Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP’s price has slipped by 4.7% in the past 24 hours, continuing a pattern of high volatility that has defined much of March. Amid this decline, however, some see opportunity, with one popular analyst identifying an interesting reversal pattern that could turn the tide to bullish trajectory.

Related Reading

Inverse Head And Shoulders Pattern Appears On XRP Chart

XRP has extended its decline run from $2.47 into the past 24 hours. Particulary, XRP is currently down by 13.8% in the past three days and now looks like it could easily break below $2.10.

Crypto analyst Egrag Crypto took to social media platform X to highlight what he called a “most probably inverse head and shoulders” pattern currently unfolding on XRP’s daily timeframe. The pattern, which has been developing since early March, is now in the final stages of forming the second shoulder. As such, this phase might still see further short-term downside, as XRP potentially dips again to complete the structure of the second shoulder before a breakout rally.

If confirmed, the inverse head and shoulders would lead to a strong bullish reversal, which is going to be significant given XRP’s recent price retracement. According to Egrag Crypto, the measured move from the completion of this formation could send the price to a price range between $3.7 and $3.9.

Analyst Says XRP Could Reach All-Time High In 90 To 120 Days

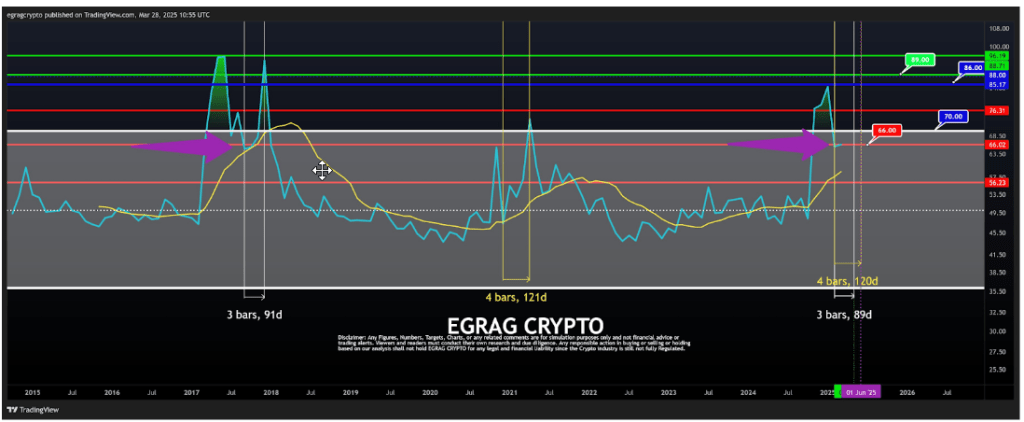

The inverse head and shoulder analysis is part of a bullish outlook that suggests that the XRP price can reach a new all-time high within the next 90 to 120 days. This prediction, also made by Egrag Crypto, is based on a recurring pattern observed in XRP’s Relative Strength Index (RSI) across past bull markets.

He pointed out that during the 2017 and 2021 cycles, the RSI indicator on XRP exhibited two distinct peaks, with the second peak coming between 90 to 120 days after the first peak. The second RSI peak in 2017 occurred about 120 days after the first peak. A similar scenario occurred in 2021, although the interval between the first and second RSI highs was shorter at just 90 days. This trend sets the stage for a historic surge that could align with the breakout from the current inverse head and shoulders setup.

So far in this cycle, XRP has already completed its first RSI peak, reaching as high as 85.17 toward the end of 2024. Following that, the RSI has been on a long cooldown phase, dipping to a low of 65. At the time of writing, the RSI sits around 66, and a bounce is expected from here, which is to peak sometime around June.

Related Reading

RSI typically rises with increased market participation, capital inflow, and bullish price movement. If the trend plays out again within the next 90 to 120 days, XRP’s RSI could peak again around June. At the time of writing, XRP is trading at $2.12, down by 4.7% in the past 24 hours.

Featured image from Gemini Imagen, chart from TradingView