Thursday (13 February) on an otherwise flat day for the FTSE 100 share index.

At £31.98 per share, the drinks bottler has leapt 7.7% to lead the UK blue-chip index higher. A forecast-topping set of financials for the last calendar year helped it rise.

Are Coca-Cola HBC shares ‘The Real Thing’ for growth investors? Let me give you the lowdown.

Strong numbers

The business bottles, sells, and distributes products for heavyweight drinks brands like Coke, Fanta, and Sprite. Their enduring popularity, combined with their strong records of innovation, support healthy sales growth even during economic downturns.

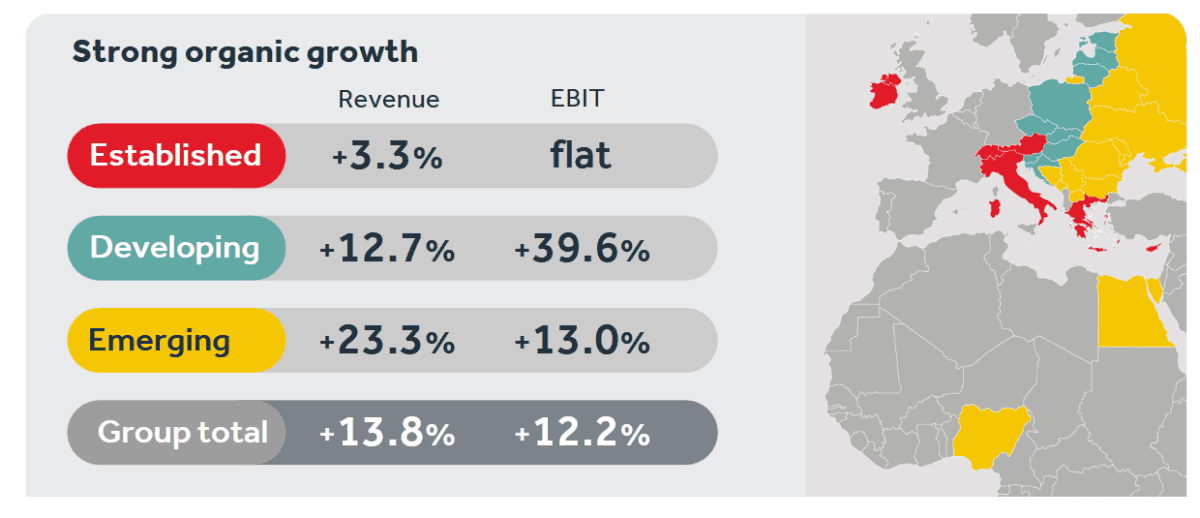

In 2024, the firm, which supplies its drinks across much of Europe and parts of Africa, reported organic net sales growth of 13.8%, to €10.8bn.

Coca-Cola HBC isn’t just about soft drinks, though. Indeed, the firm’s energy and coffee products stole the show again in 2024. Volumes across these categories soared 30.2% and 23.9% year on year.

Tasty value

Coca-Cola HBC shares have been one of the FTSE 100‘s biggest success stories so far in 2025. They’re up 14.8% since 1 January versus the broader index’s 5.7% increase.

Yet despite this, the company still offers good value compared to the Footsie’s other major consumer goods makers.

It’s forward price-to-earnings (P/E) ratio is 15.3 times, which is lower than Unilever and Diageo‘s corresponding readings of 17 times and 16.3 times, respectively. Its P/E multiple is also roughly in line with Reckitt Benckiser‘s for 2025.

Coca-Cola HBC’s valuation is all the more attractive given its superior trading momentum versus those other FTSE shares (Unilever’s share price actually slumped Thursday after it predicted soft first-half sales).

A top growth share?

I’m not saying that Coca-Cola HBC is totally risk free, of course.

The challenging economic landscape continues to cast a shadow, and the company has said it expects organic revenue growth to slow sharply, to 6%-8% in 2025.

Organic earnings (before interest and tax), meanwhile, is tipped to increase by 7%-11% this year, down from 12.2% last year.

A wide geographic footprint also leaves the company vulnerable to foreign exchange pressures. This proved the case last year as, on a reported basis, sales rose by a more modest (yet still respectable) 5.6%.

But context is everything, and those numbers are still pretty good in the current environment. It reflects in large part Coca-Cola HBC’s huge exposure to fast-growing regions: sales in its emerging and developing markets jumped by double-digit percentages in 2024.

Strong growth is also expected as the bottler executes its growth priorities. It plans to grab a larger share in the out-of-home coffee market, while further product launches in the energy category are likely (Monster Energy Green Zero was launched in another 16 territories last year).

City analysts expect group earnings to grow 11% in 2025 and another 10% next year. Given its market-leading labels, wide regional footprint, and strong record of innovation, I think it’s one of the hottest FTSE 100 growth shares to consider today.