Bitcoin hash rate falls after United States struck nuclear facilities inside Iran. Will computing power recover or more slides expected if the Iran versus Israel war continues?

On June 22, two events took place, one of which was unexpected. When the United States struck Iranian nuclear facilities, Bitcoin prices dropped as anticipated, but the accompanying collapse in the Bitcoin hash rate was unforeseen.

Hashrate dropped right after Israel’s initial strike on Iran. It’s not talked about often but Iran has been mining for many years now (over 5 years).. its likely that Israel hit part of Iran’s power grid and disrupted some of their mining operation.

Can’t say whether disrupting…

— daniel (@mars_quaking) June 23, 2025

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Bitcoin Hash Rate Drops

Price trackers showed that BTC ▼-1.19% fell to as low as $98,500 before recovering yesterday. As with past events, whenever the world’s most valuable crypto asset declines, it drags down altcoins, including some of the top Solana meme coins.

Currently, the total crypto market is down 2.4% to $3.2 trillion, per Coingecko. Although Bitcoin has recovered, trading above $101,000, the hash rate remains low and has been sliding in recent days.

Presently, the Bitcoin hash rate is roughly 861 EH/s, down from 943 EH/s recorded in mid-June. While still at record highs, there was a rapid decline over the weekend, dropping from 886 EH/s on June 18 to as low as 861 EH/s by June 22.

(Source)

Iranian Miners Going Offline?

The drop in hash rate could be attributed to miners going offline in Iran on the day the United States bombed key Iranian nuclear facilities, causing possible energy disruptions.

Bitcoin mining is an energy-intensive process, and miners, possibly operating thousands of next-generation rigs, require constant access to power and reliable internet.

Both were disrupted last week as Iran-Israel tensions escalated, with power and internet blackouts reported in both countries.

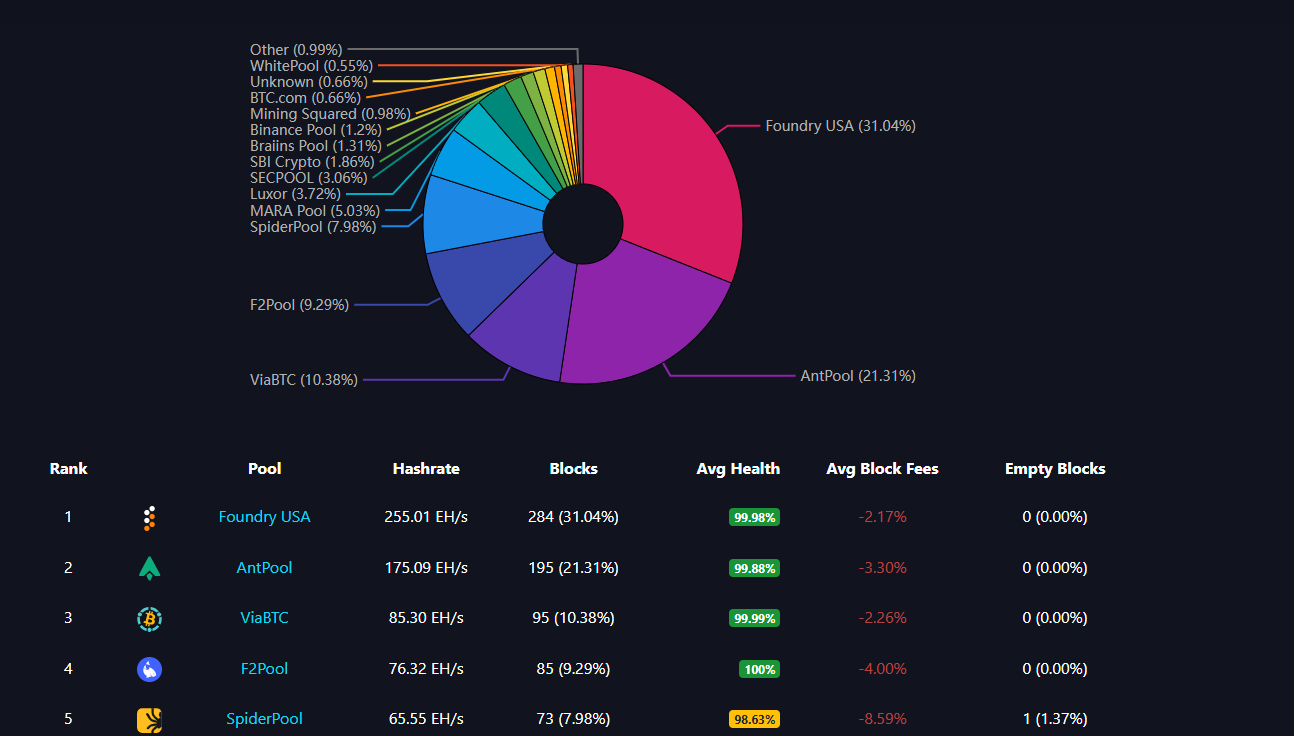

According to Mempool, a Bitcoin mining tracker, some of the largest mining pools are in the United States. Foundry USA, for example, contributes 255 EH/s, while MARA Pool contributes 41.30 EH/s of hash rate.

(Source)

There are other miners from Asia and Europe. However, thousands of smaller mining pools, though not as large, still contribute hundreds of EH/s and play a critical role in securing the Bitcoin network, ensuring it remains censorship-resistant, decentralized, and highly reliable.

Bitcoin Mining Is Legal In Iran

Among them are mining farms and pools from Iran. Despite sanctions, the country has emerged as a leading Bitcoin mining hub, playing a significant role in the broader crypto ecosystem.

The drop in hash rate over the weekend, coinciding with the bombings, strongly links Iran to Bitcoin mining, thanks to its abundant and subsidized electricity derived from fossil and even nuclear sources.

This development is unsurprising. The Central Bank of Iran began issuing Bitcoin mining licenses to operators in 2019 when the practice was legalized. With sufficient BTC and operators, the country effectively circumvented U.S.-led economic sanctions.

The Islamic Revolutionary Guard Corps (IRGC) was actively involved in these mining operations, reportedly using over 2,000 MW of power daily to mine Bitcoin.

By around 2021, Iran contributed 4.5% of the global Bitcoin hash rate, earning over $1 billion in annual revenue. However, by 2024, due to increasing regulations, enforcement inconsistencies, and a reportedly fragile power grid, their contribution fell to 3.1%.

EXPLORE: 20+ Next Crypto to Explode in 2025

Will Hash Rate Recover?

It remains to be seen whether further bombings of Iranian energy facilities will negatively impact the Bitcoin hash rate. Recovery could take time.

The good news is that, although the Esfahan complex was struck, the IAEA reported no radioactive contamination, only reparable structural damage.

Should there be more strikes taking rigs offline, the hash rate will likely fall further, and the network will adjust difficulty downward to maintain block processing every 10 minutes.

Even so, this wouldn’t be the first time the network has faced major disruptions. The Bitcoin mining ban in China caused a big hash rate drop, but after a few months, the hash rate spiked, following the prices of some of the best cryptos to buy, to new highs.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

Bitcoin Hash Rate Falls After U.S. Strikes In Iran

- Bitcoin hash rate drops from record highs

- Contraction coincides with U.S. strikes inside Iran

- Iran is a big player in Bitcoin mining

- Will the Bitcoin hash rate recover?

The post Will Iran War Threaten Bitcoin Hash Rate? Conflict Looms Over Tehran’s Bitcoin Miners appeared first on 99Bitcoins.