Dogecoin has faced increased volatility and selling pressure as February kicks off with uncertainty across global markets. The meme coin struggles to break above the $0.25 mark, reflecting broader concerns amid US trade war fears and macroeconomic instability. Investors remain cautious, with many waiting for clear signals before jumping back into the market. However, key on-chain data suggests that big players are taking advantage of current price levels.

Related Reading

Top analyst Ali Martinez shared insights revealing that whales have accumulated another 100 million DOGE in the last 24 hours. This trend signals growing confidence and rising demand for Dogecoin despite the ongoing price struggles. Historically, whale accumulation has often preceded strong price movements as large investors position themselves ahead of potential rallies.

The coming days will be crucial for DOGE, as it must reclaim key resistance levels to regain bullish momentum. While short-term sentiment remains mixed, growing demand among whales could be a sign that smart money is preparing for the next move. If Dogecoin can hold support and push above $0.25, it may be setting up for a breakout in the weeks ahead. Investors are watching closely to see whether whale accumulation will drive the next leg up for DOGE.

Dogecoin Struggles Below Key Levels

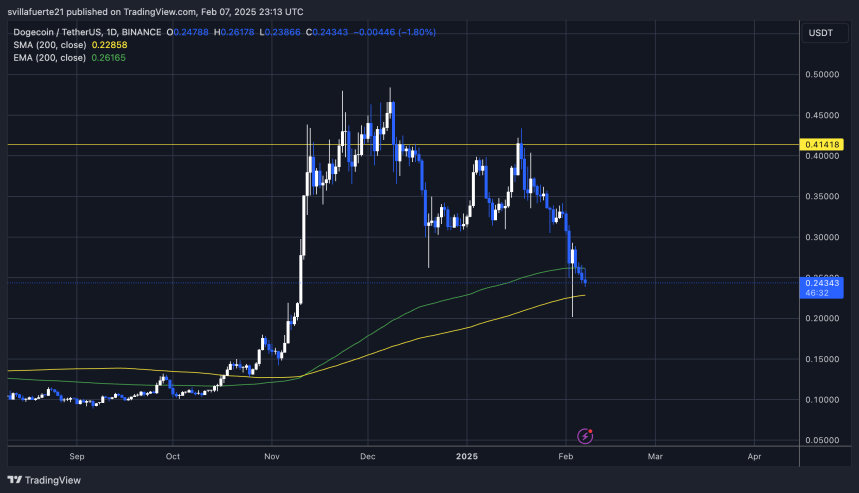

Dogecoin is facing challenges as it struggles below key supply levels between $0.29 and $0.25, with the price showing signs of exhaustion. The broader crypto market remains uncertain, with Bitcoin holding relatively strong while altcoins and meme coins continue to bleed. Dogecoin’s price action reflects this instability, as bulls fail to reclaim crucial levels and bears push prices lower.

Related Reading

Analysts and investors are growing increasingly concerned about the state of the market. Meme coins, which have historically performed well in bull cycles, are underperforming this time around, raising questions about their strength in the coming months. However, one key metric suggests that Dogecoin could be setting up for a strong move.

Martinez shared on-chain data on X revealing that whales have accumulated another 100 million DOGE in the last 24 hours. This consistent trend of accumulation signals growing confidence and rising demand for Dogecoin, even as the price remains weak. Historically, similar accumulation periods have preceded major rallies, indicating that big players may be positioning themselves for a breakout.

If DOGE can reclaim the $0.25-$0.29 range and turn it into support, the next move higher could be significant. However, failure to hold key levels could lead to further declines. The coming weeks will be crucial in determining whether Dogecoin can recover or if it will remain stuck in a downtrend.

DOGE Price Analysis: Key Levels To Watch

Dogecoin is trading at $0.24 after enduring significant selling pressure, dropping over 39% since the start of February. The price action remains bearish, with no signs of immediate recovery as long as DOGE stays below the $0.26 mark. Bulls have lost control, and every attempt to push higher has been met with strong resistance.

Now, the key demand level to hold is around the $0.228 mark, which aligns with the 200-day moving average. This level has historically acted as a crucial support zone, and losing it could trigger further declines toward the $0.20 mark. If DOGE fails to reclaim $0.26 and turn it into support, the downward trend is expected to continue in the coming days.

Related Reading

On the other hand, a strong bounce from current levels and a push above $0.26 could signal a reversal, opening the door for a retest of the $0.29 supply zone. However, with market uncertainty still weighing on meme coins and altcoins, Dogecoin needs a surge in demand to regain momentum. The next few trading sessions will be crucial in determining whether DOGE can stabilize or if further downside is on the horizon.

Featured image from Dall-E, chart from TradingView