Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Cardano is currently trading around a key daily demand zone, with bulls attempting to step in and stabilize price action after weeks of decline. The broader crypto market remains under pressure, driven by persistent macroeconomic instability and heightened global uncertainty. As financial markets continue to react to inflation fears, trade tensions, and erratic policy moves, altcoins like ADA have been hit especially hard.

Related Reading

Analysts are warning that the downtrend could continue, with little indication of a shift in sentiment in the near term. Many believe Cardano may follow the broader altcoin market, which has seen deep corrections across the board.

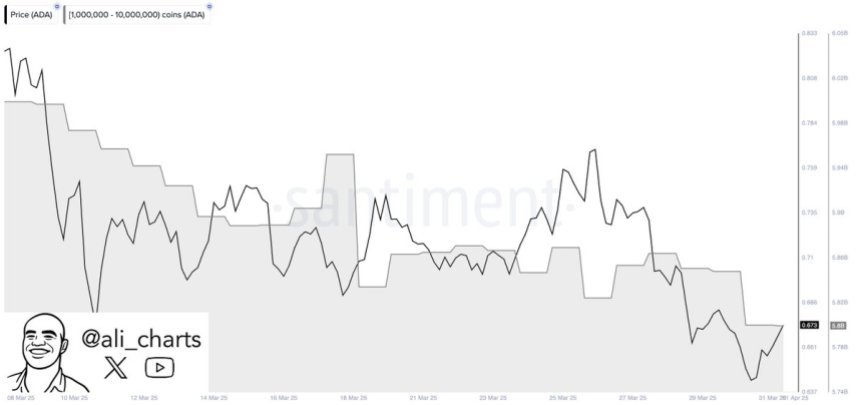

Adding to the bearish outlook, on-chain data from Santiment reveals that whales offloaded nearly 200 million ADA throughout March. This significant sell-off by large holders has only added to the downward pressure, fueling concerns that more downside may be ahead if bulls fail to reclaim key levels.

As Cardano trades near support, the next few sessions will be crucial. Whether bulls can defend this zone and push ADA higher — or if continued whale selling leads to further losses — remains to be seen in a market that’s showing few signs of stability.

Cardano Struggles As Whale Selling Intensifies

Cardano has seen a sharp decline, losing more than 45% of its value since March 3 amid a wave of selling pressure that has rocked the broader crypto market. As macroeconomic instability continues to drive uncertainty across financial markets, altcoins like ADA have taken the brunt of the damage. Now trading near a critical support zone, Cardano faces growing pressure from both retail sentiment and large-scale holders exiting their positions.

Bulls are in a difficult position, needing to step in and defend current levels to avoid a steeper correction. If ADA fails to hold support, analysts warn that a drop toward the $0.50 mark is likely — a level not seen in months and one that could confirm a shift into a deeper bearish phase.

Adding to the bearish outlook, top analyst Ali Martinez shared insights revealing that whales sold nearly 200 million ADA during March alone. This kind of large-scale selling from top holders typically signals fading confidence and adds further downside pressure to already struggling price action.

With market sentiment still fragile, Cardano’s next move will likely depend on whether bulls can reclaim momentum — or if continued whale selling and macro fears drag the price lower. Holding current levels is essential to prevent ADA from sliding into even more critical territory in the days ahead.

Related Reading

Price Action Details: Bulls Defending Critical Demand

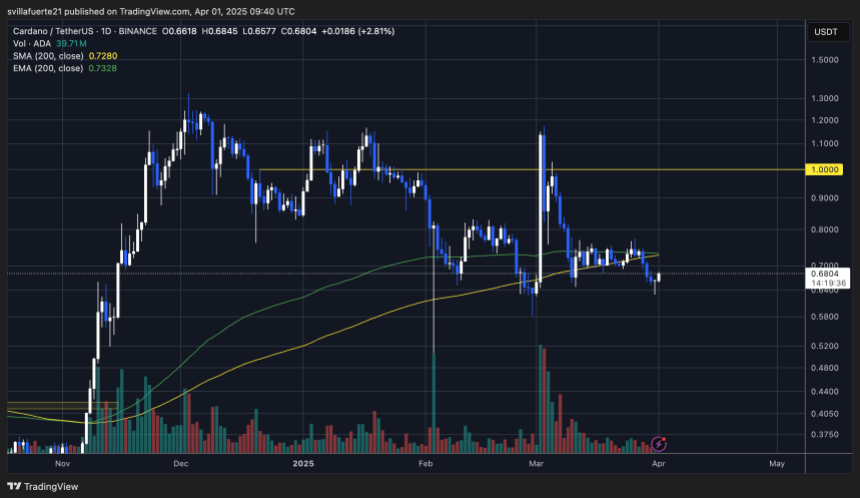

Cardano (ADA) is currently trading at $0.68 after failing to hold the $0.75 level, signaling a continuation of bearish momentum. The recent drop also pushed ADA below the 200-day moving average (MA) and exponential moving average (EMA), both sitting around the $0.72 mark — critical indicators that have now flipped into resistance. This loss has further weakened the short-term structure, leaving bulls with limited options.

The next key level to watch is $0.62. Bulls must defend this zone with conviction to prevent a deeper selloff and attempt to form a base for recovery. Reclaiming levels above $0.72 would be the first step in regaining control, but without immediate buying pressure, the outlook remains fragile.

If Cardano fails to hold above $0.62, analysts warn that a sharp decline into the $0.57–$0.55 range could follow. This would mark a significant breakdown and could trigger panic selling, especially as overall market sentiment remains shaky.

Related Reading

With ADA under pressure and technical levels breaking down, the coming days will be crucial. Bulls must act swiftly to reclaim lost ground, or risk watching Cardano slide further into lower demand zones.

Featured image from Dall-E, chart from TradingView