XRP has failed to maintain bullish momentum after pushing as high as $3.13 during the week. At the time of writing, XRP is trading around $3.00 and testing its resilience above this level after sliding alongside Bitcoin. The resulting price action is a defining moment for XRP’s short-term trend, according to technical analysis, and crypto analyst CasiTrades has pointed out a decisive support level that could determine whether the bullish structure remains intact.

Related Reading

XRP Tests $2.98 Support Zone

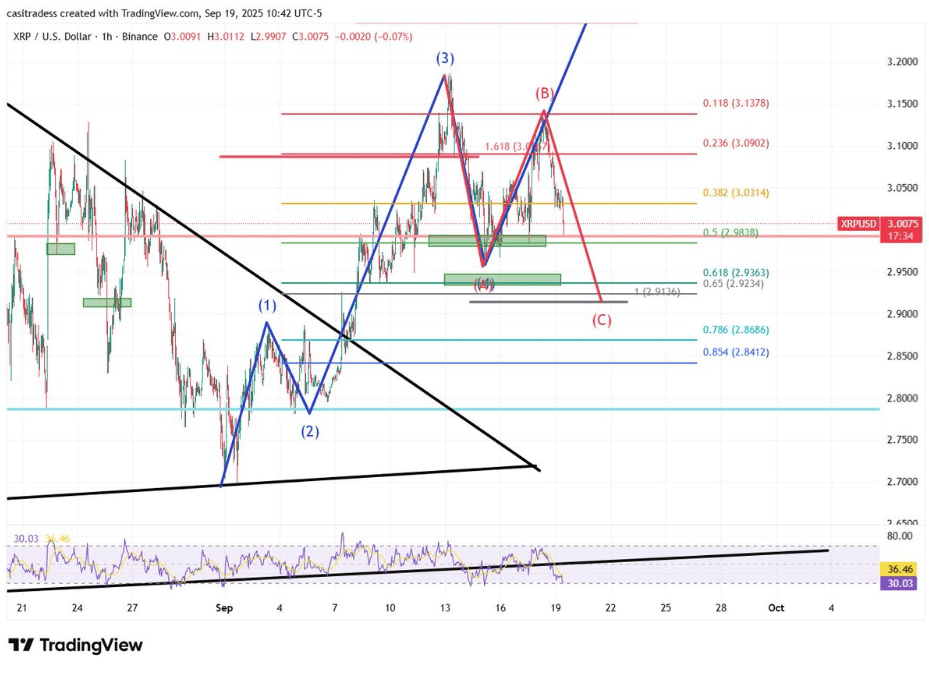

Taking to the social media platform X, crypto analyst CasiTrades highlighted an important support level that XRP must hold in order to continue its bullish momentum. According to CasiTrades, XRP’s most immediate challenge is at the $2.98 support line.

The analyst’s technical analysis outlines an Elliott Wave formation now unfolding into an ABC corrective pattern. The analysis unfolds XRP’s price action since the beginning of September into Elliot Waves and suggests that XRP is now playing out Wave 4, which is a corrective wave divided into an ABC pattern.

Although XRP is still holding above $2.98, momentum indicators such as the RSI on both the one-hour and four-hour timeframes show no bullish divergence, often a necessary condition for reversal. This puts the $2.98 level in the spotlight, and a break below it could increase the likelihood of further downside pressure.

The analysis highlights the possibility of corrective Wave C extending below $2.98 towards Fibonacci retracement levels near the low $2.90s. The measured C wave extension points to the 0.618 Fib retracement, which is around $2.92 and $2.94.

Interestingly, the 15-minute chart does reveal a short-term bullish divergence, offering a small window for relief bounces. However, without confirmation on the higher timeframes, such reactions are likely to remain temporary. The broader outlook, as outlined by the analyst, still leans toward the probability of another downward wave unless buyers step in strongly at $2.98 to restore confidence and preserve the larger bullish structure.

Chart Image From X: CasiTrades

Implications If XRP Holds Above $2.98

If buyers manage to hold above $2.98, XRP could stabilize and enter a consolidation phase that will create a foundation for the next leg higher. This consolidation would give the XRP price the breathing room it needs for an eventual upward attempt, one that would mark the beginning of an impulse Wave 5 formation within the Elliott Wave count. In this scenario, a decisive push through the $3.10 level becomes the first hurdle, and breaking it would confirm that bullish momentum is once again in play.

Should XRP successfully clear $3.10 with volume and follow-through, the next target identified by the analyst is another resistance at $3.25. A sustained bullish momentum beyond this point could carry the price toward the next resistance at $3.44.

Related Reading

At the time of writing, XRP is trading at $3.01, down by 2.8% in a seven-day timeframe. Preserving the bullish wave structure and holding above $2.98 at this point is essential to avoid the corrective pattern turning into a deeper downtrend.

Featured image from Unsplash, chart from TradingView