In right this moment’s dynamic financial panorama, seasoned traders are reevaluating their portfolios and contemplating the potential of Bitcoin as a substitute for conventional property like actual property. With a finite provide and transformative development potential, Bitcoin presents a compelling case for forward-thinking funding methods.

Actual Property: The Phantasm of Stability

Actual property has lengthy been considered a protected haven for preserving wealth. Nonetheless, the housing market is just not proof against systemic dangers equivalent to rate of interest hikes, authorities intervention, and financial downturns. Furthermore, property investments usually require important upkeep prices, taxes, and liquidity sacrifices.

Bitcoin, in distinction, provides unparalleled portability, resistance to confiscation, and immunity from native financial or geopolitical disruptions. Not like property, Bitcoin has no upkeep prices or bodily constraints.

The Rise of Bitcoin as a Retailer of Worth

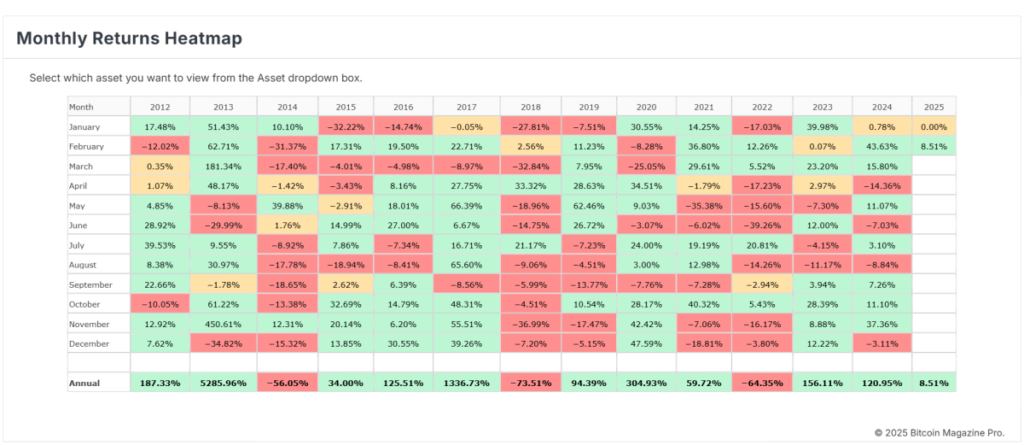

Bitcoin’s restricted provide of 21 million cash establishes it as “digital gold” for the twenty first century. Over the previous decade, Bitcoin has constantly outperformed different asset lessons, delivering exponential returns regardless of volatility.

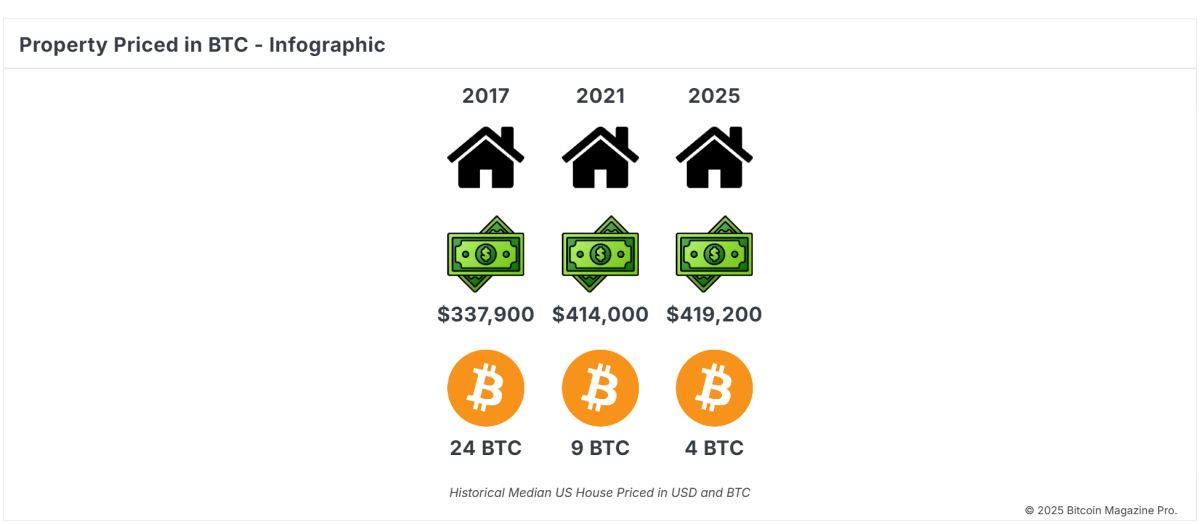

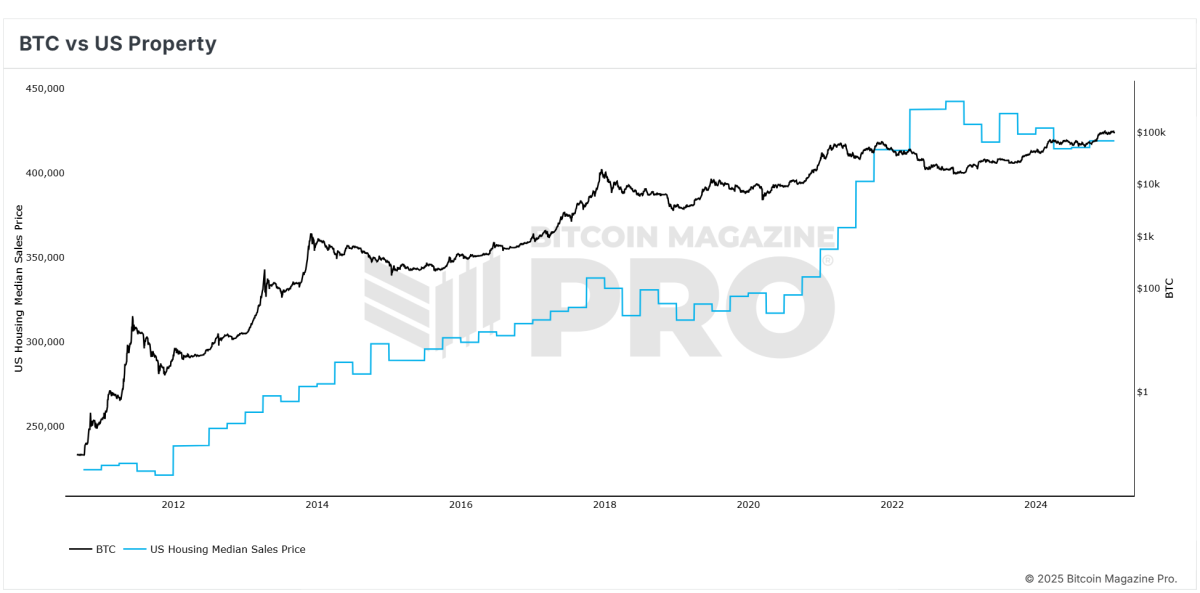

Compared, actual property’s appreciation is usually tied to inflation and authorities financial coverage, which might diminish its true worth over time. Bitcoin, however, operates on a deflationary mannequin, making certain shortage and preserving buying energy.

Liquidity and Accessibility

Actual property investments usually require prolonged transactions, excessive charges, and important regulatory hurdles. Promoting a property can take months, tying up capital and decreasing agility. Bitcoin, nevertheless, provides instantaneous liquidity and might be traded 24/7 on world exchanges. This accessibility empowers traders to maneuver their wealth seamlessly throughout borders.

The information underscores Bitcoin’s capacity to protect and develop wealth extra successfully than conventional property investments.

Hedging In opposition to Inflation

Actual property costs usually mirror inflationary traits however fail to outpace them considerably. Bitcoin, designed as a hedge towards fiat forex devaluation, has demonstrated its resilience in inflationary durations. As central banks proceed to print cash at unprecedented charges, Bitcoin’s finite provide ensures its worth is protected against financial debasement.

Flexibility for Fashionable Buyers

As we speak’s traders prioritize flexibility and world entry. Actual property is a localized, illiquid asset that limits mobility. Bitcoin, in contrast, is borderless and permits for decentralized possession with out reliance on conventional monetary methods. This function is very engaging to youthful, tech-savvy traders who worth freedom and management.

A Daring Imaginative and prescient for the Future

Bitcoin is greater than only a speculative asset; it’s a monetary revolution. By embracing Bitcoin, good traders place themselves on the forefront of this paradigm shift. As Bitcoin adoption grows, its worth proposition turns into more and more clear: a sturdy, deflationary asset designed for the trendy economic system.

Conclusion

Whereas actual property has traditionally been a cornerstone of funding portfolios, Bitcoin provides a transformative different that aligns with the calls for of a quickly evolving world economic system. For these looking for to protect wealth, hedge towards inflation, and capitalize on groundbreaking expertise, Bitcoin is the asset of selection. The query is not “Why Bitcoin?” however quite “Why not Bitcoin?”

Should you’re keen on extra in-depth evaluation and real-time information, think about testing Bitcoin Magazine Pro for helpful insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.