Over the last month, Bitcoin ranged within the $100,000 — $110,000 price region until its recent breakout to reach a new all-time high. On-chain data show that a shift in BTC holder behavior may have played a significant role in the flagship cryptocurrency’s recent price action.

LTHs Begin Distributing, But STHs Accumulate

In a July 12 post on the X platform, on-chain analyst Boris explained how a shift in Bitcoin holder activity has affected the market over the past months. This explanation was based on indicators measuring the Accumulation Vs Distribution of Long-Term Holders (LTH) and Short-Term Holders (STH).

For these two holder categories, the metric tracks and analyzes wallet behavior to determine whether they are increasing or decreasing their Bitcoin holdings over time.

Related Reading: Bitcoin Breaks Records: What Miners and Leverage Traders Are Doing Behind the Scenes

For the long-term holders, the chart above shows how accumulation grew from the later days of May to the end of June. This is represented by the growing green graphs over the red.

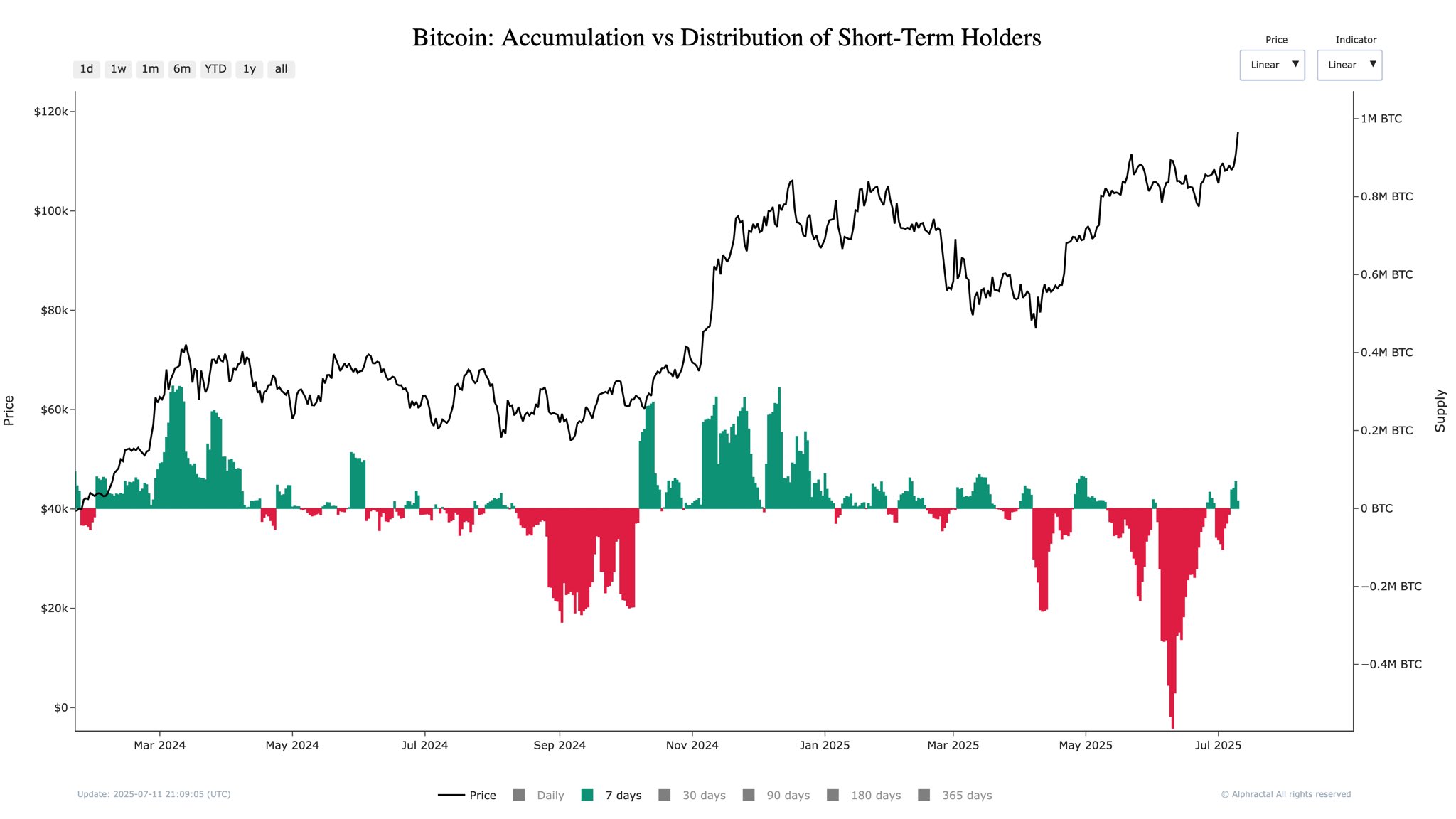

Within the same timeframe, the chart below shows short-term holders were represented more by the red graphs than the green, indicating more distribution than accumulation in the past month.

Boris credited the LTHs for Bitcoin’s survival above the $100,000 support zone. “Despite heavy STH distribution and retail selling pressure, BTC defended the 100K support — a clear sign of structural accumulation led by LTH wallets,” the on-chain analyst said.

According to Boris, the short-term holders were observed to have sold more than 563,000 BTC as Bitcoin continued to range. As this happened, the Long-Term holders steadily accumulated Bitcoin, and this absorbed most of the selling pressure from STHs.

However, this dynamic seems to have reversed very recently. The online pundit reported that the Long-Term Holders started distributing their Bitcoin holdings. This sell-off from the LTHs may be a result of profit-taking, as the cryptocurrency’s upward drift would necessitate.

On the other hand, the short-term holders have started to accumulate Bitcoin. This trend seen with this reactive group of investors indicates renewed retail interest or speculative entry amidst the current bullish rally.

Boris further inferred that this handover from LTH support to STH support must have fuelled Bitcoin’s latest breakout, as short-term momentum is injected into the market.

What’s Next For Bitcoin?

While this rotation of supply between holder classes may not be strange in crypto market cycles, the scale and timing of this switch suggest that Bitcoin’s price action holds more interesting rallies in the near future. However, if the short-term buying pressure should taper, the absence of long-term support may cause a lower support to be retested. As of this writing, Bitcoin is valued at $117,300, reflecting no significant movement in the past 24 hours.

Related Reading

Featured image from iStock, chart from TradingView