Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a fresh update posted on X, market strategist Dom (@traderview2) argues that a single, well-defined technical line now holds the key to XRP’s next directional move. His six-hour TradingView chart shows the Binance XRP/USDT pair peaking at $2.48-2.50 overnight before stalling precisely at the volume-weighted average price anchored to the 2018 all-time high (the so-called “ATH VWAP”, plotted in green).

Since late January that dynamically descending VWAP has capped every significant rally attempt and, on four separate occasions, triggered immediate, high-velocity rejections.

The latest foray produced a brief spike to $2.4082 (session high) and a settling price of $2.3644, leaving a clear upper wick just beneath the VWAP. Dom calls the reaction “expected” given the pair’s very clean technical memory, but he also stresses that the market has already reclaimed a critical intermediate pivot: the quarterly VWAP at roughly $2.30.

That level, the analyst notes, is now being “back-tested” intraday; a successful hold there would leave price wedged between converging support at $2.30 and resistance at the ATH VWAP near $2.48-2.50. A decisive close above the latter would, in Dom’s words, “open the sky for a larger breakout” by removing the final barrier that has contained XRP since its early-January high near $3.50.

Massive XRP Breakout Coming?

Order-flow data backs the bulls’ case. Dom has been tracking aggregated net flows by trade size and finds that tickets of 10,000–50,000 XRP and 50 000+ XRP have flipped firmly positive over the past three days, while smaller clips (100–1,000 and 1,000–10,000 XRP) have turned net-negative. “Little fish have sold the rip and bigger money has been behind it,” he wrote, adding that the dataset cannot distinguish between retail and institutional wallets but “very unlikely” points to exchange internalisation.

Related Reading

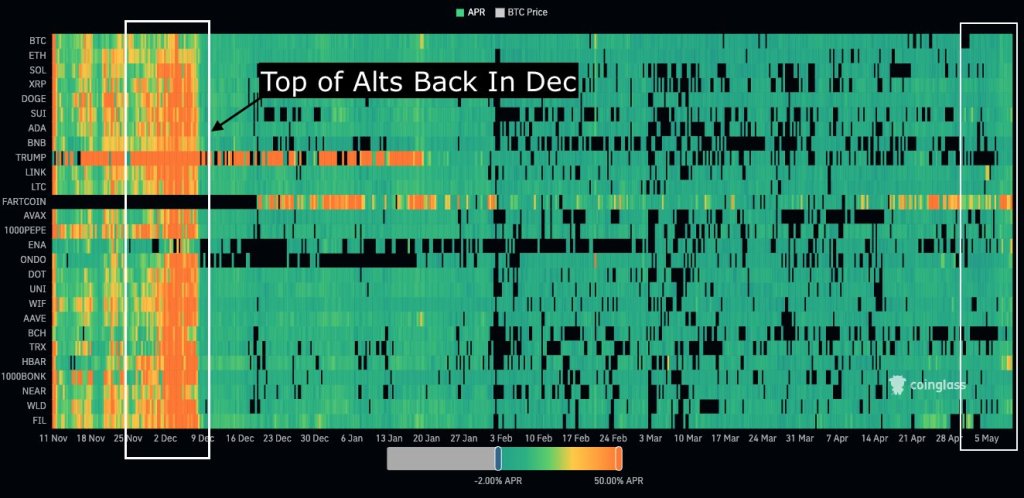

Broader market context corroborates the sense of a maturing impulse. A separate CoinGlass heat-map of perpetual-swap annualised funding rates that Dom shared plots twenty-seven large-capitalisation altcoins from November through May. The graphic highlights two periods – late November to 9 December and the first weeks of May.

The December cluster coincided with the “top of alts”, and he argues that the current cluster represents the most intense speculative pressure since that episode. “Strongest move in the altcoin market since November and funding looks like this… I said it last week and I’ll say it again. Hated rally,” Dom argues.

Against that backdrop, the immediate technical roadmap remains binary. XRP must first defend the $2.30 quarterly VWAP, a level that has switched from resistance to support within the last forty-eight hours. Hold that shelf and traders will continue to probe the ATH VWAP ceiling. Lose it, and the path of least resistance swings back toward the mid-$2.00s congestion that defined most of April.

But should bulls finally force acceptance above the descending VWAP – a feat they have not achieved once this year – the analyst sees little in the way of overhead supply until the mid-$2.70s, the lower boundary of the late-January distribution block. As Dom concludes, “Acceptance above ATH VWAP opens the sky for a larger breakout.”

At press time, XRP traded at $2.46.

Featured image created with DALL.E, chart from TradingView.com