Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

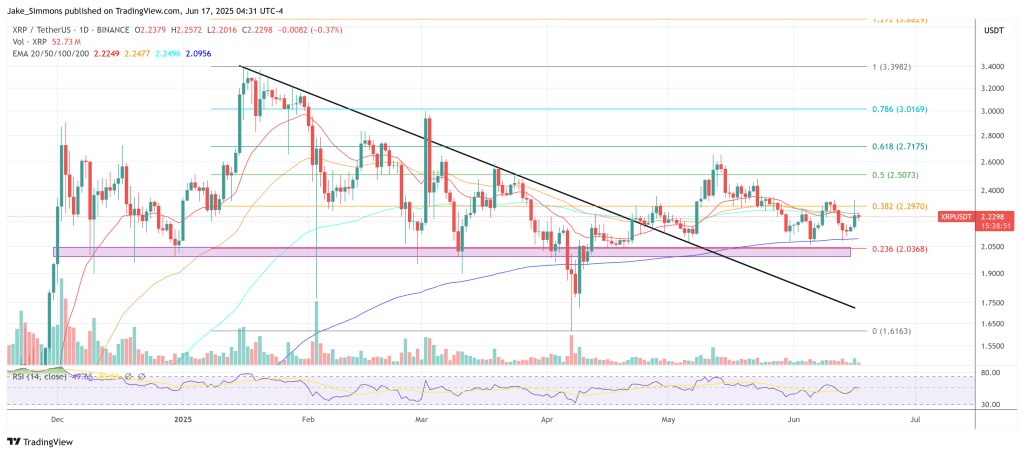

XRP bulls appear to be facing one last test of conviction before the market’s next explosive phase, according to CryptoInsightUK’s video analysis released on 16 June. The British analyst argues that the token is sculpting an inverse head-and-shoulders formation whose right shoulder “still needs to form around the high-$1.80s” before any sustained rally can commence.

How Low Must XRP Go?

In the broadcast, he emphasised that “dense liquidity is below us,” pointing to a confluence of resting bids and stop-loss clusters between roughly $1.92 and $1.80. “I still think it comes down to make the right shoulder which is around 1.88,” he said, adding that a swift wash-out into that pocket would “flush the lows, tap in there and send it.”

At present, XRP is changing hands near $2.24, up about 3% over the past 24 hours, which implies a prospective drawdown of roughly 20% if the market fulfills his downside scenario. From the analyst’s vantage point, such a retreat is less a cause for alarm than a prerequisite for the next major leg higher: “If we come down first, we’ve done the downside part. Otherwise I’m still going to be worried about going down even if we come up to $2.42 or higher.”

Related Reading

He linked the bearish short-term bias to structural forces beyond the XRP Ledger’s ecosystem. Bitcoin dominance, he noted, has crept toward a historical inflection zone that previously triggered alt-seasons: “Anywhere in this box could be the start of alt-season… That would probably coincide with Bitcoin dropping to between $100,000 and $93,000.” A dominance spike fed by a late-cycle Bitcoin dip, he argued, would typically inflict outsized percentage losses on major altcoins—including XRP—before liquidity rotates back into them.

Within XRP’s own order book, CryptoInsightUK highlighted a “liquidity vacuum” created by May’s capitulation candle. Although the token has since retraced most of that single-session collapse, he described the rebound as “choppy corrective price action,” lacking the conviction and volume that accompanied earlier impulse waves. The right-shoulder flush, in his view, would neutralise residual leverage, particularly among traders who re-loaded longs too aggressively during the $2.15–$2.40 bounce.

How High Can XRP Explode?

The inverse head-and-shoulders thesis also features prominently on his long-range chart, stretching back to mid-May. The analyst first published the pattern on X, showing a left shoulder near $2.42, a head at $1.47, and a neckline just above $2.50. Completing a symmetrical right shoulder near $1.88 would, by classical pattern-measuring rules, project an upside target above $3.50—a level not visited since late-2021’s cycle top.

Related Reading

Liquidity dynamics across the broader market reinforce his caution. Open interest in perpetual swaps for Ether, he observed, remains “as high as it’s ever been,” suggesting that any sudden drop in majors could spark a forced-liquidation cascade across altcoin pairs. “These people will be flushed out,” he warned, calling attention to negative-funding episodes that hint at an overcrowded short base waiting to be squeezed—once the final downside pocket has been filled.

Despite the near-term jitters, CryptoInsightUK reiterated a resolutely bullish macro stance. “The next stage I’m most certain about is that we’re going to go significantly higher for crypto,” he told viewers. Drawing parallels with gold’s record weekly close, he argued that an undercurrent of global risk aversion is quietly supporting non-sovereign stores of value, positioning both Bitcoin and XRP for accelerated appreciation once the technical reset concludes.

For long-term holders, his advice was unequivocal: avoid wholesale portfolio shifts and instead treat any sub-$2.00 wick as a final accumulation window. “Dollar-cost averaging from here is a good thing to do,” he said, revealing that 97% of his own capital remains in spot positions, with only a single-digit percentage reserved for surgical bids in the $1.80–$1.92 zone.

Whether XRP respects that script will become clear in the days ahead. Should the market indeed sweep into the high-$1.80s and rebound with the aggressive thrust the analyst expects, the right shoulder will be complete—and the runway clear—for the long-awaited take-off.

At press time, XRP traded at $2.23.

Featured image created with DALL.E, chart from TradingView.com