Crypto buying and selling is usually a powerful activity. Not solely will you must face all of the challenges related to common buying and selling, additionally, you will should battle the extra volatility current within the crypto market.

Reversal candlestick patterns are one of many principal instruments {that a} dealer can use. These patterns might help establish bullish and bearish reversals available in the market and discover worthwhile buying and selling alternatives.

Whats up! I’m Zifa, a seasoned crypto author with over three years within the discipline. As we speak, I carry you an all-encompassing information on reversal candlestick patterns. We’ll discover what they’re and how one can leverage them in your buying and selling method.

Key Highlights

- Reversal candlestick patterns might help spot market shifts. Nevertheless, it’s best to double-check with different alerts like quantity to remain on monitor.

- Bullish reversals counsel potential development, however don’t overlook to set cease losses to handle your danger correctly.

- Bearish reversals trace at value drops, so use instruments like RSI or assist/resistance ranges to filter out false alerts.

- Begin with easy patterns like Doji and Engulfing to construct your confidence earlier than shifting on to extra complicated setups.

What Is a Reversal Candle Sample?

A reversal candlestick sample is a bullish or bearish reversal sample shaped by a number of candles. One can use these sorts of patterns to establish a possible reversal in property’ costs.

Varied candlestick reversal patterns exist, however not all of them are equally sturdy or dependable. Among the hottest ones embrace the bullish engulfing sample, the bearish engulfing sample, the bullish harami sample, and the bearish harami sample.

Bullish vs. Bearish Reversal Candle Patterns

Reversal candlestick patterns will be both bullish or bearish. Bullish reversal patterns happen when the market is in a downtrend and kinds a bullish reversal sample. Bearish reversal patterns happen when the market is in an uptrend and kinds a bearish reversal sample.

Full Checklist of All Reversal Candlestick Patterns: Cheat Sheet

Right here’s an entire checklist of reversal candlestick patterns, together with each bullish and bearish reversals:

Bullish Reversal Candlestick Patterns

- Hammer

- Inverse Hammer

- Bullish Engulfing

- Piercing Line

- Morning Star

- Morning Doji Star

- Three White Troopers

- Dragonfly Doji

- Tweezer Bottoms

- Deserted Child Backside

- Bullish Harami

- Bullish Harami Cross

- Bullish Kicker

- Bullish Assembly Strains

- Three Inside Up

- Three Outdoors Up

- Bullish Stick Sandwich

- Bullish Breakaway

- Bullish Belt Maintain

- Ladder Backside

Bearish Reversal Candlestick Patterns

- Hanging Man

- Capturing Star

- Bearish Engulfing

- Night Star

- Night Doji Star

- Three Black Crows

- Headstone Doji

- Darkish Cloud Cowl

- Tweezer Tops

- Deserted Child High

- Bearish Harami

- Bearish Harami Cross

- Bearish Kicker

- Bearish Assembly Strains

- Three Inside Down

- Three Outdoors Down

- Bearish Stick Sandwich

- Bearish Breakaway

- Bearish Belt Maintain

- Upside Hole Two Crows

Every sample has its personal distinctive formation and implications. We are going to take a better take a look at the preferred patterns later on this article.

Learn additionally: Chart patterns cheat sheet.

Candlestick Efficiency

Candlestick reversal patterns are among the many strongest bullish and bearish reversal alerts available in the market. Due to their excessive accuracy, these patterns can be utilized to commerce each lengthy and brief positions.

To be able to benefit from candlestick reversal patterns, it’s best to use them together with indicators and complete market and technical evaluation. Don’t overlook that no sample or indicator is ever totally dependable per se.

High Bullish Reversal Candlestick Patterns

Though they might generally be unreliable, studying how you can establish the highest bullish patterns that may sign reversal remains to be an immensely vital talent for any crypto dealer. Let’s overview a number of the mostly seen ones and be taught what they’ll imply.

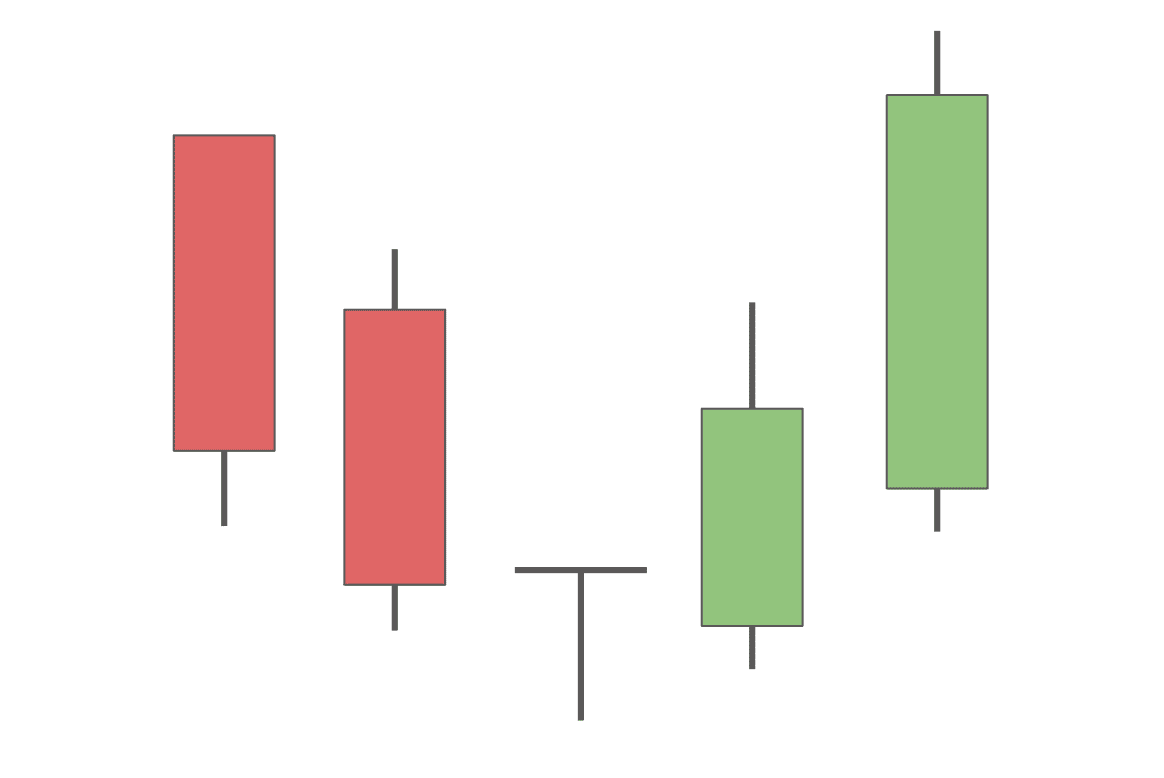

Three White Troopers

Three white troopers is among the most well-known three-candle reversal patterns. It’s shaped by three candlesticks that every one have lengthy our bodies and the next shut than the earlier candle. Three white troopers all open inside the physique of the previous candle. Moreover, additionally they have brief wicks, which signifies comparatively low volatility and a robust bullish development.

The three white troopers sample often comes after a downtrend and confirms that bulls have taken over the market.

Dragonfly Doji

The dragonfly doji is a bullish reversal sample shaped when the open, the excessive, and the shut are all equal or very shut to one another. It mainly has no physique. As an alternative, it has a extremely lengthy decrease wick however an nearly non-existent higher one.

This sample exhibits that though the asset’s worth briefly went down in the course of the set timeframe attributable to promoting stress, it opened and closed at a excessive value. The dragonfly doji exhibits that the bulls at present have the higher hand available in the market, and we may even see a reversal from a bearish development to a bullish one fairly quickly.

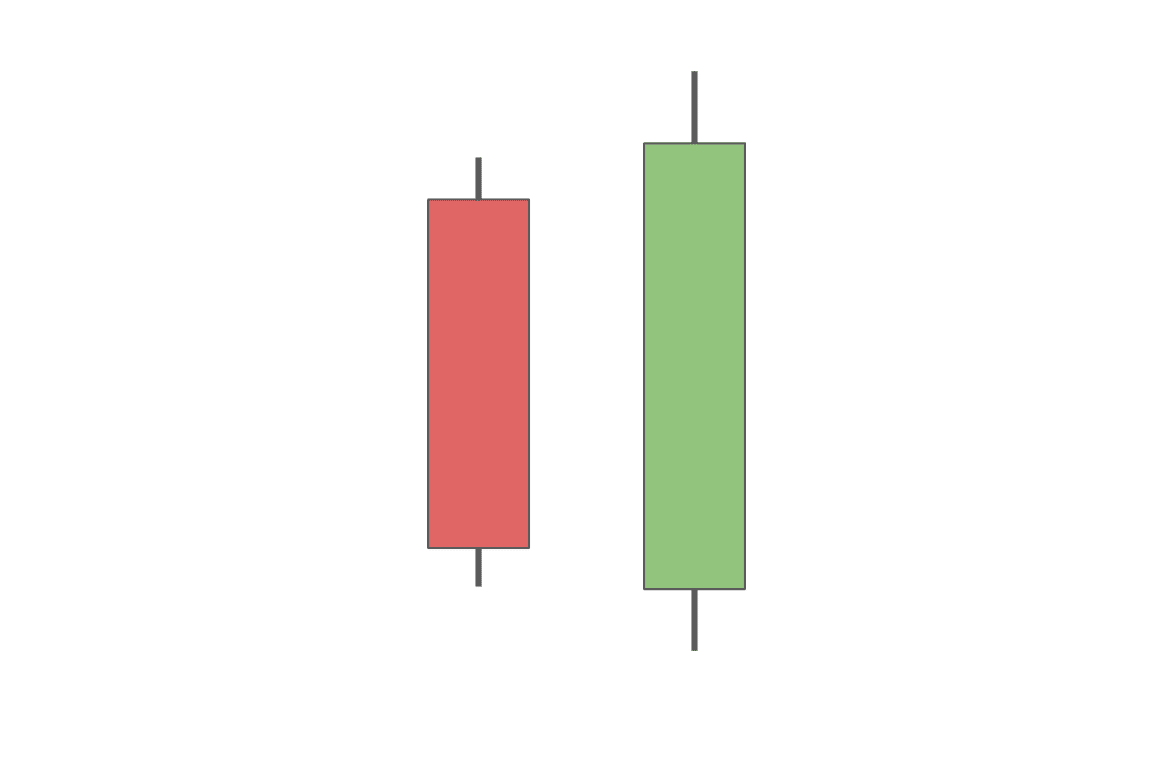

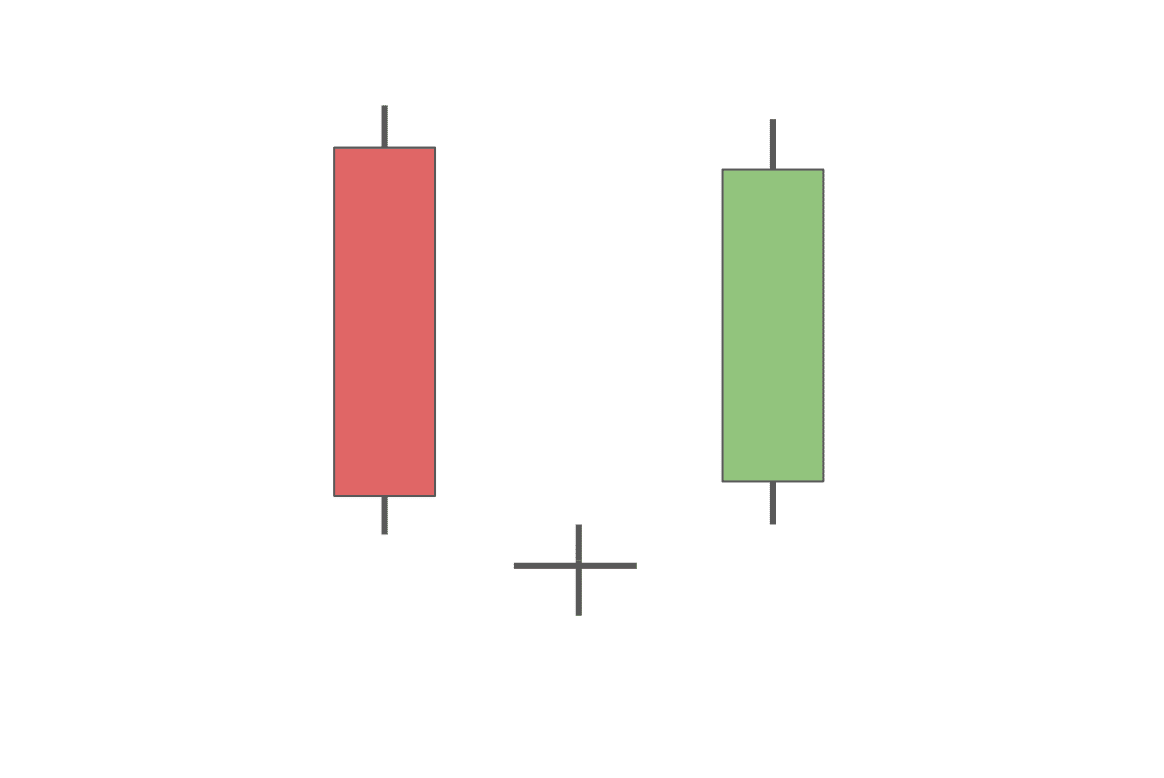

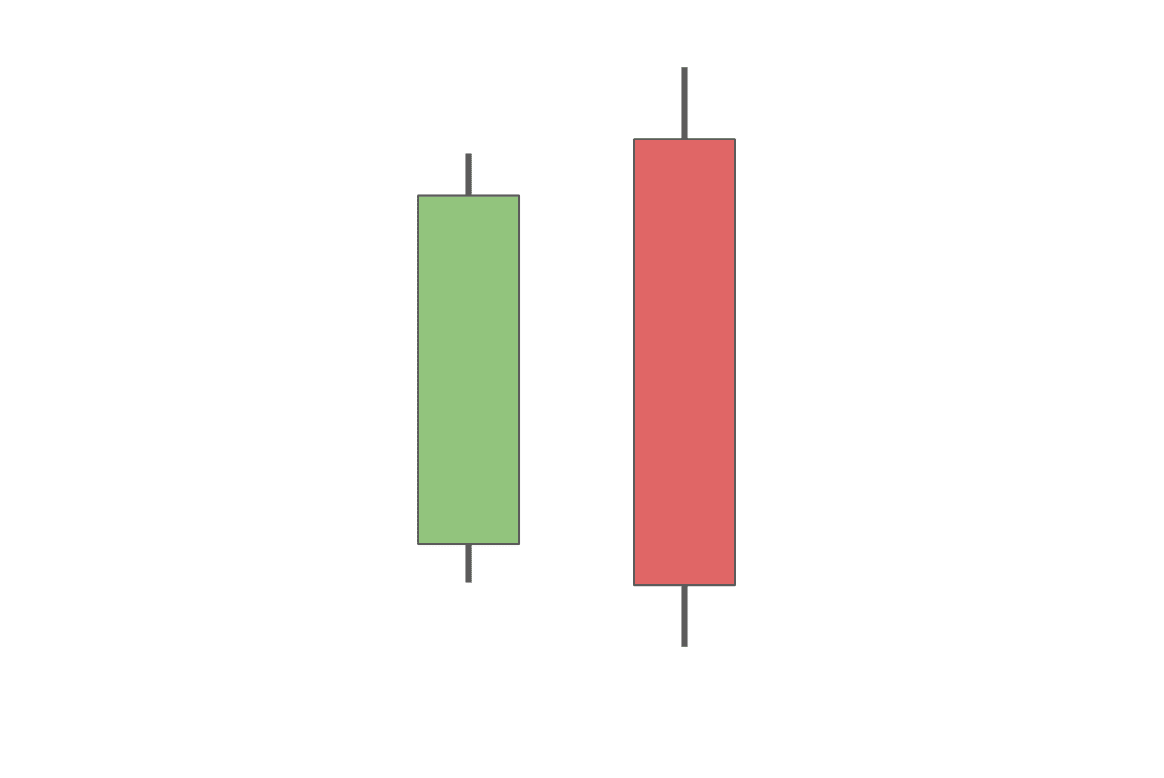

Bullish Engulfing

The bullish engulfing sample is a relatively easy sample shaped by two candlesticks. The primary candlestick is bearish, and the second is bullish. Identical to the title suggests, the second candle engulfs the physique of the primary one.

The engulfing is taken into account to be some of the highly effective bullish reversal patterns because it exhibits that though the asset’s value touched a brand new low, it nonetheless managed to shut above the opening of the previous candle.

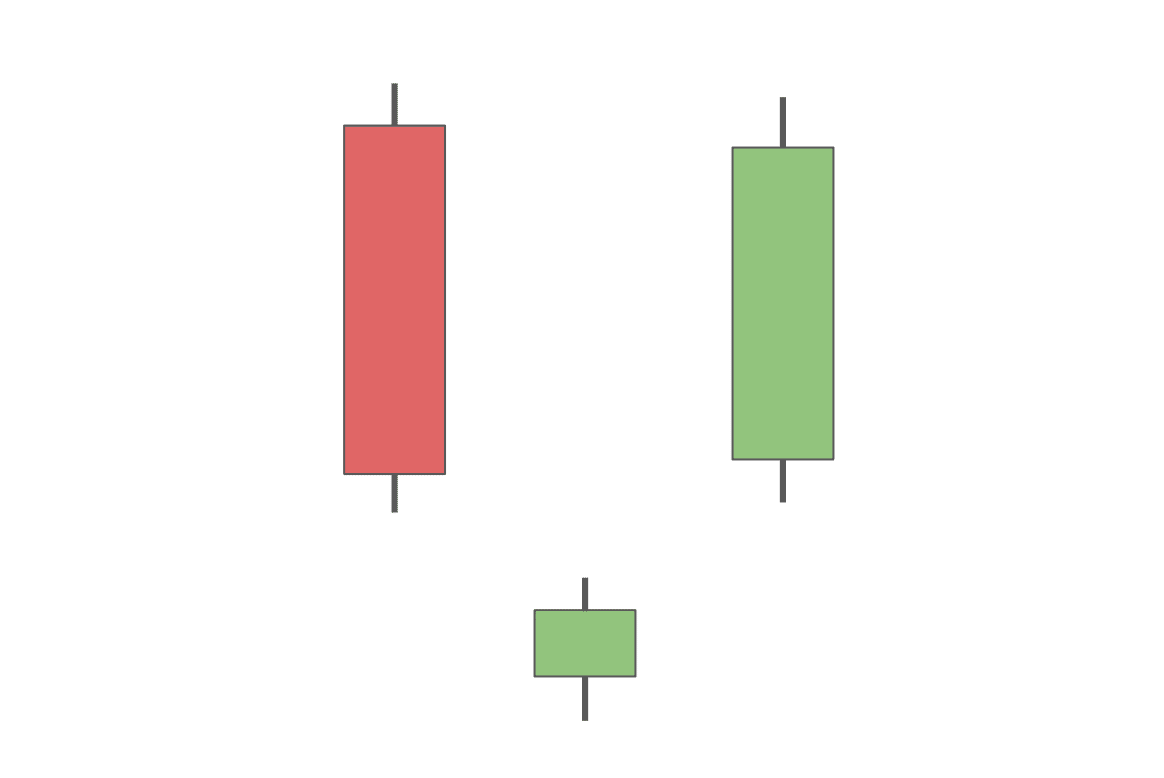

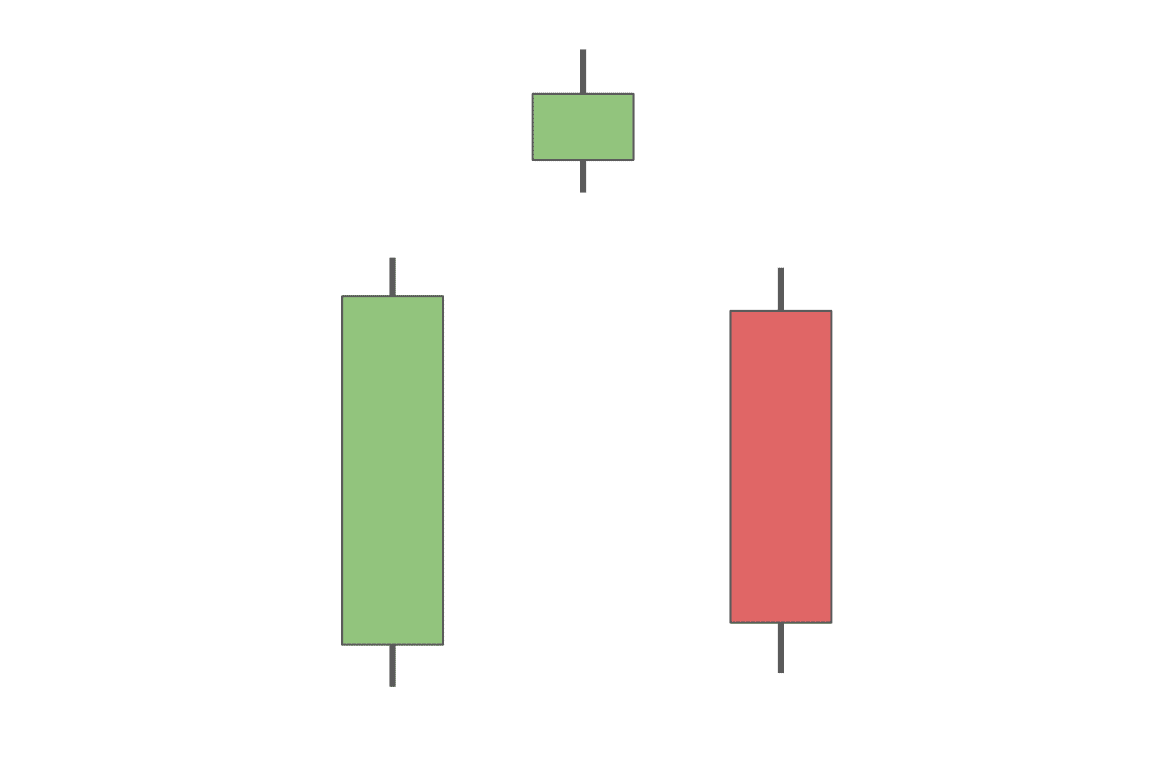

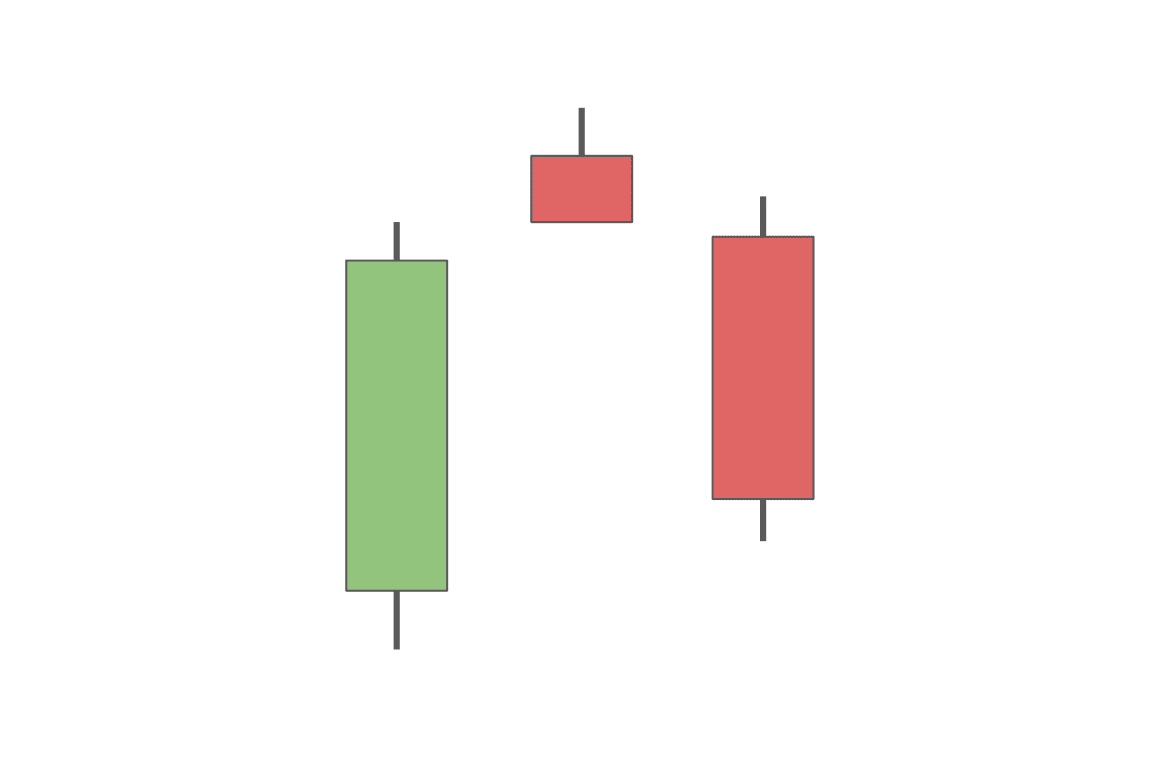

Bullish Deserted Child

The bullish deserted child is a bullish reversal sample that consists of three candlesticks: one bearish and two bullish ones. It’s actually much like the morning star however has one essential distinction. The deserted child — the second candle — is beneath the decrease wicks of each the primary and the third candlesticks within the sample. Generally, there’s a couple of “child” between the 2 large candles.

The small second candle exhibits that the promoting stress has grow to be weaker. Its distance from the opposite two candles alerts that promoting stress has presumably been exhausted.

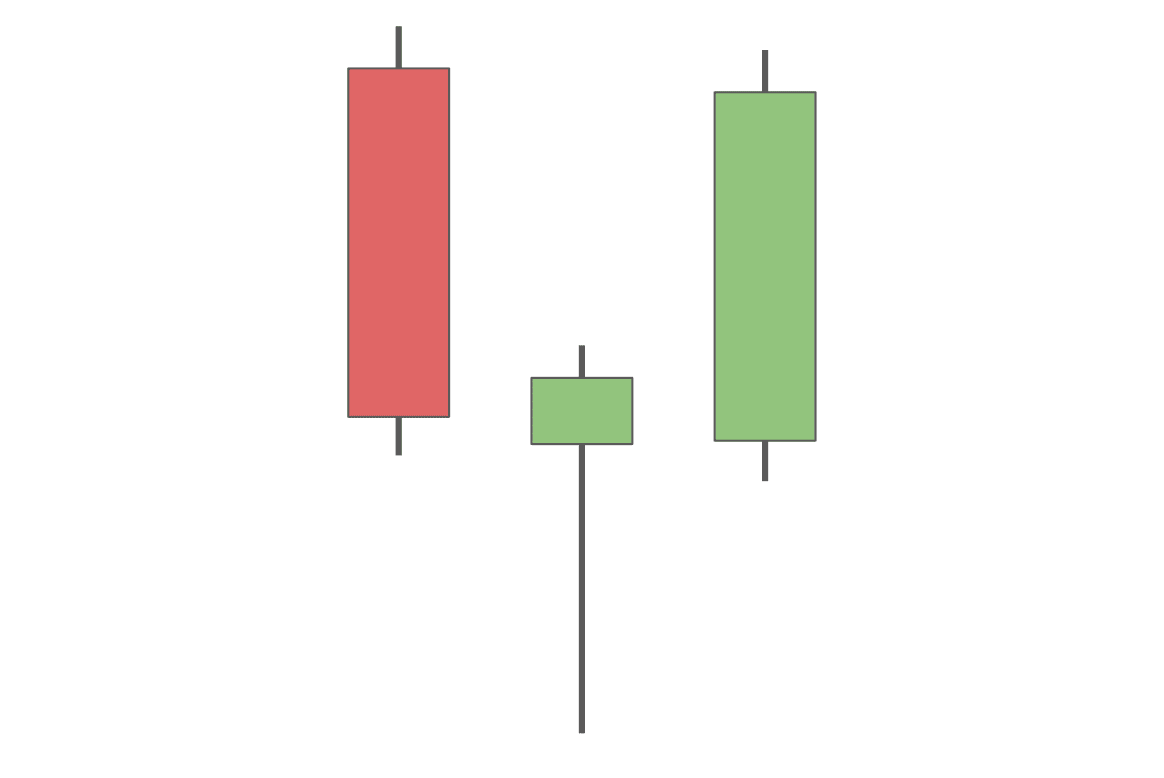

Morning Star

The morning star is a bullish reversal sample shaped by three candlesticks. The primary candlestick is bearish, the second is a small bullish or bearish candlestick, and the third one is a giant bullish candle.

The second candle finally ends up being so small as a result of though there’s a push to a brand new low, there’s additionally a rebound, which receives bullish affirmation by way of the third large inexperienced candle.

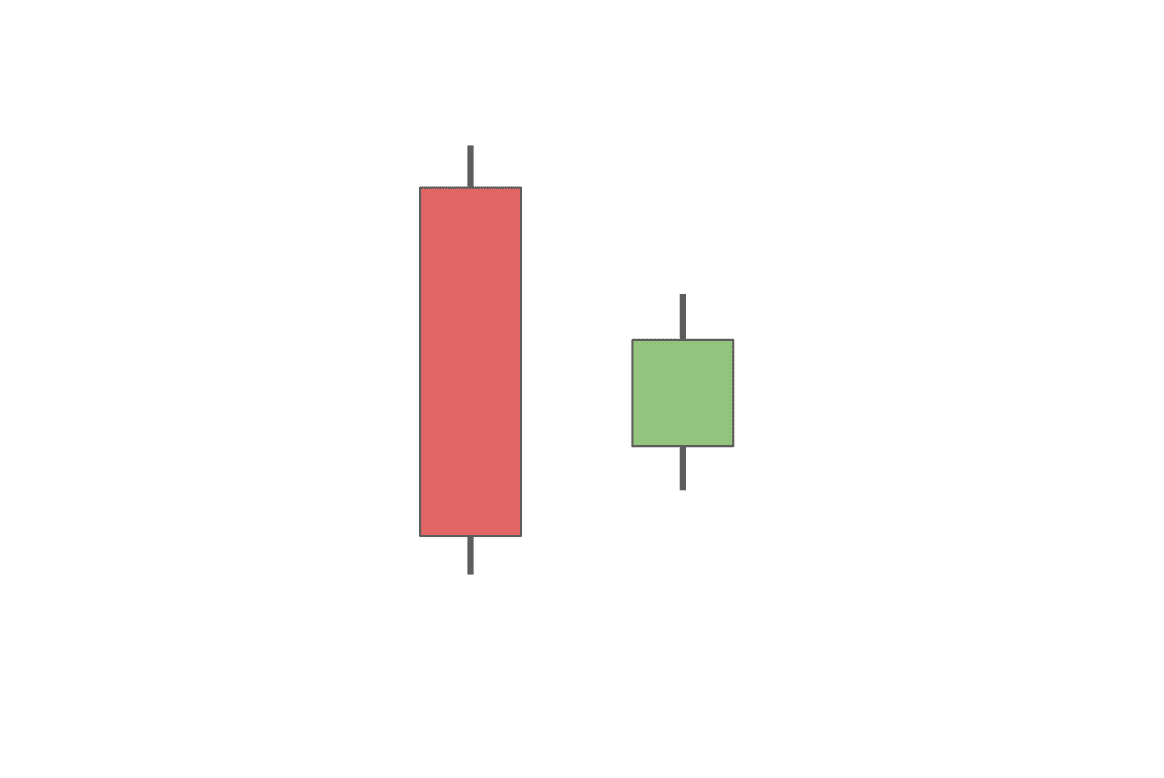

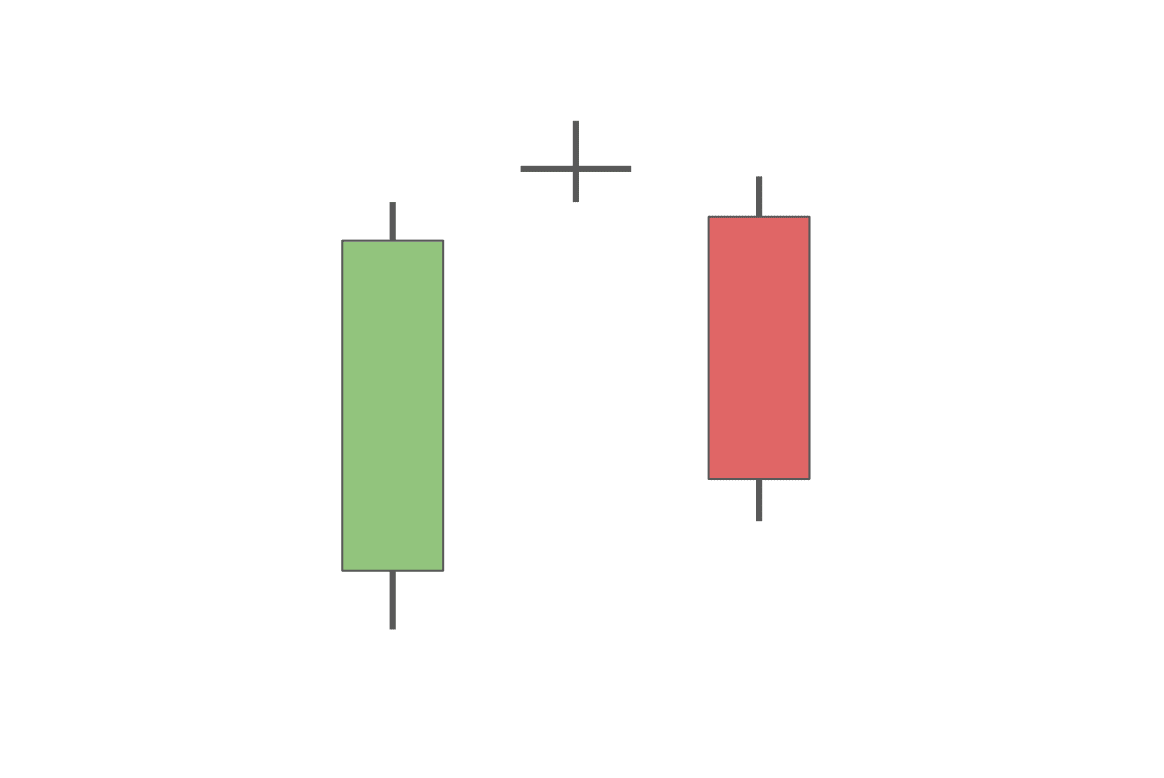

Morning Doji Star

The morning doji star is similar to the common morning star. The primary distinction is that on this case, the second candle’s physique is lots smaller — it’s a doji. Its small physique alerts indecisiveness available in the market, whereas its lengthy wicks replicate the continuing value volatility. These two elements mixed, particularly alongside the opposite parts of the morning star sample, sign a potential reversal.

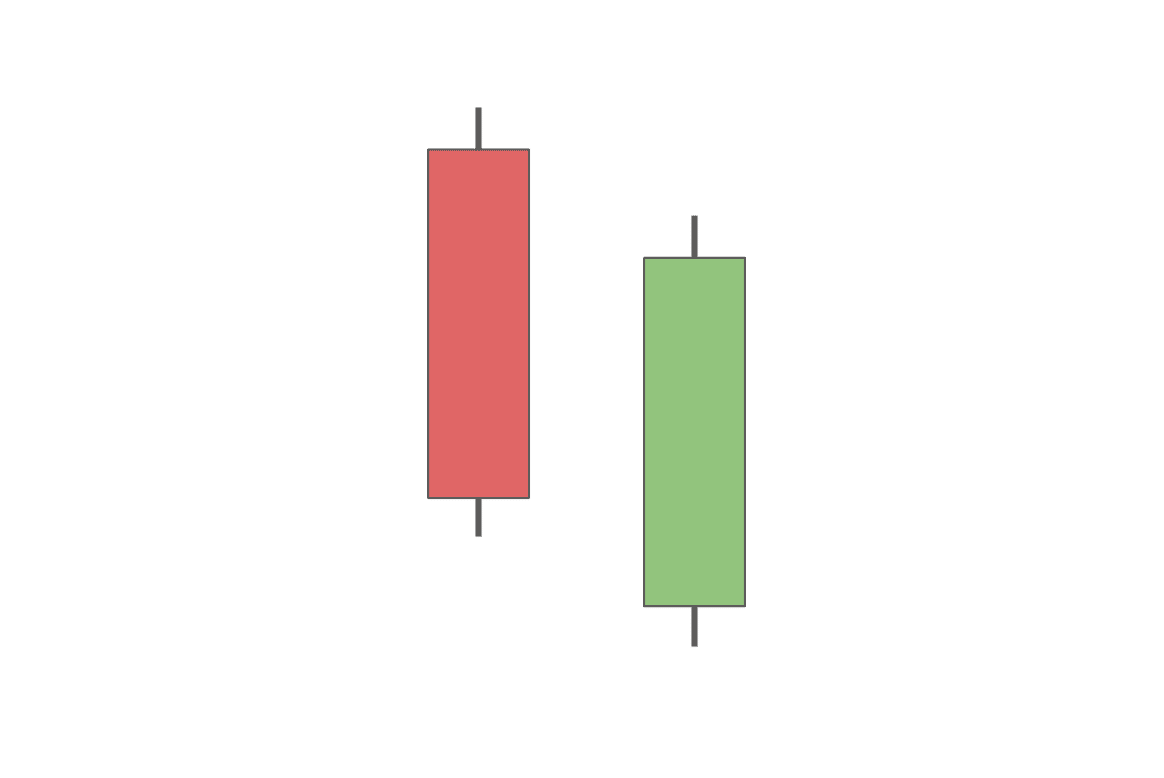

Piercing Line

The piercing line is shaped by two candlesticks, a bearish and a bullish one, which each have common or massive our bodies and wicks of common size. The second candle’s low is all the time beneath that of the earlier candle. Regardless of that, this bullish candlestick would possibly signify the start of a rally.

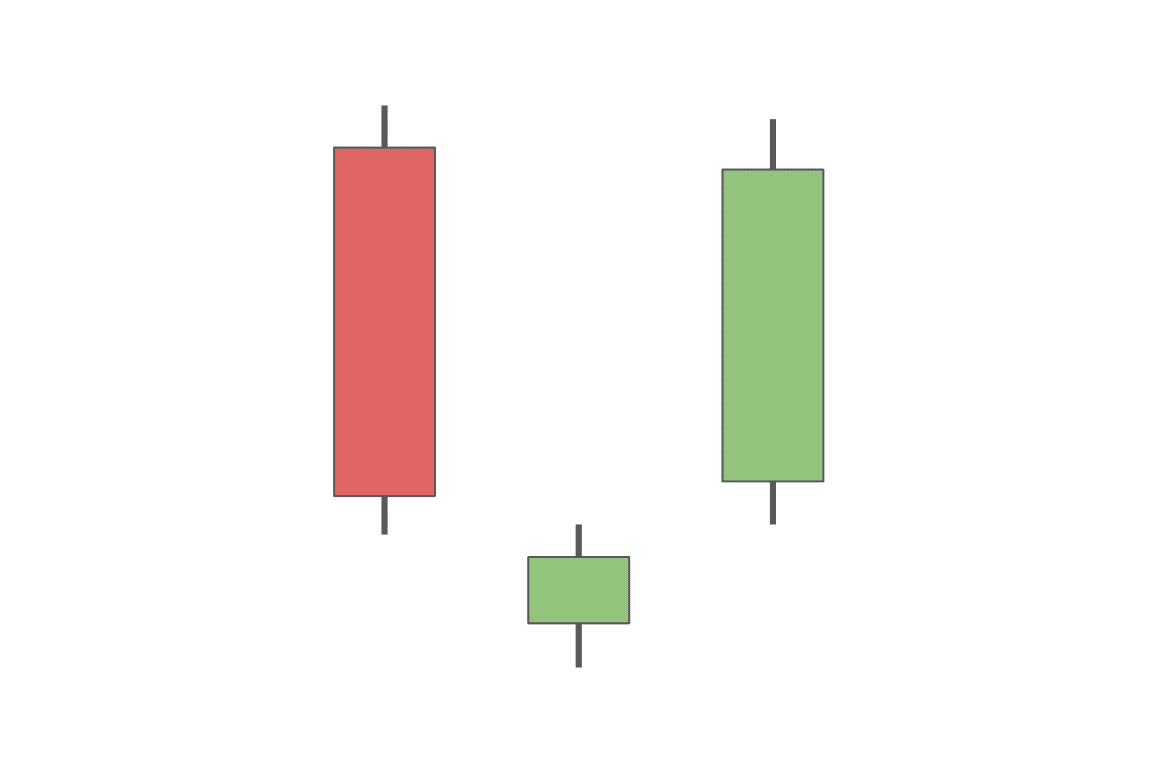

Bullish Harami

The bullish harami is shaped by two candles, a bearish and a bullish one. The inexperienced candle is lots smaller than the purple one. This sample signifies that there has presumably been a change available in the market sentiment, and a rally could occur quickly.

Hammer Candlestick

A hammer is among the best patterns to identify: it has an simply recognizable form and is made up of 1 single candlestick. This candle has a small physique and a extremely lengthy decrease wick.

That lengthy decrease wick together with a brief higher one and a physique that’s on the smaller aspect provides a reversal sign. It exhibits that whereas the asset briefly traded actually low, it managed to recuperate and continued being traded close to its excessive level and above the opening.

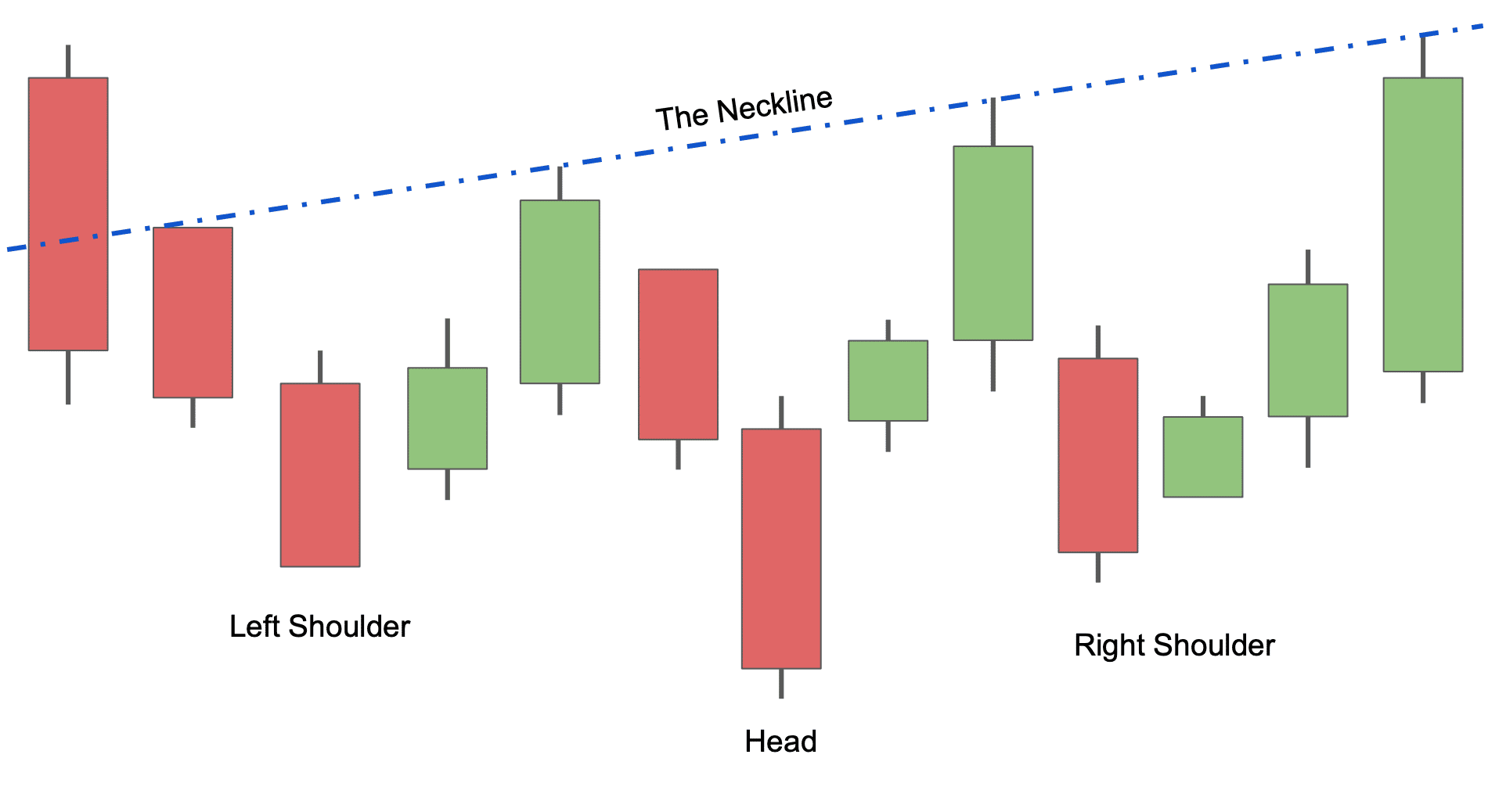

Inverse Head and Shoulders

The inverse head and shoulders is essentially the most complicated bullish reversal sample on this checklist. Made up of a number of candles, it’s often acknowledged by its total form, which resembles three inverted triangles. The primary one kinds the left shoulder, the second is the pinnacle, and the third one represents the correct shoulder.

First, costs go right down to a brand new minimal, which sparks a short-lived value rise. Then, the development reverses, and the asset’s worth goes even decrease, solely to shoot again up once more and return down once more. These two excessive factors are known as the neckline. Lastly, the asset goes up one last time and often continues rising.

The complexity of this sample makes it stronger: as a result of it takes longer to be accomplished, the rallies that come after it often are typically stronger.

High Bearish Reversal Candles

Now that we’ve examined bullish reversal candles, let’s check out some bearish reversal candles.

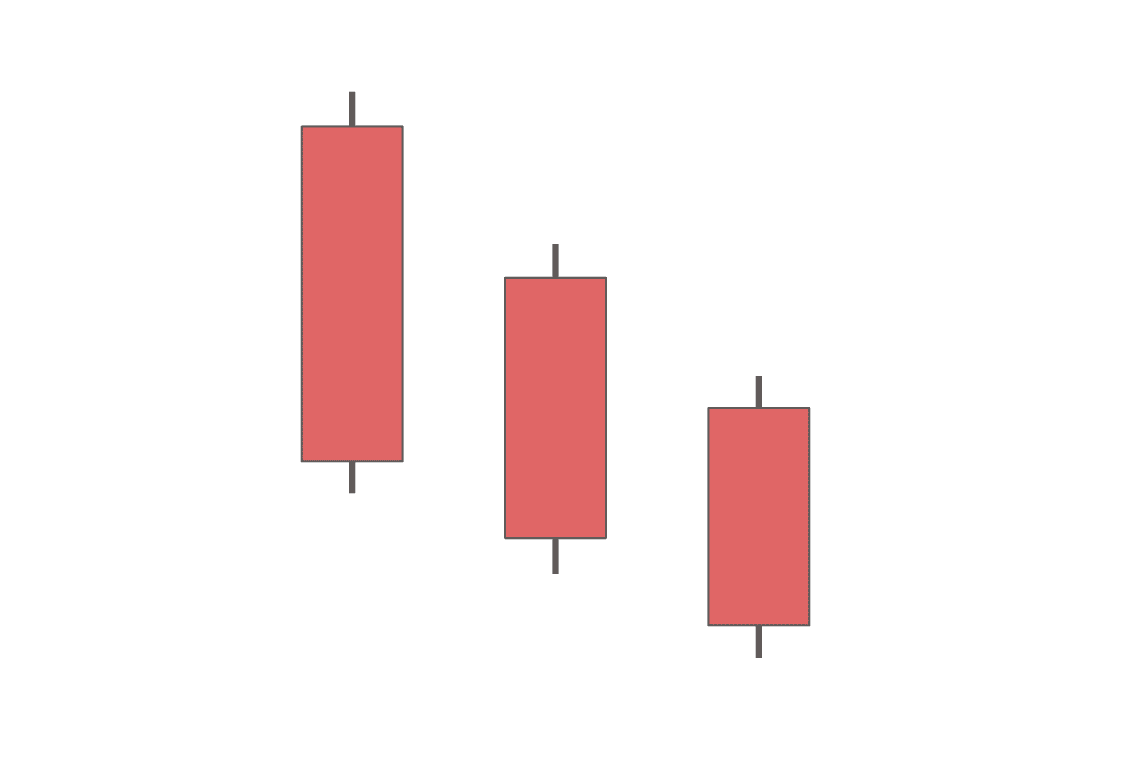

Three Black Crows

The three black crows is a bearish reversal sample shaped by three consecutive candlesticks with decrease closes. All of them have small wicks — the opening value is mostly additionally the best, and the closing value is almost the bottom.

That exhibits that the worth continues to fall all through the set timeframe and retains on taking place inside the candle. Three black crows is taken into account to be a extremely highly effective bearish sample. When preceded by a bullish development, it alerts a reversal.

Capturing Star Candlestick

The capturing star is a bearish reversal sample shaped by one candlestick with a small physique, an extended higher shadow, and a brief decrease shadow. It often seems after a bullish development and alerts its ending.

This candlestick’s construction exhibits that though a brand new excessive has been hit, the development is beginning to reverse as there’s not sufficient shopping for stress.

Bearish Deserted Child

The bearish deserted child is much like its bullish counterpart however turned the other way up. Identical to its cousin, it’s also made up of three candles, with the center one being comparatively small.

The primary distinction between them is that on this sample, the second candlestick is above the opposite two, not beneath. Moreover, the primary candle shall be inexperienced, and the third one will flip purple, as this sample alerts the top of a rally and the start of a downtrend.

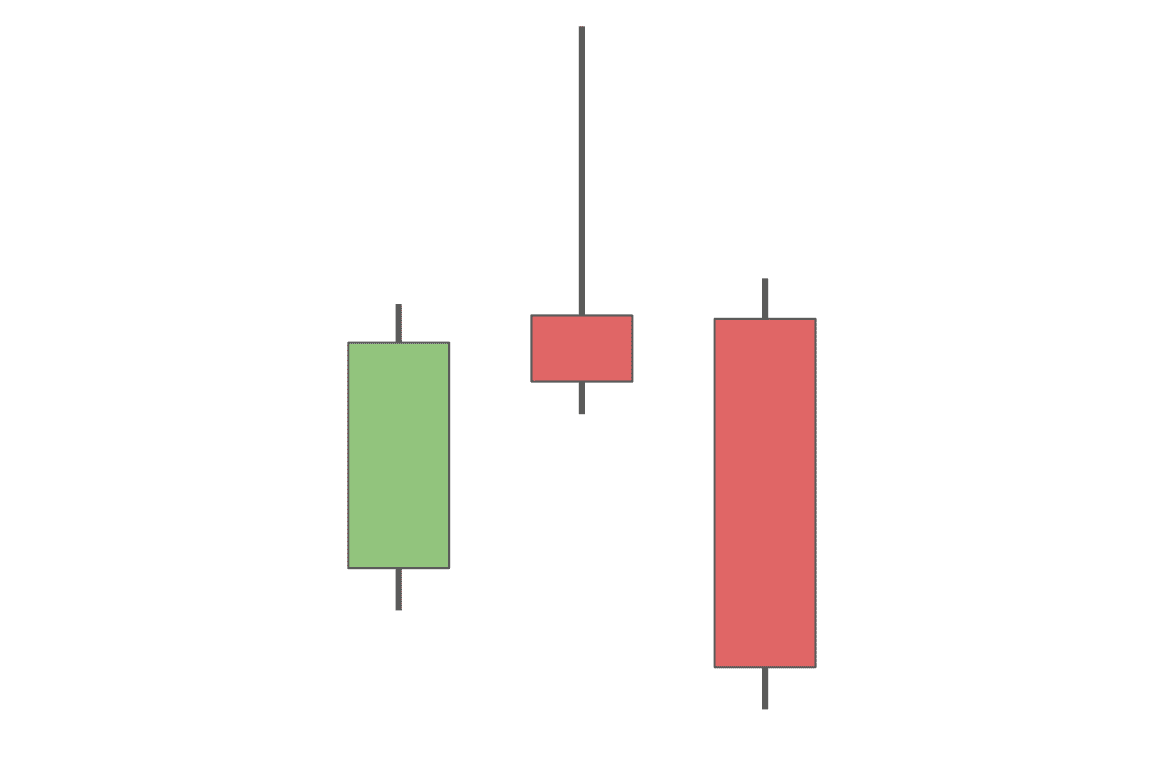

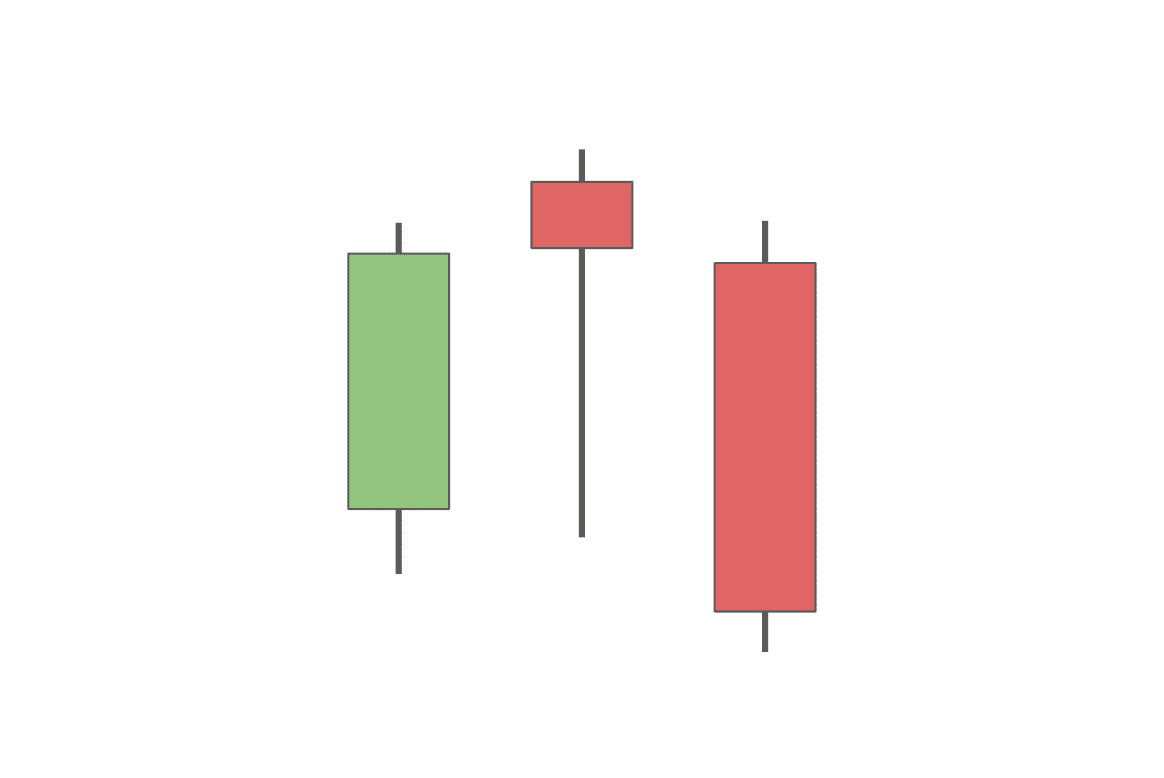

Night Star

The evening star consists of three candlesticks. The primary and the third candles each have a big physique, whereas the center one is relatively small.

The primary candlestick is bullish, and so is the second. Nevertheless, its small measurement exhibits that the rally has stalled, which is then confirmed by the third — bearish — candle. It often alerts the start of a downtrend.

Night Doji Star

The night doji star is similar to the traditional night star sample, however its second candle is a doji with an nearly non-existent physique. Identical to the morning doji star, it exhibits indecisiveness available in the market, though this time, it alerts a potential reversal right into a bearish course.

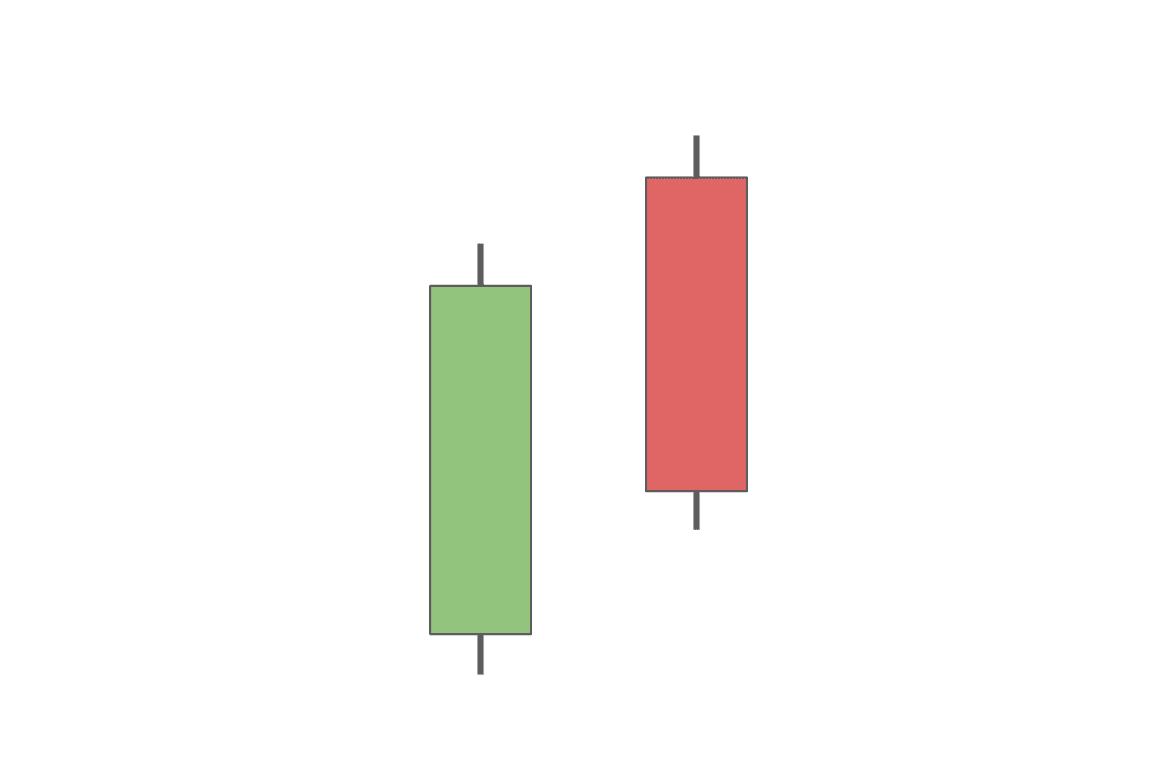

Darkish Cloud Cowl

The darkish cloud cowl is one other sturdy sample. It’s shaped by two candles, first a bullish after which a bearish one. Each of them are sturdy, with large our bodies and average-sized wicks.

This sample exhibits a scenario during which the worth of an asset tries to push to a brand new, greater place however finally fails and closes beneath its opening. It alerts a bearish reversal development.

Hanging Man Candlestick

The hanging man is shaped by only one candlestick. It has a small physique with a brief higher wick and an extended decrease one. Primarily, it’s the identical because the hammer candle. This candlestick known as a dangling man when it comes on the finish of a bull run. Identical to its bullish counterpart, it alerts a potential value reversal.

Bearish Engulfing

The bearish engulfing is the other of the bullish engulfing sample. This time, it’s the bearish candle that engulfs the smaller physique of the previous bullish one. It exhibits that though the asset’s worth briefly rallied above the best level of the earlier candlestick, it nonetheless closed beneath each its personal opening and the opening value of the previous candle. This often results in a bearish reversal.

How Is Reversal Completely different from Retracement?

In buying and selling, understanding the distinction between a development reversal and a retracement is essential. A development reversal signifies a big change available in the market’s course, marking the top of an present development and the beginning of a brand new one. This shift is commonly recognized by patterns like head and shoulders or double prime/backside, indicating a considerable change in market sentiment. These reversals often have an extended period and are crucial in signaling new tendencies.

Contrastingly, a retracement is a brief reversal inside an ongoing development. It’s seen as a minor market correction and is often short-lived. Instruments like Fibonacci retracement ranges or shifting averages assist establish potential assist or resistance ranges throughout these actions. In contrast to reversals, retracements don’t signify an entire development change however are extra like transient pauses within the present development.

Change into the neatest crypto fanatic within the room

Get the highest 50 crypto definitions you’ll want to know within the business without spending a dime

Easy methods to Use Reversal Candlestick Patterns

Reversal candlestick patterns are important for merchants to identify shifts in market tendencies. Patterns just like the bullish reversal doji, reversal hammer, and bearish engulfing sample can point out adjustments from bearish to bullish tendencies and vice versa.

Merchants ought to use these patterns alongside affirmation alerts, like a subsequent greater or decrease candle shut, to validate potential development reversals. For example, a bullish reversal doji following a downtrend could sign an upcoming uptrend, particularly if adopted by the next closing candle.

What to Do When Reversal Candle Formations Seem

Upon recognizing reversal candle formations, merchants ought to act swiftly to evaluate potential market course adjustments. Recognizing patterns equivalent to bullish engulfing or capturing stars is essential. The secret’s to know these indicators and combine them into your buying and selling technique successfully, managing open positions accordingly and doubtlessly capitalizing on new market instructions.

Entry Factors

Figuring out entry factors includes recognizing single, twin, or three-candlestick patterns. Merchants ought to enter a place within the course of the reversal on the opening of the subsequent candle, leveraging the potential development change with out awaiting additional affirmation.

Cease Loss

A stop loss is an important danger administration software. For bullish reversals, set it beneath the sample’s low; for bearish reversals, above the sample’s excessive. This technique helps safeguard in opposition to market actions that oppose the anticipated development.

Take Revenue

Setting a take revenue stage includes verifying it’s at the very least twice the gap from the entry level to the cease loss. This ratio ensures a positive risk-reward steadiness, aligning together with your danger administration technique and maximizing potential good points whereas minimizing potential losses.

Are All Reversal Candles Dependable?

Reversal candles, fashionable in technical evaluation, should not all the time dependable indicators of market reversals. Whereas they are often helpful, their effectiveness varies relying on a number of elements. The accuracy of those indicators usually relies upon in the marketplace context and the particular candlestick sample being analyzed. For example, an inverted hammer could point out a possible rally in a downtrend, but it surely requires affirmation from subsequent buying and selling durations to validate this prediction.

Merchants mustn’t solely depend on reversal candles for decision-making. As an alternative, they need to think about these patterns as a part of a broader buying and selling technique that features different technical indicators and an intensive evaluation of the present development. Understanding the restrictions of those patterns is essential in stopping over-reliance on them and making extra knowledgeable buying and selling selections.

Benefits and Limitations of Candlestick Patterns

Candlestick patterns are famend for offering visible cues about bullish and bearish tendencies available in the market, thus aiding merchants in anticipating future value actions. Patterns just like the morning doji star sample and the hammer sample can sign potential shifts in market sentiment, serving to merchants to establish potential entry and exit factors.

However, there’s all the time one of many foremost limitations of candlestick patterns — their subjective interpretation. Interpretations of the identical sample would possibly range and result in contrasting buying and selling selections.

Moreover, these patterns can generally produce false alerts, significantly in unstable markets. To mitigate these limitations, it’s advisable to make use of candlestick patterns together with different types of technical evaluation, equivalent to assist ranges, continuation patterns, and momentum oscillators. This multifaceted method helps to validate the alerts supplied by candlestick patterns and improve the reliability of buying and selling predictions.

Frequent Errors to Keep away from in Decoding Candlestick Patterns

Decoding candlestick patterns successfully is essential to profitable buying and selling, however there are widespread errors that merchants needs to be cautious of.

One such mistake is analyzing these patterns in isolation with out contemplating the broader market context. For example, a Doji candle could point out indecision available in the market, however its significance is best understood when considered in relation to the present development and surrounding candlestick formations.

One other error is overlooking the significance of quantity in validating candlestick patterns. Excessive buying and selling quantity can reinforce the credibility of a sample, equivalent to a continuation candlestick sample, indicating a stronger market dedication to the present development or a possible reversal.

This holistic method reduces the chance of misinterpretation and permits for extra correct and reliable buying and selling selections.

What Is the three Candle Reversal Technique?

The three candle reversal technique is a technical evaluation technique utilized in buying and selling to establish potential reversals available in the market development. It’s based mostly on the remark and interpretation of a particular sequence of three candlesticks on a chart. Right here’s the way it usually works:

- Identification of a Development: Step one includes figuring out the prevailing development available in the market, whether or not it’s upward (bullish) or downward (bearish). This technique is handiest when utilized after a robust and clear development.

- The Three Candle Sample: The technique seems to be for a particular sample of three candles:

- First Candle: That is according to the present development. For a bullish development, this may be an upward candle (often inexperienced), and for a bearish development, a downward candle (often purple).

- Second Candle: This candle begins to indicate the reversal. In a bullish development, it could open greater however shut beneath the midpoint of the primary candle. In a bearish development, it could open decrease however shut above the midpoint of the primary candle.

- Third Candle: The important thing candle that confirms the reversal. For a bullish development reversal, this candle ought to shut properly into the physique of the primary candle (ideally beneath it). For a bearish development reversal, it ought to shut properly above the physique of the primary candle.

- Affirmation and Entry: Merchants search for extra affirmation alerts on the fourth candle or by way of different technical indicators like quantity, assist and resistance ranges, or momentum indicators. Entry factors are sometimes thought-about on the shut of the third candle or the open of the fourth, relying on affirmation.

- Threat Administration: As with all buying and selling methods, danger administration is essential. This includes setting acceptable stop-loss orders and take-profit targets to guard in opposition to potential losses and lock in income.

The three candle reversal technique is fashionable as a result of it’s comparatively easy and will be utilized throughout varied time frames and markets. Nevertheless, it’s vital to notice that no technique ensures success, and this method needs to be used together with different evaluation instruments and a transparent understanding of market situations.

FAQ

What’s the finest reversal candlestick?

Probably the greatest-known and generally used reversal candlestick patterns is the Doji. A Doji candlestick signifies market indecision, the place the opening and shutting costs are almost equivalent, usually indicating a possible reversal. One other sturdy contender is the Engulfing sample—both bullish or bearish—which includes a big candle totally overlaying the earlier one, signaling a big shift in momentum.

What’s the finest timeframe for day buying and selling?

The 15-minute timeframe is the most effective one for day buying and selling. It’s brief sufficient to mean you can make fast selections but lengthy sufficient to offer you a good suggestion of what’s going on available in the market.

What’s the finest indicator for development reversal?

There isn’t a one finest indicator for development reversal. Some fashionable indicators that can be utilized to establish development reversals are the shifting common convergence divergence (MACD) indicator, the relative energy index (RSI) indicator, and the stochastic oscillator.

What’s bullish reversal energy?

The energy of a bullish reversal refers back to the probability of the reversal truly occurring.

What’s a reversal candlestick sample?

A reversal candlestick sample is a formation that happens on a candlestick chart indicating a possible change available in the market course. There are bullish and bearish reversal patterns.

How do you see a reverse candle?

One of the simplest ways to identify reserve candles is to memorize the commonest patterns, such because the bearish and the bullish engulfing, three white troopers, three black crows, and so forth.

What’s the strongest reversal candlestick sample?

Among the strongest candlestick patterns embrace the bullish engulfing sample, the morning star sample, and the night star sample. These patterns are typically extra dependable than different ones.

What are bullish reversal candlestick patterns?

Bullish candlestick reversal patterns are formations that happen on a candlestick chart indicating a possible change available in the market course from bearish to bullish.

Disclaimer: Please notice that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.